SCM - Strategic Sourcing

Strategic

sourcing can

be defined as a collective and organized approach to supply chain management

that defines the way information is gathered and used so that an organization

can leverage its consolidated purchasing power to find the best possible values

in the marketplace.

We cannot build up

the significance of operating in a collaborative manner. Several decades have

witnessed a major transformation in the profession of supply chain, from the

purchasing agent comprehension, where staying in repository was the criterion, to

emerging into a supply chain management surrounding, where working with cross

functional and cross location teams is important, to achieve success.

Strategic sourcing

is organized because of the necessity of some methodology or process. It is

collective because one of the most essential necessities for any successful

strategic sourcing attempt is of receiving operational components, apart from

the procurement, engaged in the decision-making and assessment process.

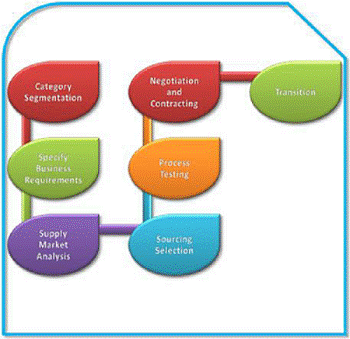

The process of

strategic processing is a step by step approach. There are seven distinct steps

engaged in the process of strategic processing. These steps are explained below

in brief.

Understanding the Spend Category

The first three

steps involved in the strategic sourcing are carried out by the sourcing team.

In this first stage, the team needs to do a complete survey on the total

expenditure. The team ensures that it acknowledges every aspect regarding the

spend category itself.

The five major

regions that are analyzed in

the first stage are as follows −

● Complete previous expenditure

records and volumes.

● Expenditures divided by items

and sub items.

● Expenditures by division,

department or user.

● Expenditures by the supplier.

● Future demand projections or

budgets.

For example, if

the classification is grooved packaging at a customer goods company, the team

has to acknowledge the description of the classification, application patterns

and the reason behind specification of particular types and grades specified.

Stakeholders at

all functioning units and physical locations are to be determined. The

logistics, for instance, needs an updated report regarding the transportation

specifications and marketing requirements to acknowledge some quality or

environmentally applicable features.

Supplier Market Assessment

The second step

includes frequent assessment of the supplier market for pursuing substitute

suppliers to present incumbents. A thorough study of the supplier marketplace

dynamics and current trends is done. The major element of the key products

design is should-cost. Along with it, an analysis on the major

suppliers’ sub-tier marketplace and examination for any risks or new

opportunities are also important.

Now, it is not

recommended to analyze the

should-cost for every item. There are many instances where conservative

strategic sourcing techniques tend to work better. But in the instances where

the application of strategic sourcing is not applicable, the should-cost

analysis supplies a valuable tool that drives minimizing of cost and regular

progress efforts of the supplier.

Supplier Survey

The third step is

developing a supplier analysis for both incumbent and potential substitute

suppliers. This analysis assists in examining the skills and abilities of a

supplier. In the meanwhile, data collected from incumbent suppliers is used for

verifying spend information that suppliers have from their sales systems.

The survey team

considers the above-mentioned areas for gathering information. The areas are as

follows −

● Feasibility

● Capability

● Maturity

● Capacity

The analysis is

done to examine the potential and skills of the market to satisfy the customer

demands. This analysis helps in the examination done at the initial stage to

find out if the proposed project is feasible and can be delivered by the

identified supply base.

This analysis also

supplies an initial caution of the customer demands to the market and enables

suppliers to think about how they would react to and fulfill the demand.

Here the motto is to motivate the appropriate suppliers with the right structural

layout to respond to the demands.

Building the Strategy

The fourth step

comprises constructing the sourcing strategy. The merger of the first three

steps supports the necessary elements for the sourcing strategy. For every

region or category, the strategy depends on answering the questions given below.

● How willing is the

marketplace to oppose the supplier?

● How supportive are the

clients of a firm for testing incumbent supplier relationships?

● What are the substitutes to

the competitive assessment?

Generally, these

substitutes are opted when a purchasing firm has little leverage over its

supply base. They will depend on the belief that the suppliers will share the

profits of a new strategy. Thus, we say that the sourcing strategy is an

accumulation of all the drivers thus far mentioned.

RFx Request

Mostly, the

competitive approach is applied in general cases. In this approach, a request

for proposal or bid needs to be prepared (e.g., RFP, RFQ, eRFQ,

ITT) for most spend classifications or groups.

This defines and

clarifies all the needs for all prequalified suppliers. The request should

comprise product or service specifications, delivery and service requirements,

assessment criteria, pricing structure and financial terms and conditions.

In the fifth

stage, an interaction plan needs to be executed to allure maximum supplier

interest. It must be ensured that each and every supplier is aware that they

are competing on a level playing field. After sending the RFP to all suppliers,

it is to be confirmed that they are given enough time to respond. In order to

motivate greater response, follow-up messages should also be sent.

Selection

This step is all

about selecting and negotiating with suppliers. The sourcing team is advised to

apply its assessment constraints to the responses generated by the suppliers.

If information

across the limitation of RFP response is required, it can be simply asked for.

If done correctly, the settlement process is conducted first with a larger set

of suppliers and then shortlisted to a few finalists. If the sourcing team

utilizes an electronic negotiation tool, large number of suppliers can sustain

in the process for longer duration, giving more wide suppliers a better

opportunity at winning the enterprise.

Communicaction With New

Suppliers

After informing

the winning supplier(s), they should be invited to take part in executing

recommendations. The execution plans vary according to the scale of switches

the supplier makes.

For obligatory

purposes, a communication plan will be set up, including any modification in

specifications and improvements in delivery, service or pricing models. These

tend to be communicated to users as well.

As we know, the

company gains immensely from this entire process of creating a communication

plan, making some modifications according to the customer demand and further

forwarding this to the customer. It’s essential that this process should be

acknowledged by both the company and the supplier.

For new suppliers,

we need to construct a communication plan that copes with the alteration from

old to new at every point in the process engaged by the spend category. The

sections that have an impact of this change are the department, finance and

customer service.

In addition, the

risk antennae will be particularly sensitive during this period. It is

essential to gauge closely the new supplier’s performance during the first

weeks of performance.

Another essential

task is to grasp the intellectual capital of the sourcing team, which has been

developed within the seven-step process, so that it can be used the next time

that category is sourced.