Do UK Companies Make Use of Corporate Mobility Instruments to ‘Escape’ Brexit?

Is there an impact of Brexit on corporate mobility in the form of companies incorporated in the United Kingdom making use of as cross-border mergers, conversions, divisions or seat transfers of SEs (hereinafter also ‘cross-border transactions’) in order to exit the United Kingdom towards Member States of the European Union?

There is evidence that, particularly in the financial industry, companies have moved to the European mainland in order to diminish the impact of Brexit-related risks on their businesses. One of the main risks envisaged is that, after (some version of hard) Brexit, financial actors (investment fund managers, insurers) would not be able to use the so-called ‘passporting system’ anymore. Many of them thus relocated structures and staff to Amsterdam, Frankfurt, Luxembourg or Paris.

Yet, the relocation of businesses can be carried out in different ways than by means of the cross-border transactions mentioned above: company groups can simply incorporate a new legal entity in the new host Member State or modify the use of an existing legal entity in the new host Member State. Would data show that company groups would also use cross-border mergers or cross-border conversions to relocate from the United Kingdom to European mainland?

Based on the data gathered in the ‘Cross-Border Corporate Mobility in Europe’ project, we have found that—arguably due to the looming threat of Brexit—UK companies have used cross-border transactions in order to move out of the United Kingdom.

The data has been gathered until 31 August 2019 and will be considered for the period between 1 January 2007 and 31 August 2019. For some Brexit-specific assessments, the period 1 January 2017 to 31 August 2019 is considered.

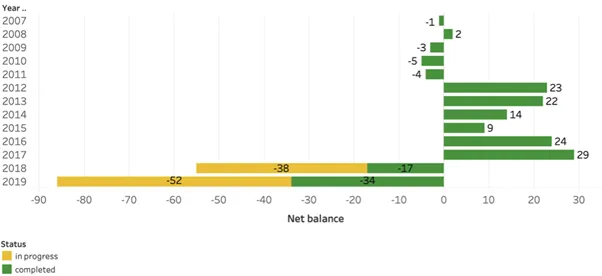

Figure 1: Net balance of cross-border transactions to and from the United Kingdom between 2007 and 2019 (N = 629)

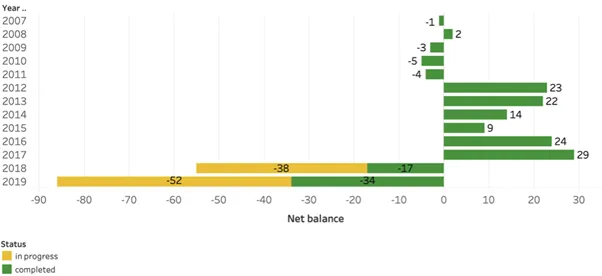

When considering the data from 2007 to 2019, it can be seen that, between 2012 and 2017, more entry cases than exit cases could be identified for the United Kingdom. For the simplicity of this blogpost, entry cases are cases in which companies enter the United Kingdom and exit cases are those in which companies leave the United Kingdom. In a cross-border merger, an entry case would be one in which the surviving entity in the merger would be incorporated in the United Kingdom. In an exit case, the legal entity incorporated in the United Kingdom would disappear in a cross-border merger. Between 2007 and 2017, the United Kingdom had 233 entry cases compared to 123 exit cases (see Figure 2). Thus, the United Kingdom was, for that period, a so-called ‘net-receiving’ country.

However, this picture changed in 2018. For 2018, 65 entry transactions could be identified compared to 120 exit transactions. As regards to 2019, the picture is even more drastic thus far. Only 1 entry transaction could be identified, as opposed to 87 exit transactions. In total, for the period between 2007 and 2019, 299 entry cases and 330 exit cases could be identified, thus making the United Kingdom a ‘net-sending’ country for the overall period of time. It should be noted that 90 cases identified are still in progress but it can be assumed that most of them will be closed successfully and, therefore, such cases are included in the dataset for the purpose of this blogpost.

Figure 2: Overview of cross-border transactions to (entry) and from (exit) the United Kingdom between 2007 and 2019 per year and transaction form (N = 629)

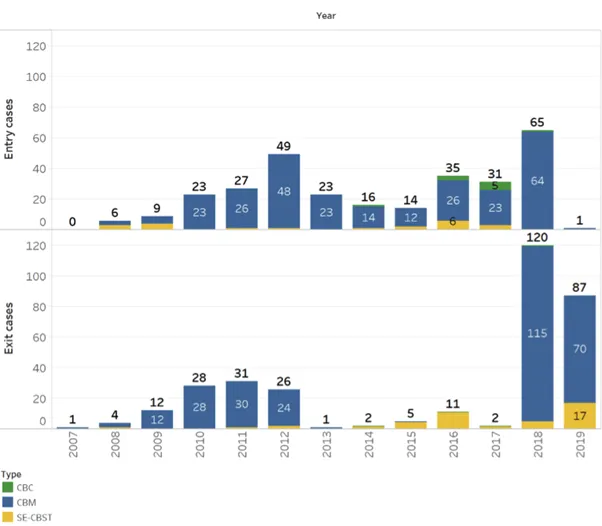

If the transactions are not considered on a per-year but on a monthly basis between 2017 and 2019, the picture becomes even clearer (see Figure 3 below). The initial Brexit dates were set for 29 March and 12 April. In the months prior to these dates, a substantial increase in the number of exit cases could be found. Whilst there have been nearly no exit cases until December 2017, the exit transactions increased on a nearly monthly basis, reaching their peak in December 2018 with 34 transactions, declining then to 13 and 6 transactions respectively in March and April 2019. At the same time, 1 entry case could still be identified for January 2019, while no entry cases were found thereafter.

That exit cases peaked in December 2018 may have a simple explanation: the operations were timed in a way that they would be closed before March 2019. In order to avoid that any delays may cause problems, the legal teams on the operations will have attempted to ensure that the timelines were structured so that the operation closed in advance of this date.

Figure 3: Overview of cross-border transactions to (entry) and from (exit) the United Kingdom between 2017 and 2019 per month and transaction form (N = 629)

Equally interesting is that a certain number of cross-border seat transfers of Societas Europaea (SE) could be identified (27 cases). For the reason that the United Kingdom does not allow cross-border seat transfers in which a UK company transfers its registered office to a different country (and thus generally adopts the legal form of a different country, also called a cross-border conversion), another option for such companies may have been to carry out a cross-border seat transfer through the SE company law form. Cross-border seat transfers are allowed for this company form.

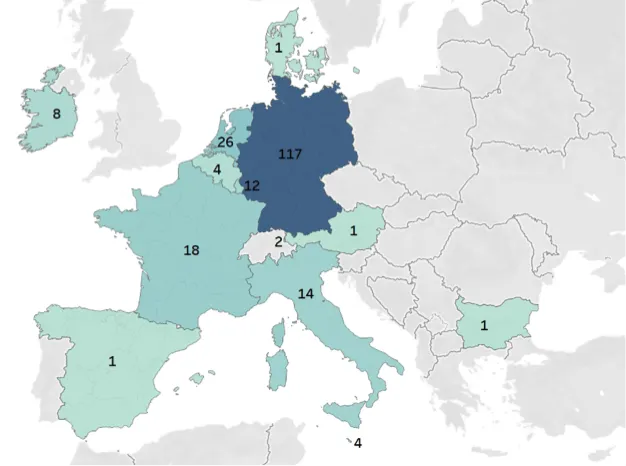

The country most chosen as destination in cross-border transactions between 2017 and 2019 was Germany (117 cases); it was followed by the Netherlands (26), France (18), Italy (14), Luxembourg (12), Ireland (8), Belgium and Malta (4), Liechtenstein (2), Austria, Bulgaria, Denmark and Spain (1). It also means that Germany was the destination in more cases than all other EU/EEA Member States combined.

Figure 4: Map of destination countries for UK companies exiting by means of cross-border transactions between 2017-2019 (N = 209)

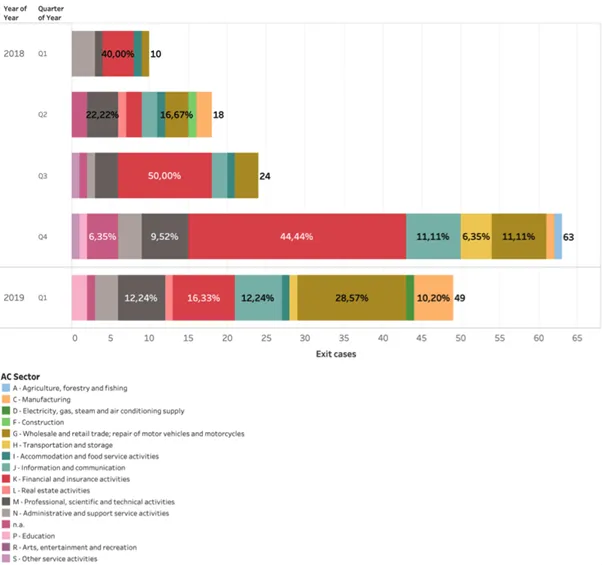

When considering the NACE codes (sector classifications) of the legal entities that exited the United Kingdom, it is remarkable that the entities do not belong with a clear majority to the category of ‘financial and insurance activities’. The picture is more diverse, as ‘wholesale and retail trade’ is prominent, as well as ‘information and communication’ and also ‘professional scientific and technical activities’ (see Figure 5).

Nevertheless, it is clear that big financial groups are amongst those merging and relocating legal entities, such as the Bank of America, J.P. Morgan, PayPal, UBS, AXA Real Estate, AIG Europe, Liberty Mutual Insurance or Clearstream.

Figure 5: Number of exit transactions per sector between Q1 2018 and Q1 2019 (N = 164)