Today’s supply chain practitioners are under constant pressure to bring value to their organizations. Two of the biggest supply chain challenges are exponential growth in complexity of the supply chain and cost savings fatigue driven by a relentless and unsustainable pursuit of achieving bottom-line growth by constantly cutting costs.

Companies are responding to these challenges with a renewed approach to their supply chains. A University of Tennessee white paper, “End-to-end Supply Chain Collaboration Best Practices,” shows a highly collaborative end-to-end focus on supply chain, which enables organizations to achieve greater levels of optimization as supply chain partners collaborate to drive continuous improvement and innovations.

But end-to-end optimization is not easy. It demands that supply chain partners shift from traditional transactional business models with the focus on cost savings to models that shift the focus to value creation. To make the shift organizations must first understand the fundamental differences in value extraction, value exchange and value creation.

Value extraction occurs when an enterprise attempts to shift value from one player in the supply chain to itself (classic win-lose scenario), extracting profit and value from one member of the supply chain and transferring that value to a leading player. This is often done using highly competitive bids and power-based negotiations approaches. Value exchange is better, but still falls short. In a fair and balanced value exchange, organizations check their power at the door and instead focus on getting to a fair price versus value tradeoff (such as quality/service). While definitely better than value extraction, value exchange still falls short because the parties’ focus is to optimize within their own four walls.

The winners of today’s supply chains have made the shift to focusing on value creation, enabled by true end-to-end collaboration and win-win pricing models. By working as true partners with a more transparent, win-win mindset, parties can identify opportunities that they simply cannot see by working within their four walls. The longer-term strategic focus, coupled with transparency and a win-win approach, motivates suppliers to invest in solutions they likely would not feel comfortable with.

Collaboration is a key to unlocking supply chain optimization. Unfortunately, far too many organizations rely on conventional arms-length procurement methods and commercial models that disincentivize true collaboration and value creation. Traditional buy decisions tend to be based on transactional models, which at its most basic level, rely on a competitive environment to drive lower costs and creates an arms-length buyer-supplier relationship.

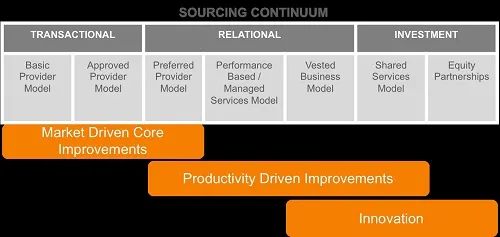

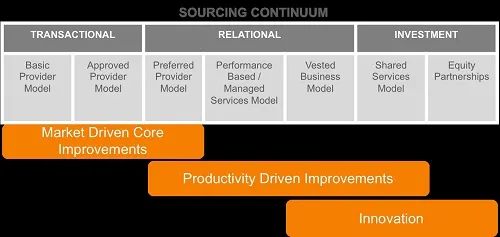

Progressive companies are shifting along a sourcing continuum to more sophisticated and collaborative sourcing business models that are purpose built for making the shift to towards value creation as seen in graphic below.

As suggested by the diagram, transactional contracts work best to drive general market improvements. Market-based improvements are typically incremental in nature as suppliers seek to improved products or services and lower prices to beat out their competitors.

Organizations seeking productivity driven improvements should shift to a preferred provider model or a performance-based/managed services model. When an organization shifts along the sourcing continuum to a preferred provider model or performance-based model they are making a commitment to the supplier who then commits to driving productivity improvements. Often these productivity improvements come from working in a collaborative manner and investing in continuous improvement programs.

As organizations move even further along the sourcing continuum they shift from a mindset of buyer-supplier relationship to one of a highly strategic partner. A Vested business model and investment-based model encourages investment in innovation because there is equal partnership between buyer and seller. Structured properly, a Vested model and investment-based models rely on win-win economics where all parties “win” when improvements are made.

Win-Win economics makes sense when you think about an equity partnership (e.g., a joint venture) because both parties are investing with the hope to drive value for the partnership. A Vested business operates in a similar manner as an equity partnership – but unlike an equity partnership a Vested model uses a buyer-supplier relational contract instead of shareholders agreement.

A Vested model – like investment-based models - works because it creates a win-win outcome-based economic model that aligns the interest of the buyer and supplier partners. In short, the parties shift from a buyer-supplier to one of a mindset of strategic business partners focused on a common end in mind – to drive business outcomes that will create value for both the buyer and the supplier.

A second enabler for success outlined in the UT white paper is a focus on end-to-end total value creation that focuses on breaking through silos and building value from across the supply base, through the four walls of the organization right through to the customer’s customer.

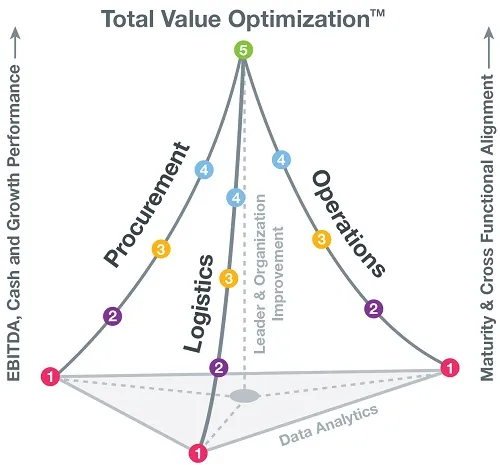

Maine Pointe’s Total Value Optimization™ (TVO) is a best practice method for value optimization that allows an organization to dynamically anticipate and meet demand by synchronizing its buy-make-move-fulfill supply chain to deliver the greatest value to customers and investors, while still achieving lowest costs to the business.

Senior executives are universally interested in meaningful tools to help communicate where and how opportunities can be realized in their business to achieve high performance and competitive advantage. TVO is an easily communicated maturity scale of how any firm is performing in the critical buy-make-move-fulfill supply chain across the critical dimensions of Procurement, Logistics, Operations, Data Analytics, Leadership and Organization.

Using the methods outlined in Total Value Optimization, it becomes more realistic to add a true level of competitive differentiation through the supply chain – ultimately transforming the supply chain into a competitive weapon. The Total Value Optimization approach looks beyond the basic metrics such as cost of ownership and purchase price variance, and adds an increased focus on the total added-value characteristics of the relationship with each supplier.

Total Value Optimization ranks that added value in a maturity scale of zero to five, with the higher levels incorporating that value-added consideration and allowing a firm a more sustainable process that permits themselves as well as their supply chain to continue to grow and improve.