VRIO Analysis

VRIO Analysis is an analytical technique brilliant for the evaluation of company’s resources and thus the competitive advantage. VRIO is an acronym from the initials of the names of the evaluation dimensions: Value, Rareness, Imitability, Organization.

The VRIO Analysis was developed by Jay B. Barney as a way of evaluating the resources of an organization (company’s micro-environment) which are as follows:

● Financial resources

● Human resources

● Material resources

● Non-material resources (information, knowledge)

What is the VRIO good for?

Is perfect for evaluation of the company’s resources. One you know your resources you can better understand your competitive advantages or weaknesses. The VRIO considers for each type of the resource the following questions (called evaluation dimension) both for your company and for your competitors. The dimensions of VRIO are:

● Value - How expensive is the resource and how easy is it to obtain on the market (purchase, lease, rent..)?

● Rareness - How rare or limited is the resource?

● Imitability - How difficult is it to imitate the resource?

● Organization, respectively arrangement - Is the resource supported by any existing arrangements and can the organisation use it properly?

How to make the VRIO Analysis?

VRIO analysis is a complement to a PESTEL analysis (which assesses macro-environment). VRIO is used to assess the situation inside the organization (enterprise) - its resources, their competitive implication and possible potential for improvement in the given area or for a given resource. Such an assessment is then used for example in the strategic management of development in various areas or for decision making about the advantage of an external or internal process and the securing service (e.g. outsourcing decision).

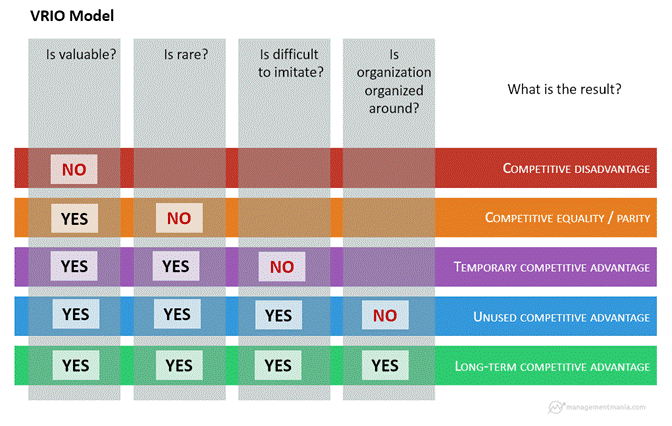

● If the resource is not valuable it should be outsourced because it brings no value to us

● If the resource is valuable but not rare the company is in competitive conformity. It means we are not worse than our competition,

● If the resource is valuable and rare but it is not expensive to imitate it, we have a temporary competitive advantage. Other companies will try to imitate it in the near future, then we lost our competitive advantage.

● If the resource is valuable, rare and is expensive to imitate it but we are not able to organize our company, the resource become expensive for us (unused incurred costs)

● if we can manage the advantages and we are able to organize our company and temporary competitive advantage, it becomes as permanent competitive advantage

In practice, the VRIO analysis is also used in combination with other analytical techniques to help organizational management evaluate business resources in a more detailed view. For financial resources, there are many detailed financial indicators that evaluate the financial condition or performance of the business from different perspectives. Likewise, human resources, property or information are other detailed indicators of their performance, efficiency or quality. The advantage of a VRIO analysis is its simplicity and clarity.

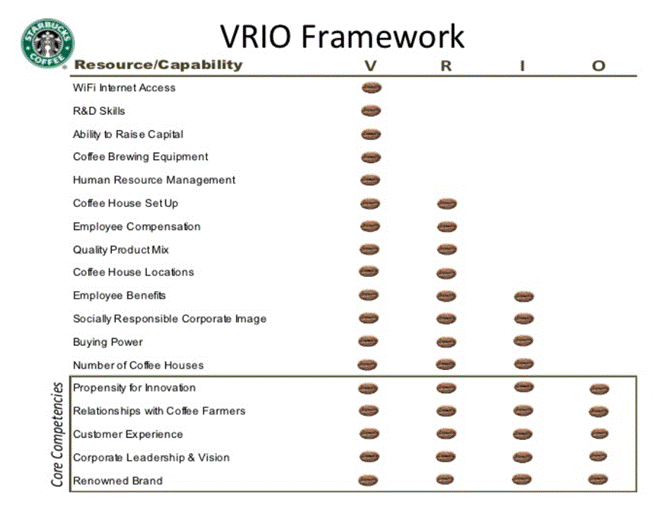

Example of VRIO analysis from Starbucks