WHAT IS STRATEGY FORMULATION PROCESS IN ENVIROMENT PROCESS?

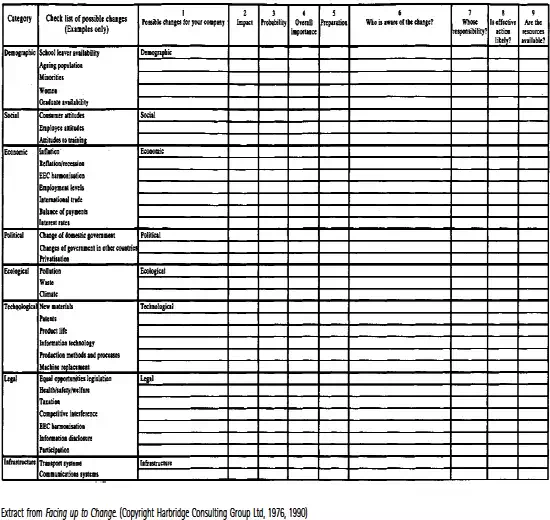

It is capable of use as an analytical check list, but is more often used in small group work to facilitate thinking about the environment among line and other managers who are involved in the strategy formulation process. The heart of the approach is reproduced in below figure.

Under each heading there are subheadings showing the type of factor that may be important. The aim here is to provide a starting prompt list. It is not the intention to suggest that all items are relevant to a particular organisation, nor that only items on the list should be considered. The analysis really begins with column1, where respondents identify the issues that appear important. An effective method is to have the questionnaires completed individually by a number of managers, preferably including line people who know the business well, and others who may have access to environmental information. The individuals come together in groups to agree what is important. If done well, one value of this approach is that it encourages a deep consideration of more factors, and forces thinking about their relative importance. Columns 2 to 4 require respondents to reach a view on the importance of each identified factor to the organisation.

This is achieved through a scoring method which converts opinions into numbers. Overall importance is calculated by multiplying the impact score by the probability score. ‘Don’t know’ scores high so that something important is not overlooked through ignorance. Attention is focused on those factors which have the highest overall scores. Column5, headed Preparation, is the response to another question. How ready are you for the important changes? The word ‘you’ refers to the unit for which the strategies are being considered, and could be a total company, a business unit, a department or a product. Again a numerical score is entered. This time attention is focused on the low scores for preparedness, concentrating on those items with a high score for impact. Columns 6 and 7 begin to explore the possibilities for action. The next column pins down responsibility for dealing with the change. Columns 8 and 9 both use numerical scales. The rest of the approach consists of a number of other questions and headings which are designed to lead to action.

An additional technique has been developed around columns 1–5 of Figure, and related to methods of portfolio analysis. This is called risk matrix, and will be described in a later chapter, as it is not possible to make sense of it independently of portfolio analysis, a topic in its own right.

The Neubauer/Solomon approach

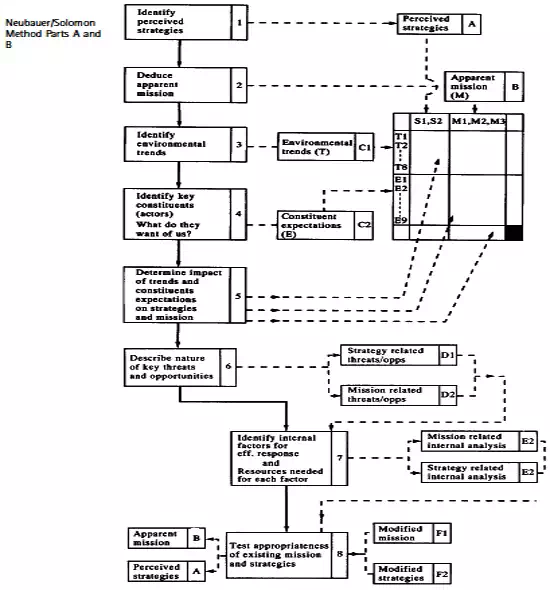

There are several techniques for looking at the impact of the environment, and the Neubauer and Solomon approach has characteristics of some of the methods described in the previous entry, in that it uses a concept of impact.Why it deserves a separate listing is that it is a far more comprehensive approach, which hones down the vast array of influences from the environment to those with most impact, and relates these to corporate strategies and missions.The technique studies trends and the expectations of different groups, or constituents, in the environment.It is not a technique to be learned on one reading, and needs considerable practice to gain proficiency.

The whole approach has the merit of being oriented to making the strategies compatible with the business environment. The method goes through a number of steps, beginning with the identification of the current strategies and mission of the business.Trends and constituents are identified, and an impact matrix created to identify the threats and opportunities.The next step is to identify the effects of the issues identified on the strategies and mission of the business.In turn, this leads to a reassessment of mission and strategies.

Trends are self-descriptive. Constituents refer to those individuals and institutions in the environment who may impact the business, such as trade unions and governments. The method identifies the critical factors and their impact, as will be explained, and studies the threats and opportunities that they create. In turn these are related to the mission and strategies of the organisation. The final part of the exercise examines organisational responsiveness, including constraints and capabilities.

The below figure illustrates the steps that the approach takes to reach a new strategy, if required: shown as a modified strategy in the figure. For the purpose of this analysis the authors define strategy as the ‘major decisions and/or action programmes employed by the company to fulfil it mission’.

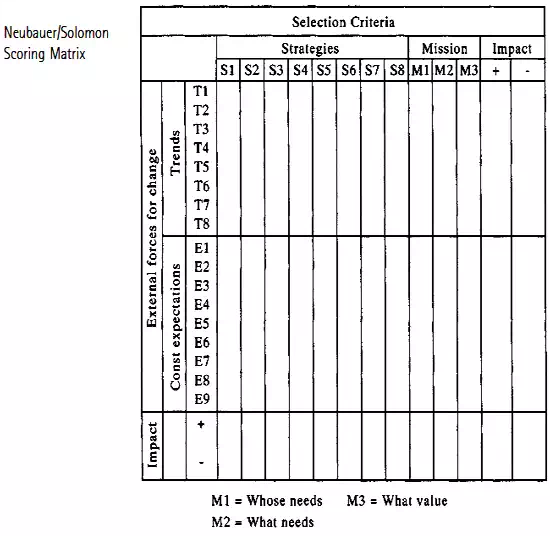

With this background we can begin to look at Figure, which is an enlargement of the matrix within Figure, and into which the analyst will enter scores which relate the impact of the environmental factors on the strategies and mission of the organisation. This figure is shown uncompleted, and it will be noted that in addition to restricting the number of strategies considered, the authors also suggest limiting the external factors to eight trends and nine expectations of constituents. A larger number may be examined in the initial stages of analysis, but only the most important will be carried through for this detailed study.

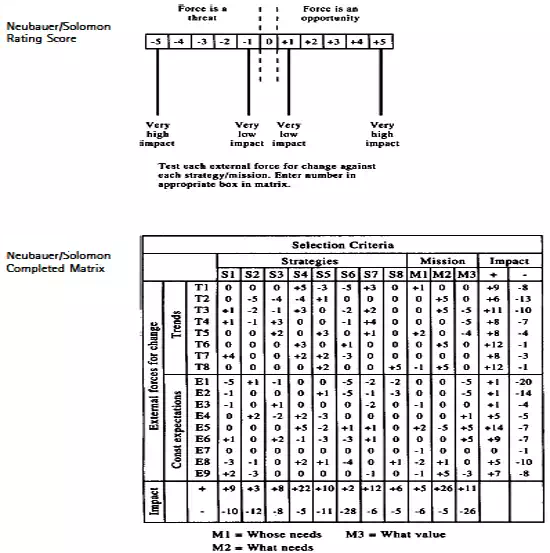

The rating scale is shown in Figure. Zero is neutral: a negative score represents a threat and a positive score an opportunity. The larger the number scored, the greater is the impact on the organisation.

Scores are entered into the matrix, as in the example in Figure. This gives a great deal of information. Reading across the matrix we can see from the final two columns which trends and constituent expectations impact the organisation most, in either a beneficial or harmful way. Reading down the matrix we can see which strategies and which elements of the mission should be reconsidered, either because of threats or opportunities. An alternative action might be to continue a strategy, but with a better understanding of its risks, which in turn might indicate some hedging strategies, or a modification so that a risky strategy is still followed, but the organisation’s involvement reduced.