Active and passive automotive safety systems

Passenger safety occupies a prime spot in the automobile sector today. Stakeholders across the automobile value chain acknowledge the importance of passenger/occupant safety and are constantly upgrading their offerings to provide fail safe safety technologies that will protect passengers and pedestrians. Proactive policy implementation and consumer awareness has played a key role in making automotive safety systems popular.

However the penetration of these lifesaving technologies differs from country to country. Economically developed countries tend to have a high penetration of these technologies across various passenger and commercial vehicle segments. Traditionally Automobile Safety Systems can be classified in to two segments, namely Active Safety Systems and Passive Safety Systems.

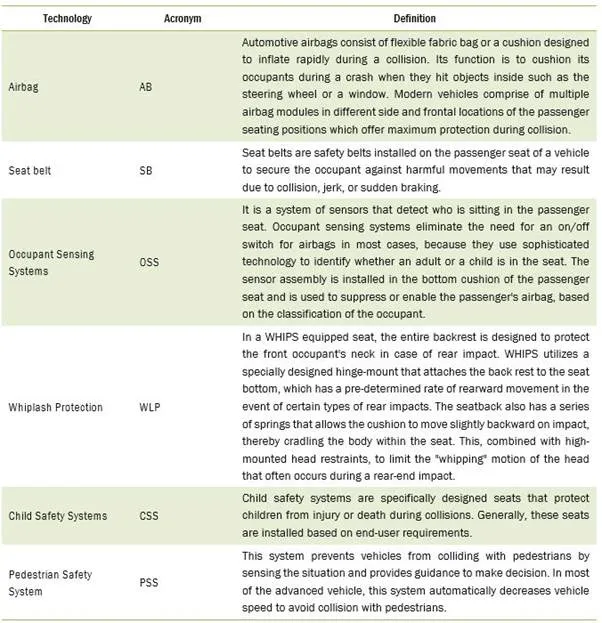

Active Safety Systems as the term suggests play a preventive role in mitigating crashes and accidents by providing advance warning or by providing the driver with additional assistance in steering/controlling the vehicle. Head-Up Display (HUD), Anti-Lock Braking Systems (ABS), Electronic Stability Control (ESC), Tire Pressure Monitoring System (TPMS), Lane Departure Warning System (LDWS), Adaptive Cruise Control (ACC), Driver Monitoring System (DMS), Blind Spot Detection (BSD) and Night Vision System (NVS) are common Active Safety Systems. Passive Safety Systems play a role in limiting/containing the damage/injuries caused to driver, passengers and pedestrians in the event of a crash/accident. Airbags, Seatbelts, Whiplash Protection System etc. are common Passive Safety Systems deployed in vehicles these days.

An emerging trend witnessed in the global automotive safety system market is the increasing demand from the countries like India, China, Russia and Brazil. Since the market for the safety systems like Airbags and ABS in developed economies is maturing and becoming saturated, OEMs and suppliers are focusing on increase demand from emerging markets. The demand is becoming higher in emerging markets primarily because of the improving road safety standards/supporting legislation and consumer awareness. Rapidly increasing vehicle population in emerging markets such as China, Thailand, Brazil and India is also driving up the risk of road fatalities and supporting demand for safety systems in passenger and commercial vehicles. Further, programmes like New Car Assessment Programe (NCAP) a government car safety evaluation programme which provides ratings, based on the safety performance of cars have become a catalyst for encouraging significant safety improvements initiatives from original equipment manufacturers, that drive consumer confidence and hence demand for Active and Passive Safety Systems.

Active safety systems:

Passive safety system:

Head up display:

The automotive HUD finds application in the majority of the passenger car segments. Given the increasing adoption of HUD in the automotive sector, it has become a standard feature for various models in the luxury car segment. Additionally, the increasing demand for comfort and safety has compelled automakers to incorporate this feature in premium and mid segment models as well. The market in growing regions such as Asia-Pacific, and North America indicate promising growth potential for the automotive HUD market. The Asia-Pacific automotive market in particular presents high-growth opportunities; the region includes Japan, China, and India, with the latter two having huge production capabilities. The European HUD market is primarily driven by the growing awareness regarding driver safety and convenience. Europe has many luxury/premium car manufacturers. Major high-end car OEMs such as Audi AG (Germany), BMW (Germany), Mercedes-Benz (Germany), Bentley Motors (UK), Maserati (Italy), Ferrari (Italy), and Bugatti Automobiles (France) have their headquarters in Europe. The automotive HUD comes as standard safety feature in the majority of European automobiles. The region therefore has a wide customer base for this technology.