What Is Financial Risk?

There are several ways in which we may define financial risk. In understanding the impact of financial risk on the organisation, the nature of the cash flows or transactional exposures needs to be understood. The risk is in both the amount involved and its timing. The most obvious way to understand such risks is in terms of the impact of changes in the risk factors on the organisation’s accounting numbers. Changes in the reported earnings will be indicative of the different outcomes experienced by the organisation. However, as mentioned earlier, financial risk will extend to contingent exposures; that is, expected future transactions. But there is a further, more general type of financial risk, known as economic exposure, that comes from the interaction between changes in macroeconomic variables and an organisation’s overall competitive position. Note that all of these ultimately relate to the value of the firm, and – in financial terms – this can be considered as the present value of the future cash flows that the firm will generate.

We can define the nature of The Nature of Cash Flows

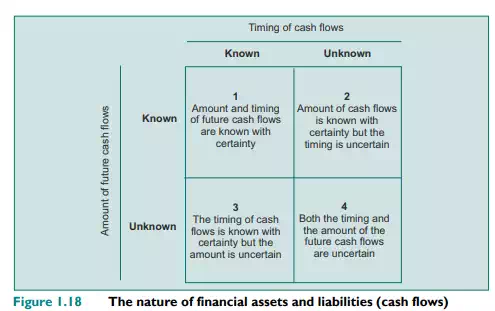

financial risk to cash flows in two ways: first, whether the amount of the cash flows is known and, second, whether the timing is known. We therefore have four different types of cash flow, as shown in Figure 1.18.

Financial risks involve contractual or potential contracted payments where the cash flows either are known for certain or are conditional. A conditional cash flow requires some event to make it take place. For instance, an insurance company may expect to make claims on policies, but it will not know the exact amount until a claim is made. The timing of these cash flows is also either certain or conditional. Conditional timing is where the exact date that the cash flow will occur is not known for certain ahead of time, although it might be expected. Payments firms receive for goods sold on trade credit fall into this category. These lead to the four types of risk given in Figure 1.18.

Type 1 cash flows are contracted payments that it is known will have to be met in the future. Examples of such known cash flows include the fixed-rate term deposits made with a bank and the coupon and principal payments on a fixed-rate bond. Both the cash flows and their timing are known with certainty. The deposit will mature at a given date, and both the amount deposited and the set interest thereon will be paid to the depositor. With a bond, the issuer will pay periodic coupon payments as defined by the bond terms on set dates. The holder knows in advance when these will take place.

Type 2 cash flows are contracted payments where the amount due is known but where the actual timing is undetermined. These include, for instance, the payments from customers when trade credit is given by the seller. The payment amount is known, but the exact date on which payments will be received is not known for certain. Uncertainty about the payment date also applies to various types of conditional financial contracts, such as life insurance, where the payout is known, since it is contracted, but the timing is unknown, since it depends on an uncertain event: the death of the insured.

Note that indeterminate does not mean that estimation is not feasible. Estimation is possible, often with a fair degree of accuracy. When a large number of transactions are involved, the statistical properties of the event come into play and, in particular, the law of large numbers applies. As we will see in later sections, the risk manager will make use of data from past cases as a predictor for outcomes in the future.

Type 3 cash flows have fixed timing but unknown amounts. These can arise, for instance, when money is borrowed at a floating rate over a given period. In this case, the contracted interest payments are not known for certain, since these will be set in line with future, unknown market conditions for each of the interest periods. For example, on a five-year bank loan that has the interest set every six months the timing of the interest payments is known, but the amount will not be known until the actual interest rate is set in accordance with the terms of the borrowing. Note that, once this happens, the cash flow then becomes a Type 1 cash flow.

Type 4 cash flows have neither fixed timing nor known amounts. These are typically various contingent contracts or obligations where the cash flow crystallises only when a specific event occurs. These include many types of insurance contract that require payments if a loss is incurred by the insured party and where the extent of the loss becomes known only when the event happens. Type 4 cash flows also include situations such as tenders for contracts, where the future cash flows are conditional on success in the bidding process.

The different nature of these cash flows is captured in most organisations through internal management information, often of an accounting or transactional nature.