The Dutch partners want to build 4 GW of large-scale offshore wind capacity and convert gas transport grids in a complete value chain plan for renewable hydrogen supply.

The Dutch proposal could make the Groningen port area a key supply hub for renewable hydrogen.

Last month, oil giant Shell, Dutch gas grid operator Gasunie and Groningen Seaports unveiled a plan to build around 4 GW of offshore wind capacity to produce renewable hydrogen by 2030.

Under the NortH2 plan, new North Sea wind farms would feed a large electrolysis facility in Eemshaven, followed by additional electrolysis plants, potentially offshore. By 2040, some 10 GW of offshore wind could feed hydrogen production facilities, the partners said.

Importantly, Gasunie will convert existing gas pipeline infrastructure to distribute the hydrogen to industrial customers across north-western Europe.

Lack of transport infrastructure remains a key hurdle for hydrogen market development and Gasunie's proposed investment underlines a growing confidence in hydrogen demand.

"The sheer scale of the project and its holistic approach to the value chain makes it one of the single most important projects to be announced," Nicolas Kraus, Policy Coordinator at Hydrogen Europe, told New Energy Update.

"Its vision to bring electrolysis offshore is the first of its kind in Europe and globally," he said.

The NortH2 partners believe Groningen could act as a center for green hydrogen production in Europe, boasting port access, established logistics and transport networks and nearby industrial customers.

Clusters of industrial facilities in Eemshaven and nearby Delfzijl want to use green hydrogen to lower carbon emissions, Michiel Bal, spokesman for Gasunie, said.

In addition, Gasunie and chemical company Nouryon will take the final investment decision this year on a planned 20 MW electrolysis plant in Delfzijl.

Set to be Europe's largest electrolysis facility, the Delfzijl project will combine renewable hydrogen with CO2 to produce renewable methanol. The project was recently awarded an 11-million euro ($12 million) grant from the European Union (EU), on top of 5 million euros in regional government subsidies. Gasunie and Nouryon may expand the facility to 60 MW to also produce sustainable jet fuel.

The NortH2 partners plan to complete a feasibility study this year and expand the consortium to include new project partners.

"This project offers opportunities throughout the entire hydrogen chain," Marjan van Loon, President-Director of Shell Nederland, said in a statement.

“In order to realize this project, we will need several new partners,” van Loon said.

Price challenge

The Netherlands currently has 1 GW of installed offshore wind capacity and the government has set a target of 11.5 GW by 2030.

The NortH2 project would require additional offshore wind allocations as the current plan would not meet future demand for renewable hydrogen, Bal said.

Europe's hydrogen production is currently around 9 million tonnes per year (Mt/y), according to the International Energy Agency (IEA). Around half of this hydrogen is consumed by refineries, 40% for ammonia production and the remainder for chemicals and metallurgy. Fuel for transportation is seen as a key growth market.

The roll-out of NortH2 will also require price incentives for customers to switch to renewable hydrogen products, Bal said.

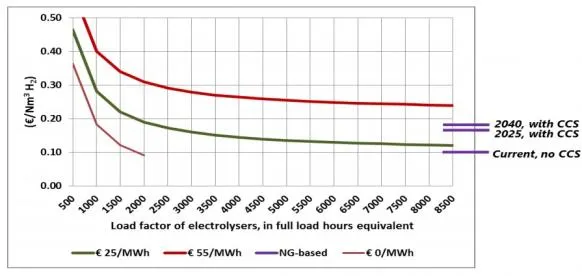

Costs for producing hydrogen from electrolysis remain far higher than steam methane reforming (SMR) methods. Early stage electrolysis deployment may require national and EU-level subsidies, but costs will fall as installed capacity rises, Bal said.

“We foresee that by scaling up the electrolyses technology from MW size to GW size serious cost reductions can be achieved before 2030," he said.

Hydrogen electrolysis costs vs natural gas reforming

In the short to medium term, EU members must set clear targets for renewable hydrogen and implement measures such as Guarantee of Origin and other sustainability certificates to qualify projects, Kraus said.

“A smart sector integration to allow and provide a long-term stable framework, with predictable remuneration mechanisms remains a key challenge that we want to address, together with the European and national institutions," he said.

On March 10, the EU announced plans for a new renewable hydrogen alliance that would “build on existing work to identify technology needs, investment opportunities and regulatory barriers and enablers.”

The speed in which electrolysis can become competitive with SMR will depend on the price of natural gas and the cost of carbon emissions from SMR, Bal noted.

“We expect that the production of hydrogen with electrolysis will be competitive when we have had the first roll-out of GW scale electrolysers," he said.

Offshore interest

The NortH2 proposal to dedicate 10 GW of offshore wind capacity to hydrogen production shows the partners' conviction in future hydrogen demand.

Developers in Germany and Belgium are also looking to grab a share of the growing hydrogen market. These projects plan to supply both grid electricity and hydrogen from new offshore wind projects.

Shell, Siemens and grid operator TenneT joined forces to propose new joint offshore wind power and hydrogen tenders in Germany.

Under their plan, drawn up by E-Bridge Consulting, 900 MW of wind capacity and 800 MW of hydrogen capacity could be tendered every two years with construction starting in 2026-2030.

Investors in the projects would receive a tariff premium for hydrogen production while electricity revenues would be market-based, Vigen Nikogosian, principal consultant at E-Bridge Consulting, told New Energy Update last year.

Before then, the Port of Ostend and Belgian groups DEME and PMV plan to build the world's first commercial-scale hydrogen production facility powered by offshore wind farms.

Under the Hyport Ostend project, the partners plan to build a 50 MW demonstration electrolysis plant by 2022, followed by a large-scale commercial unit by 2025, DEME said in January.

The electrolysis facility would use excess power not required by the grid due to differences in supply and demand peaks, it said.

The NortH2 partners clearly see room for much larger offshore wind development.