What does this signal for crude oil?

Very clearly, it suggests an up-move in the price of crude oil.

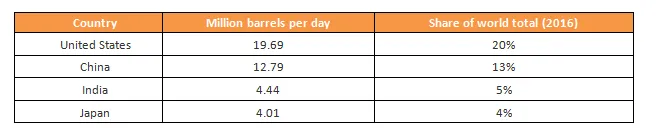

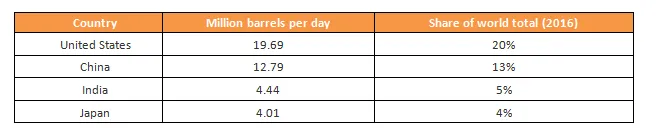

The United States and China are the two top consumers of crude oil, followed by Japan and India.

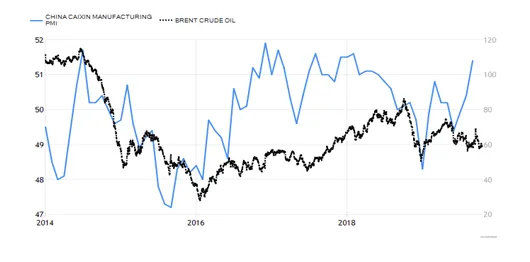

Any slowdown in these countries would put pressure on crude demand and drag down prices. However, a recovery in the US will trigger a pick up the demand for crude, which in turn will lead to higher crude prices.

There are signals of recoveries in the US economy

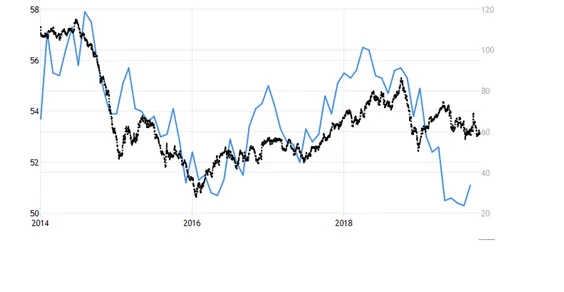

§ U.S. Manufacturing PMI and China PMI have witnessed an uptick (See graph at the end of the article).

§ Negotiations between the US and China are seeing some positive moves.

§ Central Bank stimulus measures (in the form of rate cuts) have been initiated in various countries, including and quite importantly, the US, China and India.

Technical outlook for crude

The WTI Nymex Crude is trading @ USD 55 per barrel. Technically, the trend line is holding strong support at USD 50 levels. We expect the price to head towards USD 58-60 in the short term (i.e. around 2 months).

Short term View: USD 60 (1 to 2-month period)

Medium Term View: USD 65-68 (3 to 5-month period)

Long term View: USD72-76 (8 to 9-month period)

Disclaimer:

We, Ventura Securities Ltd, (SEBI Registration Number INH000001634) its Analysts & Associates with regard to blog article hereby solemnly declare & disclose that:

We do not have any financial interest of any nature in the company. We do not individually or collectively hold 1% or more of the securities of the company. We do not have any other material conflict of interest in the company. We do not act as a market maker in securities of the company. We do not have any directorships or other material relationships with the company. We do not have any personal interests in the securities of the company. We do not have any past significant relationships with the company such as Investment Banking or other advisory assignments or intermediary relationships. We are not responsible for the risk associated with the investment/disinvestment decision made on the basis of this blog article.