Inverted Yield Curve

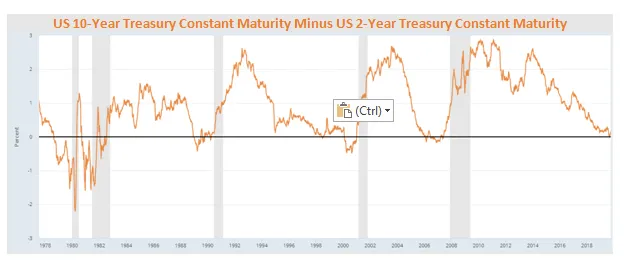

On 14th Aug 2019, the 10 -year US Treasury bond yield fell below the yield on two-year bonds, creating an Inverted Yield curve. This scenario occurred for the first time since the financial market crisis of 2007-08. Now, before we get to whether this economic phenomenon will impact crude prices, let’s first back up a little and understand what an inverted yield curve is and how it impacts economies, in general.

What is an inverted yield curve?

Generally speaking, an inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. It signals the future perception of businesses to be uncertain and usually is an omen of a looming recession.

Inverted US yield curves and recessions

An inverted yield curve for US Treasury bonds is among the most consistent recession indicators. A look at the most recent previous inverted yield curve, which manifested in 2006, reveals that it was a precursor to the 2008 financial crisis. It occurred two years before the meltdown.

In fact, there have been “Inverted Yield Curve” formations before US recessions since 1950.

Currently, investors and economists are especially worried, mainly due to the fact that there is no end in sight to the US-China trade war and some sectors, particularly automobiles, are facing a downturn.

So, is a recession imminent?

In the past, the inversions of the yield curve typically occurred when rates were rising. This time, however, rates are generally following a downward trend. The exception occurred in 1998, wherein a falling rate scenario culminated in an inverted yield curve. Even during that instance, the curve re-steepened, and there was no recession over the following two years.

Secondly, while inverted yield curves may be precursors to a recession, not every inversion has been followed by a recession. In the past, a recession did not follow three of ten inverted yield curve situations.

Currently, only the ‘Yield Curve’ in the US has touched the bottom, other indicators such as the ISM and the Housing market trend are in the ‘Neutral’ space and other leading indicators are in ‘Positive’ territory.

Nevertheless, despite past occurrences in 1980, 1990, 2001 and 2008, it does not seem likely that 2019-2020 will witness a recession.

1. Firstly, due to rate cuts in the US and stimulus programs across the globe, there is hope that a lower interest rate regime could offset the ill-effects of a recession or pre-empt it all together. Stimulus packages could arrest the slowdown and restore economic growth.

2. Secondly, we could see a resolution to the US-China trade war, ahead of the US Presidential Election in Nov 2020.

As a result, we expect that either there will be an outright exception to the rule and the current inverted yield curve will not be an indicator of a recession or there could be a prolonged delay between the current yield curve inversion and a recession. Of course, one other major factor of uncertainty which could topple the equation is how the BREXIT will pan out.