5 key signposts that will set the cost of the marginal barrel of oil in the long term

Our updated Global Oil Supply & Demand Outlook to 2030 explores in detail the 5 signposts that will set the cost of the marginal barrel of oil in the long term. This article provides a quick overview of each signpost, color-coded to reflect the positive or negative impact on oil prices.

March 1, 2018We expect prices to increase towards $70/bbl after 2020 as the full effect of MARPOL regulations is reflected on global demand while non-OPEC supply is short due to lack of investment in the last 3 years. OPEC and US shale oil producers will capture this opportunity by increasing production. US shale oil will plateau by 2027-28, opening up investment opportunities for other resource types such as deepwater and international shale oil.

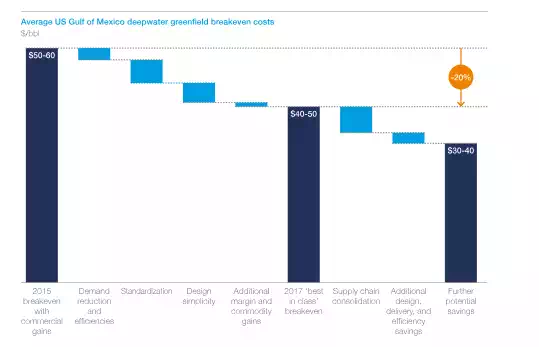

1. Global oil demand

Long-term oil demand growth is driven mainly by chemicals, but at a much slower pace of 0.7%p.a., as energy efficiency and EV substitution cause road transportation consumption to peak. Meanwhile, MARPOL legislation will bring further 1MMb/d of demand p.a.

Exhibit 1

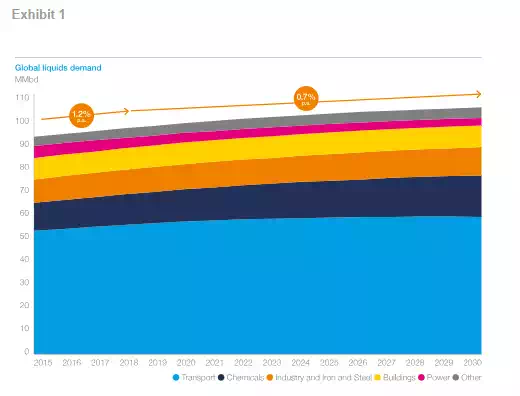

2. Non-OPEC declines

In the long term, the industry will need to replace 4-5MMb/d production every year due to declining production in mature basins.

Exhibit 2

3. North American shale oil

US shale oil will grow above 10MMb/d, but resource constraints in legacy plays will restrain long-term output.

Exhibit 3

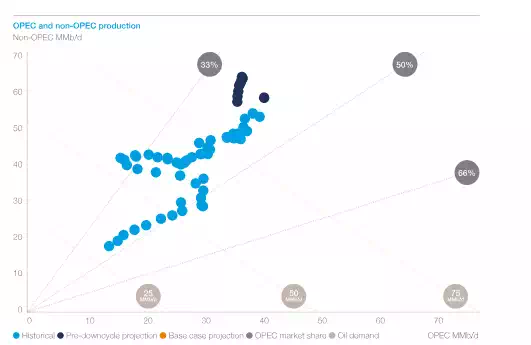

4. OPEC production

OPEC is set to maintain its market share at around 43% in the long run, as the organization will manage supply to balance the market when needed.

Exhibit 4

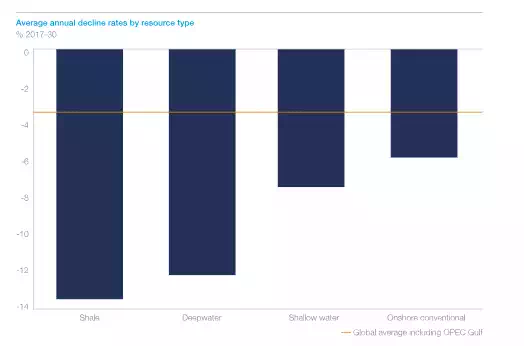

5. New project costs

Recent improvements in project cost savings are expected to be partially maintained and translate to 15-20% reductions in project breakeven costs by 2030.

Exhibit 5