Who is paying for the biofuels mandate?

The cost of complying with the US renewable fuels standard (RFS) has become a major cost item for US refiners as both the mandate volumes and the traded price for credits —renewable identification numbers (RINs) —have increased.

May 18, 2018The cost of complying with the US renewable fuels standard (RFS) has become a major cost item for US refiners as both the mandate volumes and the traded price for credits —renewable identification numbers (RINs) —have increased. These costs have fallen recently but remain a major concern for refiners.

The US oil industry has an obligation to blend 19.29 billion gallons of biofuels into the domestic transportation fuel pool (including gasoline and on-road diesel).

The obligation for compliance rests with refiners and importers of fuel, and is achieved by submitting RINs. These are created when fuel is blended (typically just before final delivery to retailers), not when it is refined. This means that most refiners must buy RINs from blenders to satisfy their regulatory obligation.

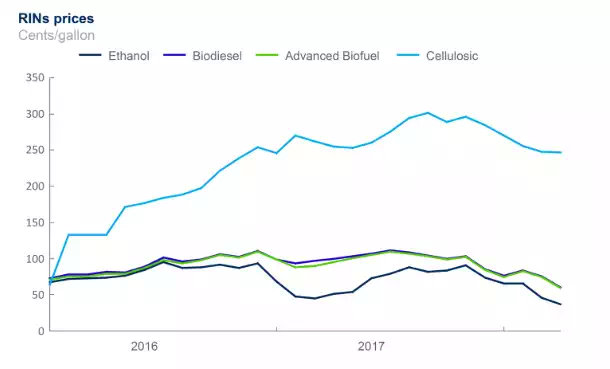

The price for the basic ethanol RIN averaged around 70 cents per gallon in 2017. This translated to a cost of more than $3.50 for each barrel of transport fuel. For an individual refinery, this has added hundreds of millions of dollars to the cost of operations, raising big concerns about the effect on plant profitability.

Exhibit 1

In recent weeks, prices have seen some significant declines. The average price for the basic ethanol RIN in April was 36 cents/gallon or about half the value at the end of 2017. The sharp decline is widely attributed to moves by the EPA to be more generous in granting hardship wavers to smaller refiners, effectively exempting them from compliance. The rules for the renewable fuels mandate allow the EPA to exempt refineries with capacity of less than 75 thousand barrels/day if the EPA determines that compliance creates a financial hardship for the company.

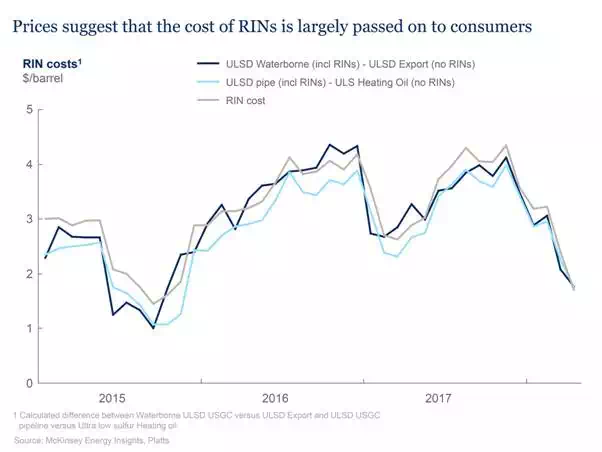

Even at the current lower levels, RIN costs are still a significant cost to refiners that must comply with the mandate. However, it appears that most, if not all, of this cost is being passed on to consumers in the form of higher product prices, keeping refiners whole. The evidence of this comes in a few forms:

§ Price differences between similar fuels that are and are not exposed to the biofuels obligation generally show a differential in line with the cost of RINs. For example, the price difference between waterborne ultra-low-sulfur diesel (ULSD), which has a RIN obligation, and export ULSD, which does not, averaged $3.34/barrel in 2017, versus a RIN-obligation cost of $3.50/barrel.

§ Refiner optimization decisions are largely being made using an LP model that builds in the cost of RINs when considering whether to make a product that is RIN-obligated or not.

§ Traders report that waterborne product transactions include a discount for the cost of RINs if the product is for export.

§ So, who is capturing this higher margin? Most of the direct value from higher prices is flowing to the blenders of fuel who put the biofuel into the final product, which “releases” the RIN that they can then sell to refiners. While refining companies benefit from the blending they do for their own marketing networks, most of the blending is done by large fuel wholesalers and retailers, who buy fuel from refiners and biofuel from ethanol producers. The benefit to ethanol producers comes mostly from the demand for ethanol that the mandate drives.

Exhibit 2

For refiners, these pricing dynamics suggest that their profitability is not seeing a dramatic hit from RIN-compliance costs, once they are managing the exposure well.

Put simply, good management includes:

§ Buying RINS at market value as the RIN obligation is incurred (at least every month)

§ Incorporating the cost of RINs compliance accurately into economic decision making.Specifically, this requires including the cost of RINs in refinery LP models as part of the cost of making RIN exposed products, and updating these costs with changes in RIN prices

§ Closely managing the compliance process including registering transactions, confirming transactions, and submitting RINs