Instruments of Monetary Policy

Definition:

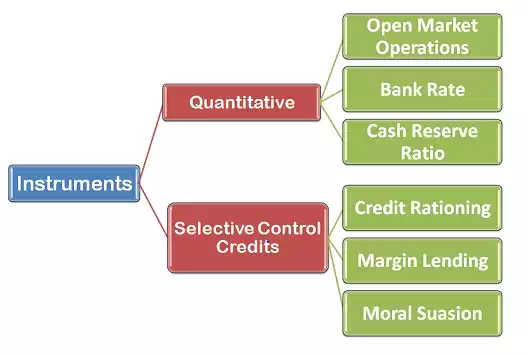

The Monetary Policy is a process whereby the monetary authority, generally the central bank controls or regulate the money supply in the economy. The central bank uses several instruments of monetary policy, referred to as monetary variables at its discretion, to regulate the credit availability and liquidity (money supply) in a manner that controls inflation and at the same time stimulate the growth of the economy. The instruments of monetary policy are also called as “weapons of monetary policy”. These instruments can be categorized as:

1. Quantitative Measures: These are the traditional measures of monetary control. All the quantitative methods affect the entire credit market in the same direction. This means their impact on all the sectors of the economy is uniform. But however it does not take into consideration the objectives of credit control. The quantitative measure includes the following methods:

· Open Market Operations

· Bank Rate or Discount Rate

· Cash Reserve Ratio

2. Selective Credit Controls: Since the objectives of credit control are not served by the quantitative methods, the economists rely on selective control methods to fulfill the purpose. The credit objectives may include rationing the credit, directing the flow of credit from least important sectors to the most important sectors, controlling a speculating tendency based on the availability of bank credit. Thus, these objectives are very well served by the selective control methods. It includes the following monetary measures:

· Credit Rationing

· Change in Lending Margins

· Moral Suasion

In addition to these measures, the central bank uses a Liquidity Adjustment Facility, Repo Rate, and Reverse Repo Rate, to control and regulate the money supply in the economy. The Repo Rateis the rate at which commercial banks borrow from RBI while the Reverse Repo Rate is the opposite of Repo rate. It is the rate at which RBI borrows from the commercial banks against the government securities. The RBI keeps changing these rate at its discretion. The Repo Rate increases the money supply while the Reverse Repo Rate decreases the money supply in the economy.