9/9/18: Populism, Middle Class and Asset Bubbles

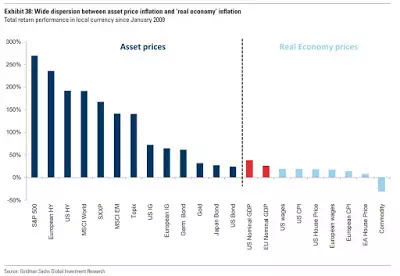

The range of total returns (unadjusted for differential FX rates) for some key

assets categories since 2009 via Goldman Sachs Research:

The above highlights the pivot toward financial assets inflation under the

tidal wave of Quantitative Easing programmes by the major Central Banks. The

financial sector repression is taking the bite out of the consumer / household

finances through widening profit margins, reflective of the economy's move

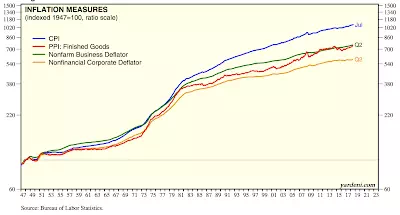

toward higher financial intensity of output. Put differently, the CPI gap to

corporate costs inflation is widening, and with it, the asset price inflation

is drifting toward financial assets:

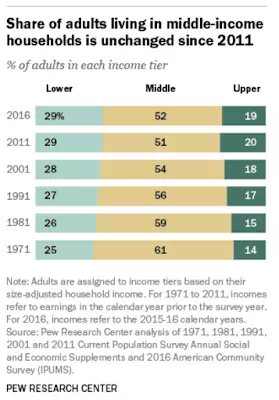

This is the 'beggar-thy-household' economy, folks. Not surprisingly, while the

proportion of total population classifiable as middle-class might be

stabilising (after a massive decline from the 1970s and 1980s levels):

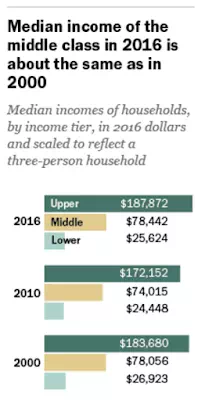

Incomes of the middle class are stagnant (and for lower earners,

falling):

And post-QE squeeze (higher interest rates and higher cost of credit

intermediation) is coming for the already stretched households. Any wonder that

political populism/opportunism is also on the rise?