11/9/18: Slow Recoveries & Unemployment Traps: Hysteresis and/or Secular Stagnation

The twin secular stagnations hypothesis (TSSH, first postulated on this blog)

that combines supply-side (technological cyclicality) and demand-side (demographic

cyclicality) arguments for why the world economy may have settled on a lower

growth trajectory than the one prevailing before 2007 has been a recurrent

feature of a number of my posts on this blog, and has entered several of my

policy and academic research papers. Throughout my usual discourse on the

subject, I have persistently argued that the TSSH accommodates the view that

the Global Financial Crisis and the associated Great Recession and the Euro

Area Sovereign Crisis of 2007-2014 have significantly accelerated the onset of

the TSSH. In other words, TSSH is not a displacement of the arguments that

attribute current economic dynamics (slow productivity growth, slower growth in

the real economy, reallocation of returns from labour and human capital to

technological capital and, more significantly, the financial capital) to the

aftermath of the structural crises we experienced in the recent past. The two

sets of arguments are, in my view, somewhat complementary.

The paper starts with the - relatively common in the literature - superficial

(in my opinion) dichotomy between the secular stagnation hypothesis and the

"alternative explanation" of the slowdown in the economy, namely

"that large, temporary downturns can themselves permanently damage an

economy’s productive capacity." The latter is the so-called 'hysteresis

hypothesis', "according to which changes in current aggregate demand can

have a significant effect on future aggregate supply" which dates back to

the 1980s. The superficiality of this dichotomy relates to the causal chains

involved, and to the impact of the two hypotheses.

However, as the authors note, correctly: "While the two sets of

explanations may be observationally similar, they have very different normative

implications. If exogenous structural factors drive slow growth,

countercyclical policy may be unable to resist or reverse this trend. In

contrast, if temporary downturns themselves lead to persistently or permanently

slower growth, then countercyclical policy, by limiting the severity of

downturns, may have a role to play to avert such adverse developments."

The authors develop a model in which countercyclical monetary policy can

"moderate" the impact of the sudden, but temporary large downturns,

i.e. in the presence of hysteresis. How does this work?

The authors first describe the source of the deep adverse shock capable of

shifting the economy toward long-term lower growth rates: "in our model,

hysteresis can arise because workers lose human capital whilst unemployed and

unskilled workers are costly to retrain". This is not new and goes back to

the 1990s work on hysteresis. The problem is explaining why exactly such deep

depreciation takes place. Long unemployment spells do reduce human capital

stock for workers, but long unemployment spells are feature of less skilled

workforce, so there is less human capital to depreciate there in the first

place. Retraining low skilled workers is not more expensive than retraining

higher skilled workers. In fact, low skilled workers seek low skilled jobs and

these require only basic training. It is quite possible that low skilled

workers losing their jobs today are of certain demographic (e.g. older workers)

that reduces the effectiveness of retraining programs, but that is the TSSH domain,

not the hysteresis domain.

But, back to the authors: "... large adverse fundamental shocks can cause

recessions whose legacy is persistent or permanent unemployment...

Accommodative policy early in a recession can prevent hysteresis from taking

root and enable swift a recovery. In contrast, delayed monetary policy

interventions may be powerless to bring the economy back to full

employment."

"As in Pissarides (1992), these features [of long unemployment-induced

loss of human capital, sticky wages that prevent wages from falling

significantly during the downturns, costly search for new jobs, and costly

retraining of workers] generate multiple steady states. One steady state is a

high pressure economy: job finding rates are high, unemployment is low and

job-seekers are highly skilled. While tight labor markets - by improving

workers’ outside options - cause wages to be high, firms still find job

creation attractive, as higher wages are offset by low average training costs

when job-seekers are mostly highly skilled." Note: the same holds when

highly skilled workers labour productivity rises to outpace sticky wages, so

one needs to also account for the reasons why labour productivity slacks or

does not keep up with wages growth during the downturn, especially when the

downturn results in selective layoffs of workers who are less productive ahead

of those more productive. Hysteresis hypothesis alone is not enough to do that.

We need fundamental reasons for structural changes in labour productivity that

go beyond simple depreciation of human capital (or, put differently, we need

something similar to the TSSH).

"The economy, however, can also be trapped in a low pressure steady state.

In this steady state, job finding rates are low, unemployment is high, and many

job-seekers are unskilled as long unemployment spells have eroded their human

capital. Slack labor markets lower the outside options of workers and drive

wages down, but hiring is still limited as firms find it costly to retrain

these workers." Once again, I am not entirely convinced we are facing

higher costs of retraining low skilled workers (as argued above), and I am not

entirely convinced we are seeing the problem arising amongst the low skilled

workers to begin with. Post-2008 recovery has been associated with more jobs

creation in lower skilled categories of jobs, e.g. hospitality sector,

restaurants, bars, other basic services. These are low skilled jobs which

require minimal training. And, yet, we are seeing continued trend toward lower

labour force participation rates. Something is missing in the argument that

hysteresis is triggered by cost of retraining workers.

Back to the paper: "Importantly, the transition to an unemployment trap

following a large severe shock can be avoided. If monetary policy commits to

temporarily higher inflation after the liquidity trap has ended, it can

mitigate both the initial rise in unemployment, and its persistent (or

permanent)

negative consequences. Monetary policy, however, is only effective if it is

implemented early in the downturn, before the recession has left substantial

scars... [otherwise] ...fiscal policy, in the form of hiring or training

subsidies, is necessary to engineer a swift recovery."

The paper tests the model in the empirical setting. And the results seem to be

plausible: "allowing for a realistic degree of skill depreciation and

training costs... is sufficient to generate multiple steady states.... this

multiplicity is essential in explaining why the unemployment rate in the U.S.

took 7 years to return to its pre-crisis level. In contrast, the standard

search model without skill depreciation and/or training costs predicts that the

U.S. economy should have fully recovered by 2011. ...the model indicates that

had monetary policy been less accommodative or timely during the crisis,

leading to a peak unemployment rate higher than 11 percent, the economy might

have been permanently scarred and stuck in an unemployment trap. Furthermore,

our model suggests that the persistently high proportion of long-term

unemployed in the European periphery countries may reflect a lack of timely

monetary accommodation by the European Central Bank."

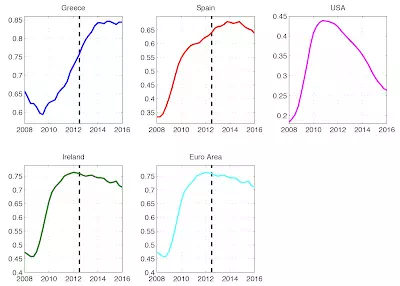

Fraction of Long-term unemployed (>27 weeks) in select countries.

The figure plots five quarter moving averages of quarterly data.

The dashed-line indicates the timing of Draghi’s “whatever it takes” speech.

Source: Eurostat and FRED.

This seems quite plausible, even though it does not explain why eventual

'retraining' of low skilled workers is still not triggering substantial

increases in labour productivity growth rates in Europe and the U.S.

One interesting extension presented in the paper is that of segmented labour

markets, or the markets where "employers might be able to discern whether

a worker requires training or not based on observable characteristics - in particular,

their duration of unemployment... [so that, if] skilled and unskilled workers

searched in separate markets, the economy would still be characterized by

hysteresis, but it would take a different form. There are two possibilities to

consider. [If] ... the firm’s share of the surplus from hiring an unskilled

worker, net of training costs, is large enough to compensate firms for posting

vacancies in the unskilled labor market, ...after a temporary recession which

increases the fraction of unskilled job-seekers, it can take a long time for

these workers to be reabsorbed into employment. Firms prefer to post vacancies

in the market for skilled job-seekers rather than the market for unskilled

job-seekers in order to avoid paying a training cost. With fewer vacancies

posted for them, unskilled job-seekers face a lower job-finding rate and thus,

the outflow from the pool of unskilled job-seekers is low. In contrast, the

skilled unemployment rate recovers rapidly - in fact, faster than in the

baseline model with a single labor market... [Alternatively], the segmented

labor markets economy could experience permanent stagnation, rather than a slow

recovery, [if] unskilled workers are unemployable, since firms are unwilling to

pay the cost of hiring and training these workers. Thus unskilled workers

effectively drop out of the labor force."

We do observe some of the elements of both such regimes in the advanced

economies today, with simultaneous increasing jobs creation drift toward

lower-skilled, slack in supply of skills as younger, educated workers are

forced to compete for lower skilled jobs, and a dropout rate acceleration for

labour force participation. Which suggests that demographics (the TSSH

component, not hysteresis component) is at play at least in part in the

equation.

In summary, a very interesting paper that, in my opinion, adds to the TSSH

arguments a new dimensions: deterioration in skills due to severity of a demand

shock and productivity shock. It does not, however, contradict the TSSH and does

not invalidate the key arguments of the TSSH. As per effectiveness of monetary

or monetary-fiscal policies in combatting the long-term nature of the adverse

economic equilibrium, the book remains open in my opinion, even under the

hysteresis hypothesis: if hysteresis is accompanied by a permanent loss of

skills twinned with a loss of productivity (e.g. due to technological

progress), adverse demographics (older age cohorts of workers losing their

jobs) will not be resolved by a training push. You simply cannot attain a catch

up for the displaced workers using training schemes in the presence of younger

generation of workers competing for the scarce jobs in a hysteresis

environment.

And the Zero-Lower Bound on monetary policy still matters: the duration of the

hysteresis shock will undoubtedly create large scale mismatch between the

sovereign capacity to fund future liabilities (deficits) and the longer-run

inflationary dynamics implied by the extremely aggressive and prolonged

monetary intervention. In other words, large enough hysteresis shock will

require Japanification of the economy, and as we have seen in the case of

Japan, such a scenario does not lead to the economy escaping the TSSH or

hysteresis (or both) trap even after two decades of aggressive monetary and

fiscal stimuli.