13/9/18: Shares Buybacks Swallow much of Trump's Corporate Tax 'Reforms'

A recent post from the U.S. Fed looked at how companies with large holdings of

cash abroad have used those funds following the Tax Cuts and Jobs Act of 2017 (the

TCJA, or the Republican Tax Cuts), which incentivised the repatriation of

foreign earnings stashed by the U.S. corporations abroad, including Ireland.

Per Fed note: "by the end of 2017, U.S. MNEs had accumulated approximately

$1 trillion in cash abroad, held mostly in U.S. fixed-income securities",

aka - bonds. Which, of course, also explains why Ireland is one of the largest

domiciles for U.S. Treasuries.

The TCJA moved the U.S. "to a quasi-territorial tax system in which

profits are taxed only where they are earned" so "...U.S. MNEs'

foreign profits will therefore no longer be subject to U.S. taxes when

repatriated. As a transition to this new tax system, the TCJA imposed a

one-time tax (payable over eight years) on the existing stock of offshore holdings

regardless of whether the funds are repatriated, thus eliminating the tax

incentive to keep cash abroad."

As of Q1 2018, the U.S. firms "repatriated just over $300 billion, roughly

30% of the estimated stock of offshore cash holdings."

This "quantity of cash repatriated since the passage of the TCJA might

have a notable effect on firm financing patterns and investment decisions in

the near term". The Fed note argues "that funds repatriated in

2018:Q1 have been associated with a dramatic increase in share buybacks;

evidence of an increase in investment is less clear at this stage, as it is

likely too early to detect given that the effects may take time to

materialize."

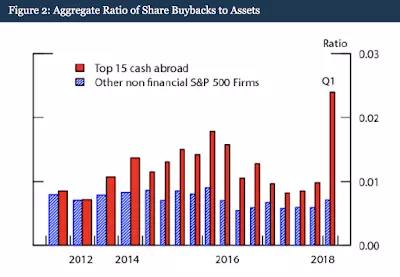

The top 15 U.S. firms (by cash holdings abroad) "account for roughly 80

percent of total offshore cash holdings, and roughly 80 percent of their total

cash (domestic plus foreign) is held abroad... following the passage of the

TCJA ...share buybacks spiked dramatically for the top 15 cash holders, with

the ratio of buybacks to assets more than doubling in 2018:Q1. In dollar terms,

buybacks increased from $23 billion in 2017:Q4 to $55 billion in 2018:Q1."

Worse: "among the top 15 cash holders, the largest holders accounted for

the bulk of the share repurchases: In 2018:Q1, the top 5 cash holders accounted

for 66 percent, and the top holder alone accounted for 41 percent." Note:

the top holder is... Apple.

Of course, "firms can also pay out cash to shareholders through dividends;

however, unlike buybacks, dividends were little changed for the top 15 cash holders

relative to the same period last year."

"...unlike in the case of share buybacks, there is no obvious spike in

investment among the top 15 cash holders in 2018:Q1 relative to the previous

quarter. Indeed, it appears that the top 15 cash holders have already been on a

slight upward trajectory relative to other firms for a few years."

The repatriation "may also have been used to pay down debt; however, the

aggregate debt of the top 15 cash holders declined only about $15 billion, or 2

percent of their total debt outstanding, suggesting limited paydowns so

far."

Thus, in simple terms, and allowing some conditionality for lags in investment,

the TCJA 2017 has primarily went to stimulate stock market activity, as opposed

to either corporate deleveraging or corporate investment. This is consistent

with 2004 repatriation amnesty, when the bulk of funds brought by the U.S. MNEs

back to the U.S. went to fund shares repurchases in 2005.