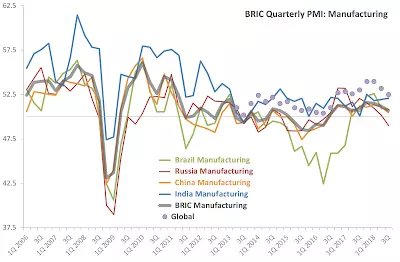

1/10/18: BRIC Manufacturing PMI dips down in 3Q 2018

BRIC Manufacturing PMIs turned south in 3Q 2018 in line with Global trend, but

leading that trend to the downside. Per latest data through September 2018:

Russia Manufacturing PMI averaged miserly

49.0 in 3Q 2018, down from anaemic 50.2 in 2Q 2018. This was the lowest

quarterly reading since 3Q 2015 when the Russian economy was in an official

recession. Russia is the only BRIC economy nominally in contraction territory,

when it comes to PMIs-signalled manufacturing sector activity, and 49.0 is

statistically close to being sub-50 reading as well.

Brazilís Manufacturing PMI remained broadly unchanged on 2Q 2018 reading of 50.9 at 50.8 in

3Q 2018. Although notionally above 50.0 mark, statistically, the reading was

not significantly different from zero growth signal of 50.0. This means that

both Russian and Brazilian economies registered deteriorating PMIs over two

consecutive quarters in the case of Brazil and 4 quarters in the case of Russia.

China Manufacturing PMI was at disappointing 50.5 in 3Q 2018, down from a weak 51.1

reading in 2Q 2018. This marks the worst reading in China PMI in five quarters.

As with Brazil, Chinaís Manufacturing PMI for 3Q 2018 was not statistically

distinct from 50.0.

India Manufacturing PMI was the only one that remained statistically in expansion

territory at 52.1 in 3Q 2018, basically unchanged on 52.0 in 2Q 2018 and barely

up on 51.8 in 1Q 2018.

Meanwhile, Global Manufacturing PMI averaged 52.5 in 3Q

2018, down from 53.2 in 2Q 2018 and 54.0 in 4Q 2017 and 1Q 2017. All in, Global

PMI has finished 3Q 2018 at the lowest level in 8 consecutive quarters.