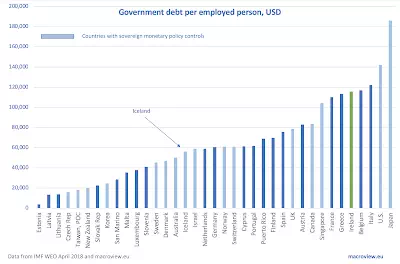

2/10/18: Government Debt per Employed Person

We often see Government debt expressed in reference to GDP or in per capita

terms. However, carry capacity of sovereign debt depends not as much on the number

of people in the economy, but on the basis of those paying the lionís share of

taxes, aka, working individuals. So here is the data for advanced economies

Government debt expressed in U.S. dollar terms per person in employment:

Some interesting observations.

Ireland, as a younger, higher employment economy ranks fifth in the world in

terms of Government debt per person employed (USD 115,765 in debt per

employed). In terms of debt per capita, it is ranked in the fourth place at USD

54,126.

Plucky Iceland, the country hit as hard by the Global Financial Crisis as

Ireland and often compared to the latter by a range of analysts and

policymakers, ranks 22nd in terms of Government debt burden per employed person

(USD 56,185) although it ranks 13th in per capita terms (USD 32,502). In simple

terms, Iceland has higher employment rate than Ireland, resulting in lower

burden per employed person.

When one considers the fact that non-Euro area countries have more sovereign

control over their monetary policies, allowing them to carry higher levels of

debt than common currency area members, Irish debt per employed person is the

third highest in the world after Italy and Belgium, and higher than that of

Greece.

Out of top ten debtors (in terms of Government debt per employed person), six

are euro area member states (10 out top 15).

Looking solely at the euro area countries, Irelandís position in terms of debt

per capita is woeful: the country has the highest debt per capita of all euro

area states at EUR43,659 per person, with Belgium coming in second place with

EUR40,139. In per-employee terms, Ireland takes the third highest place in the

euro area with EUR93,378 in Government debt, after Italy (EUR98,314) and

Belgium (EUR94,340).