3/10/18: Dumping Ice bags into Overheating Reactor: Bonds & Stocks Bubbles

"Supply shortages, induced mainly by

central bank quantitative easing have been a major factor driving asset

markets, in our opinion. Not all, but a big part." So forget the

'not all' and think about risks pairings in a complex financial system of

today: equities and bonds are linked through demand for yield (gains) and

demand for safety. If both are underpricing true risks (and bond markets are

underpricing risks, as the quote implies), it takes one to scratch for the

other to blow. Systems couplings get more fragile the tighter they become.

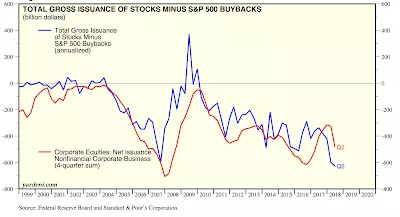

"The float of total U.S. equities has

shrunk dramatically, in part, due to cheap financing to fund share

buybacks. The technical shortage of stocks have helped boost U.S.

equity markets and killed off most bears and short sellers." In other

words, as I have warned repeatedly for years now, U.S. equity markets are now

dangerously concentrated (see this blog for posts involving concentration

risks). This concentration is driven by three factors: M&As and shares

buy-backs, plus declined IPOs activity. The former two are additional links to

monetary policies and, thus to the bond markets (coupling is getting even

tighter), the latter is structural decline in enterprise formation and

acceleration rates (secular stagnation). This adds complexity to tight coupling

of risk systems. Bad, very bad combination if you are running a nuclear power

plant or a major dam, or any other system prone to catastrophic risk exposures.

How bad the things are?

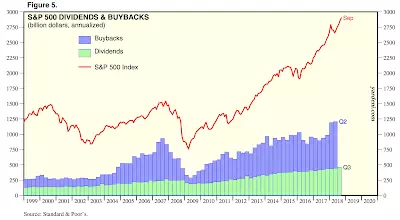

Since 1Q 2009, total cumulative

shares buy-backs for S&P500 amounted (through 2Q 2018) to USD 4.2769

trillion.

Now, those charts.

Chart 1, via Yardeni Research's "Stock

Market Indicators: S&P 500 Buybacks & Dividends" book from October

3rd (https://www.yardeni.com/pub/buybackdiv.pdf)

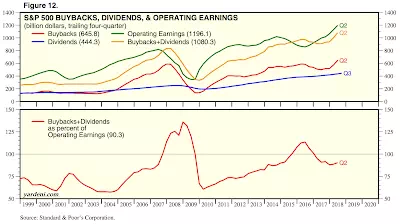

What am I looking at here? The signals revealing

flow of corporate earnings toward investment, or, the signs of the build up in

the future economic capacity of the private sector. The red line in the lower

panel puts this into proportional terms, the gap between the yellow line and

the green line in the top panel puts it into absolute terms. And both are

frightening. Corporate earnings are on a healthy trend and at healthy levels.

But corporate investment is not and has not been since 1Q 2014. This chart

under-reports the extent of corporate under-investment through two things not included

in the red line: (1) M&As - high risk 'investment' strategies by corporates

that, if adjusted for that risk, would have pushed the actual investment growth

even lower than it is implied by the red line; and (2) Risk-adjustments to the

organic investments by companies. In simple terms, there is no meaningful

translation from higher earnings into new investment in the U.S. economy so far

in 2018 and there has not been one since 2014. Put differently, U.S. economy

has been starved of organic investment for a good part of the 'boom' years.

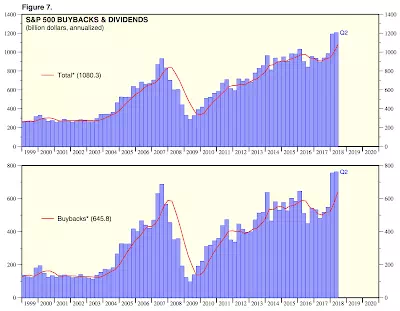

Chart 2, via the same note:

Spot something new in the charts? That's right: buybacks

are accelerating in 1H 2018, with 2Q 2018 marking an absolute historical high

at USD 1.0803 trillion (annualized rate) of buybacks. Guess what does this mean

for the markets? Well, this:

And what causes the latest spike in buybacks? No, not growing earnings

(which are appreciating, but moderately). The fiscal policy under the Tax Cuts

and Jobs Act 2017, or Trump Tax Cuts.

Let's circle back: monetary policy madness of

the past has been holding court in bond markets and stock markets, pushing

mispricing of risks to absolutely astronomical highs. We have just added to

that already risky equation fiscal policy push for more mispricing of risks in

equity markets.

This is like dumping picnic-sized bags of ice

into the cooling system to run the reactor hotter. And no one seems to care

that the bags of ice are running low in the delivery truck... You can light a

smoke and watch ice melt. Or you can run for the parking lot to drive away. As

an investor, you always have a right choice to make. Until you no longer have

any choices left.