In managerial economics another area which is of great importance is cost of production. The cost which a firm incurs in the process of production of its goods and services is an important variable for decision making. Total cost together with total revenue determines the profit level of a business. In order to maximize profits a firm endeavors to increase its revenue and lower its costs.

Costs play a very important role in managerial decisions especially when a selection between alternative courses of action is required. It helps in specifying various alternatives in terms of their quantitative values.

Following are various types of cost concepts −

Future costs are those costs that are likely to be incurred in future periods. Since the future is uncertain, these costs have to be estimated and cannot be expected to absolute correct figures. Future costs can be well planned, if the future costs are considered too high, management can either plan to reduce them or find out ways to meet them.

Management needs to estimate future costs for a various managerial uses where future cost are relevant such as appraisal, capital expenditure, introduction of new products, estimation of future profit and loss statement, cost control decisions, and expansion programs.

Past costs are actual costs which were incurred on the past and they are documented essentially for record keeping activity. These costs can be observed and evaluated. Past costs serve as the basis for projecting future cost but if they are regarded high, management can indulge in checks to find out the factors responsible without being able to do anything about reducing them.

Incremental costs are defined as the change in overall costs that result from particular decision being made. Change in product line, change in output level, change in distribution channels are some examples of incremental costs. Incremental costs may include both fixed and variable costs. In the short period, incremental cost will consist of variable cost—costs of additional labor, additional raw materials, power, fuel etc.

Sunk cost is the one which is not altered by a change in the level or nature of business activity. It will remain the same irrespective of activity level. Sunk costs are the expenditures that have been made in the past or must be paid in the future as a part of contractual agreement. These costs are irrelevant for decision making as they do not vary with the changes contemplated for future by the management.

“Out-of-pocket costs are those that involve immediate payments to outsiders as opposed to book costs that do not require current cash expenditure"

Wages and salaries paid to the employees are out-of-pocket costs while salary of the owner manager, if not paid, is a book cost.

The interest cost of owner’s own fund and depreciation cost are other examples of book cost. Book costs can be converted into out-of-pocket costs by selling assets and leasing them back from the buyer.

If a factor of production is owned, its cost is a book cost while if it is hired it is an out-of-pocket cost.

Historical cost of an asset states the cost of plant, equipment, and materials at the price paid originally for them, while the replacement cost states the cost that the firm would have to incur if it wants to replace or acquire the same asset now.

For example − If the price of bronze at the time of purchase in 1973 was Rs.18 per kg and if the present price is Rs.21 per kg, the original cost Rs.18 is the historical cost while Rs.21 is the replacement cost.

Explicit costs are those expenses which are actually paid by the firm. These costs appear in the accounting records of the firm. On the other hand, implicit costs are theoretical costs in the sense that they go unrecognized by the accounting system.

Actual costs mean the actual expenditure incurred for producing a good or service. These costs are the costs that are generally recorded in account books.

For example − Actual wages paid, cost of materials purchased.

The concept of opportunity cost is very important in modern economic analysis. The opportunity costs are the return from the second best use of the firm’s resources, which the firm forfeits. It avails its return from the best use of the resources.

For example, a farmer who is producing wheat can also produce potatoes with the same factors. Therefore, the opportunity cost of a ton of wheat is the amount of the output of potatoes which he gives up.

There are some costs which can be directly attributed to the production of a unit for a given product. These costs are called direct costs.

Costs which cannot be separated and clearly attributed to individual units of production are classified as indirect costs.

All the costs faced by companies/ business organizations can be categorized into two main types −

● Fixed costs

● Variable costs

Fixed costs are expenses that have to be paid by a company, independent of any business activity. It is one of the two components of the total cost of goods or service, along with variable cost.

Examples include rent, buildings, machinery, etc.

Variable costs are corporate expenses that vary in direct proportion to the quantity of output. Unlike fixed costs, which remain constant regardless of output, variable costs are a direct function of production volume, rising whenever production expands and falling whenever it contracts.

Examples of common variable costs include raw materials, packaging, and labor directly involved in a company's manufacturing process.

The general determinants of cost are as follows

● Output level

● Prices of factors of production

● Productivities of factors of production

● Technology

Once the firm has invested resources into the factors such as capital, equipment, building, top management personnel, and other fixed assets, their amounts cannot be changed easily. Thus in the short-run there are certain resources whose amount cannot be changed when the desired rate of output changes, those are called fixed factors.

There are other resources whose quantity used can be changed almost instantly with the output change and they are called variable factors. Since certain factors do not change with the change in output, the cost to the firm of these resources is also fixed, hence fixed cost does not vary with output. Thus, the larger the quantity produced, the lower will be the fixed cost per unit and marginal fixed cost will always be zero.

On the other hand, those factors whose quantity can be changed in the short-run is known as variable cost. Thus, the total cost of a business is the sum of its total variable costs (TVC) and total fixed cost (TFC).

TC = TFC + TVC

The long-run is a period of time during which the firm can vary all its inputs. None of the factors is fixed and all can be varied to expand output.

It is a period of time sufficiently long to permit the changes in plant like − the capital equipment, machinery, land etc., in order to expand or contract output.

The long-run cost of production is the least possible cost of production of producing any given level of output when all inputs are variable including the size of the plant. In the long-run there is no fixed factor of production and hence there is no fixed cost.

If Q = f(L, K)

TC = L. PL + K. PK

As the production increases, efficiency of production also increases. The advantages of large scale production that result in lower unit costs are the reason for the economies of scale. There are two types of economies of scale −

Internal Economies of Scale

It refers to the advantages that arise as a result of the growth of the firm. When a company reduces costs and increases production, internal economies of scale are achieved. Internal economies of scale relate to lower unit costs.

External Economies of Scale

It refers to the advantages firms can gain as a result of the growth of the industry. It is normally associated with a particular area. External economies of scale occur outside of a firm and within an industry. Thus, when an industry's scope of operations expands due to the creation of a better transportation network, resulting in a decrease in cost for a company working within that industry, external economies of scale are said to have been achieved.

Diseconomies of Scale

When the prediction of economic theory becomes true that the firm may become less efficient, when it becomes too large then this theory holds true. The additional costs of becoming too large are called diseconomies of scale. Diseconomies of scale result in rising long run average costs which are experienced when a firm expands beyond its optimum scale.

For Example − Larger firms often suffer poor communication because they find it difficult to maintain an effective flow of information between departments. Time lags in the flow of information can also create problems in terms of response time to changing market condition.

Break-even analysis is a very important aspect of business plan. It helps the business in determining the cost structure and the amount of sales to be done to earn profits.

It is usually included as a part of business plan to observe the profits and is enormously useful in pricing and controlling cost.

Break - Even Point =

Fixed Costs(Unit Selling Price – Variable Costs)

Using the above formula, the business can determine how many units it needs to produce to reach break-even.

When a firm attains break even, the cost incurred gets covered. Beyond this point, every additional unit which would be sold would result in increasing profit. The increase in profit would be by the amount of unit contribution margin.

Unit contribution Margin =

Sales Price - Variable Costs

Let’s have a look at the following key terms −

● Fixed costs − Costs that do not vary with output

● Variable costs − Costs that vary with the quantity produced or sold.

● Total cost − Fixed costs plus variable costs at level of output.

● Profit − The difference between total revenue and total costs, when revenues are higher.

● Loss − The difference between total revenue and total cost, when cost is higher than the revenue.

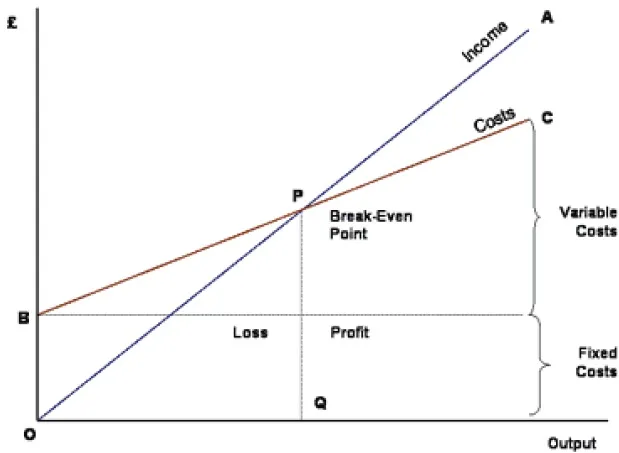

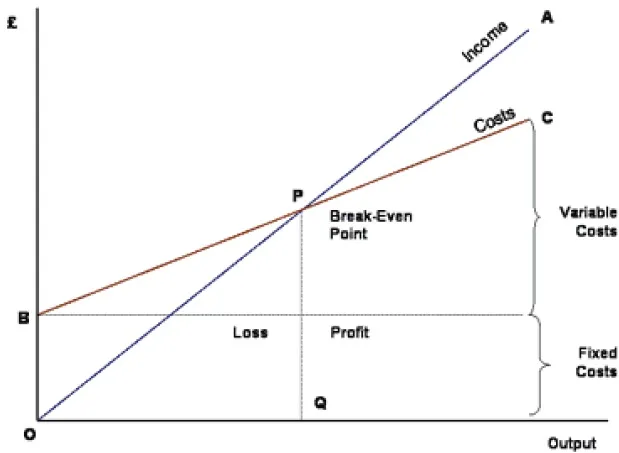

The Break-even analysis chart is a graphical representation of costs at various levels of activity.

With this, business managers are able to ascertain the period when there is neither profit nor loss made for the organization. This is commonly known as "Break-even Point".

In the graph above, the line OA represents the variation of income at various levels of production activity.

OB represents the total fixed costs in the business. As output increases, variable costs are incurred, which means fixed + variable cost also increase. At low levels of output, costs are greater than income.

At the point of intersection “P” (Break even Point) , costs are exactly equal to income, and hence neither profit nor loss is made.