Business firms are a combination of manpower, financial, and physical resources which help in making managerial decisions. Societies can be classified into two main categories − production and consumption. Firms are the economic entities and are on the production side, whereas consumers are on the consumption side.

The performances of firms get analyzed in the framework of an economic model. The economic model of a firm is called the theory of the firm. Business decisions include many vital decisions like whether a firm should undertake research and development program, should a company launch a new product, etc.

Business decisions made by the managers are very important for the success and failure of a firm. Complexity in the business world continuously grows making the role of a manager or a decision maker of an organisation more challenging! The impact of goods production, marketing, and technological changes highly contribute to the complexity of the business environment.

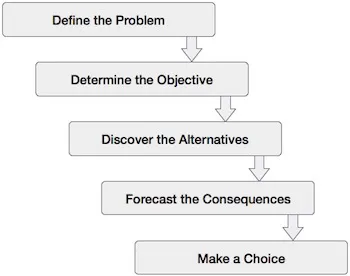

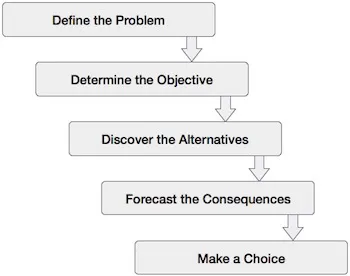

The steps for decision making like problem description, objective determination, discovering alternatives, forecasting consequences are described below −

What is the problem and how does it influence managerial objectives are the main questions. Decisions are usually made in the firm’s planning process. Managerial decisions are at times not very well defined and thus are sometimes source of a problem.

The goal of an organization or decision maker is very important. In practice, there may be many problems while setting the objectives of a firm related to profit maximization and benefit cost analysis. Are the future benefits worth the present capital? Should a firm make an investment for higher profits for over 8 to 10 years? These are the questions asked before determining the objectives of a firm.

For a sound decision framework, there are many questions which are needed to be answered such as − What are the alternatives? What factors are under the decision maker’s control? What variables constrain the choice of options? The manager needs to carefully formulate all such questions in order to weigh the attractive alternatives.

Forecasting or predicting the consequences of each alternative should be considered. Conditions could change by applying each alternative action so it is crucial to decide which alternative action to use when outcomes are uncertain.

Once all the analysis and scrutinizing is completed, the preferred course of action is selected. This step of the process is said to occupy the lion’s share in analysis. In this step, the objectives and outcomes are directly quantifiable. It all depends on how the decision maker puts the problem, how he formalizes the objectives, considers the appropriate alternatives, and finds out the most preferable course of action.

Sensitivity analysis helps us in determining the strong features of the optimal choice of action. It helps us to know how the optimal decision changes, if conditions related to the solution are altered. Thus, it proves that the optimal solution chosen should be based on the objective and well structured. Sensitivity analysis reflects how an optimal solution is affected, if the important factors vary or are altered.

Managerial economics is competent enough for serving the purposes in decision making. It focuses on the theory of the firm which considers profit maximization as the main objective. The theory of the firm was developed in the nineteenth century by French and English economists. Theory of the firm emphasizes on optimum utilization of resources, cost control, and profits in a single time period. Theory of the firm approach, with its focus on optimization, is relevant for small farms and producers.