Reporting a Balance Sheet

Question: The third financial statement is the balance sheet. If a decision maker studies a company’s balance sheet (on its Web site, for example), what information can be discovered?

Answer: The primary purpose of a balance sheet is to report an organization’s assets and liabilities at a particular point in time. The format is quite simple. All assets are listed first—usually in order of liquidityLiquidity refers to the ease with which assets can be converted into cash. Thus, cash is normally reported first followed by investments in stock that are expected to be sold soon, accounts receivable, inventory, and so on.—followed by the liabilities. A picture is provided of each future economic benefit owned or controlled by the company (its assets) as well as its debts (liabilities).

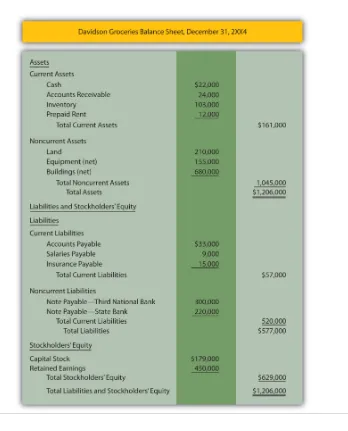

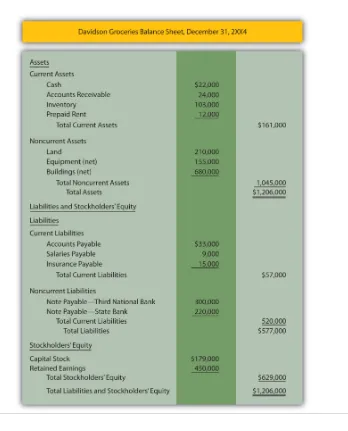

A typical balance sheet is reported in Figure 3.5 "Balance Sheet" for Davidson Groceries. Note that the assets are divided between current (those expected to be used or consumed within the next year) and noncurrent (those expected to remain within the company for longer than a year). Likewise, liabilities are split between current (to be paid during the next year) and noncurrent (not to be paid until after the next year). This labeling aids financial analysis because Davidson Groceries’ current liabilities ($57,000) can be subtracted from its current assets ($161,000) to arrive at a figure often studied by interested parties known as working capital ($104,000 in this example). The current assets can also be divided by current liabilities ($161,000/$57,000) to determine the company’s current ratio (2.82 to 1.00), another figure calculated by many decision makers as a useful measure of short-term operating strength.

The balance sheet shows the company’s financial condition on one specific date. All the other financial statements report events occurring over a period of time (often a year or a quarter). The balance sheet discloses assets and liabilities as of the one specified date.

igure 3.5 Balance SheetAs will be discussed in detail later in this textbook, noncurrent assets such as buildings and equipment are initially recorded at cost. This figure is then systematically reduced as the amount is moved gradually each period into an expense account over the life of the asset. Thus, balance sheet figures for these accounts are reported as “net” to show that only a portion of the original cost still remains recorded as an asset. This shift of the cost from asset to expense is known as depreciation and mirrors the using up of the utility of the property. On this company’s income statement—Figure 3.1 "Income Statement"—assume that depreciation for the period made up a portion of the “other” expense category.