The Need for Adjusting Entries

Question: The first two steps of the accounting process were identified in Chapter 4 “How Does an Organization Accumulate and Organize the Information Necessary to Prepare Financial Statements? “ as “analyze” and “record.” A transaction occurs and the financial effects are ascertained through careful analysis. Once determined, the impact an event has on specific accounts is recorded in the form of a journal entry. Each of the debits and credits is then posted to the corresponding T-account located in the ledger. As needed, current balances can be determined for any or all of these accounts by netting the debits and credits. It is a system as old as the painting of the Mona Lisa.

The third step in this process was listed as “adjust.” Why do ledger account balances require adjustment? Why are the T-account totals found in Figure 4.3 “Balances Taken From T-accounts in Ledger” not simply used by the accountant to produce financial statements for the reporting organization

Answer: Financial events take place throughout the year. As indicated, journal entries are recorded with the individual debits and credits then entered into the proper T-accounts. However, not all changes in a company’s accounts occur as a result of physical events. Balances frequently increase or decrease simply because of the passage of time. Or the impact is so gradual that producing individual journal entries is not reasonable. For example, salary is earned by employees every day (actually every minute) but payment is not usually made until the end of the week or month. Other expenses, such as utilities, rent, and interest, are incurred over time. Supplies such as pens and envelopes are used up on an ongoing basis. Unless an accounting system is programmed to record tiny incremental changes, the financial effects are not captured as they occur.

Following each day of work, few companies take the trouble to record the equivalent amount of salary or other expense and the related liability. When a pad of paper is consumed within an organization, debiting supplies expense for a dollar or two and crediting supplies for the same amount hardly seems worth the effort.

Prior to producing financial statements, the accountant must search for all such changes that have been omitted. These additional increases or decreases are also recorded in a debit and credit format (often called adjusting entries rather than journal entries) with the impact then posted to the appropriate ledger accounts. The process continues until all balances are properly stated. These adjustments are a prerequisite step in the preparation of financial statements. They are physically identical to journal entries recorded for transactions but they occur at a different time and for a different reason.

Question: Adjusting entries are used to update the ledger for any financial changes that have occurred gradually over time and not recorded through a regular journal entry. What kinds of adjustments are normally needed before financial statements are prepared?

Answer: A variety of adjusting entries will be examined throughout the remainder of this textbook. One of the accountant’s primary responsibilities is the careful study of all financial information to ensure that it is all fairly presented before being released. Such investigation can lead to the preparation of numerous adjusting entries. Here, in Chapter 5 “Why Must Financial Information Be Adjusted Prior to the Production of Financial Statements?”, only the following four general types of adjustments are introduced. In later chapters, many additional examples will be described and analyzed.

· Accrued expenses (also referred to as accrued liabilities)

· Prepaid expenses

· Accrued revenue

· Unearned revenue (also referred to as deferred revenue)

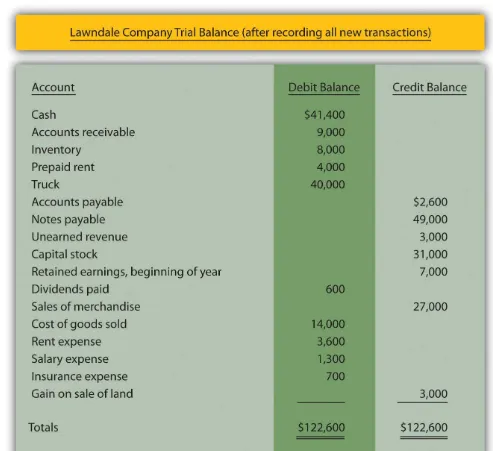

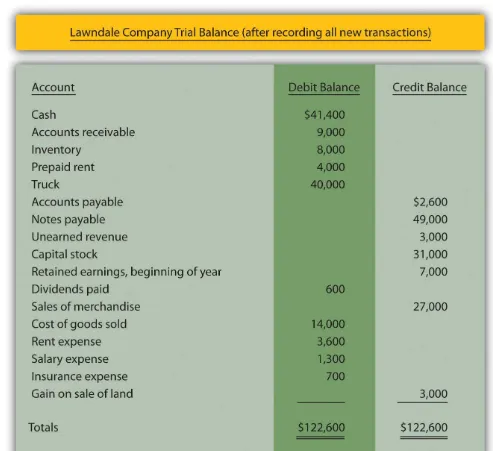

Usually, at the start of the adjustment process, the accountant prepares an updated trial balance to provide a visual, organized representation of all ledger account balances. This listing aids the accountant in spotting figures that might need adjusting in order to be fairly presented. Therefore, Figure 5.1 “Updated Trial Balance” takes the ending account balances for the Lawndale Company found in the ledger presented in Figure 4.3 “Balances Taken From T-accounts in Ledger” and puts them into the form of a trial balance.