Financial Ratio Analysis

Financial ratios are mathematical comparisons of financial statement accounts or categories. These relationships between the financial statement accounts help investors, creditors, and internal company management understand how well a business is performing and of areas needing improvement.

Financial ratios are the most common and widespread tools used to analyze a business’ financial standing. Ratios are easy to understand and simple to compute. They can also be used to compare different companies in different industries. Since a ratio is simply a mathematically comparison based on proportions, big and small companies can be use ratios to compare their financial information. In a sense, financial ratios don’t take into consideration the size of a company or the industry. Ratios are just a raw computation of financial position and performance. Ratios allow us to compare companies across industries, big and small, to identify their strengths and weaknesses. Financial ratios are often divided up into seven main categories: liquidity, solvency, efficiency, profitability, market prospect, investment leverage, and coverage.

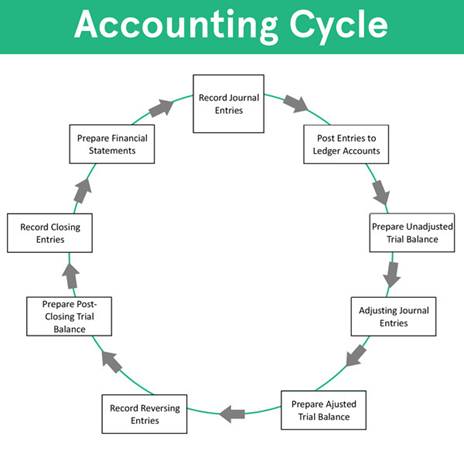

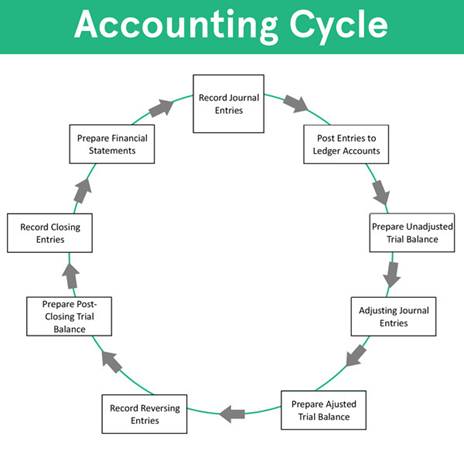

The accounting cycle is a series of steps starting with recording business transactions and leading up to the preparation of financial statements. This financial process demonstrates the purpose of financial accounting–to create useful financial information in the form of general-purpose financial statements. In other words, the sole purpose of recording transactions and keeping track of expenses and revenues is turn this data into meaning financial information by presenting it in the form of a balance sheet, income statement, statement of owner’s equity, and statement of cash flows.

The accounting cycle is a set of steps that are repeated in the same order every period. The culmination of these steps is the preparation of financial statements. Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually. This means that quarterly companies complete one entire accounting cycle every three months while annual companies only complete one accounting cycle per year.

This cycle starts with a business event. Bookkeepers analyze the transaction and record it in the general journal with a journal entry. The debits and credits from the journal are then posted to the general ledger where an unadjusted trial balance can be prepared. After accountants and management analyze the balances on the unadjusted trial balance, they can then make end of period adjustments like depreciation expense and expense accruals. These adjusted journal entries are posted to the trial balance turning it into an adjusted trial balance.

Now that all the end of the year adjustments are made and the adjusted trial balance matches the subsidiary accounts, financial statements can be prepared. After financial statements are published and released to the public, the company can close its books for the period. Closing entries are made and posted to the post closing trial balance. At the start of the next accounting period, occasionally reversing journal entries are made to cancel out the accrual entries made in the previous period. After the reversing entries are posted, the accounting cycle starts all over again with the occurrence of a new business transaction.

Here are the 9 main steps in the traditional accounting cycle.

Some textbooks list more steps than this, but I like to simplify them and combine as many steps as possible.

After this cycle is complete, it starts over at the beginning. Here is an accounting cycle flow chart.

As you can see, the cycle keeps revolving every period. Note that some steps are repeated more than once during a period. Obviously, business transactions occur and numerous journal entries are recording during one period. Only one set of financial statements is prepared however. Throughout this section, we’ll be looking at the business events and transactions that happen to Paul’s Guitar Shop, Inc. over the course of its first year in business.