The Statement of Cash Flows (also referred to as the cash flow statement) is one of the three key financial statements that reports the cash generated and spent during a specific period of time (i.e., a month, quarter, or year). The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how money moved in and out of the business.

Three sections of the Statement of Cash Flows:

Cash flows: Inflows and outflows of cash and cash equivalents

Cash: Cash on hand and demand deposits (cash balance on the balance sheet)

Cash equivalents: Cash equivalents include cash held as bank deposits, short-term investments, and any very easily cash-convertible assets – includes overdrafts and cash equivalents with short-term maturities (less than three months).

Cash flow classification

Operating Cash Flow

Operating activities are the principal revenue-producing activities of the entity. Cash Flow from Operationstypically include the cash flows associated with sales, purchases, and other expenses.

The company’s chief finance officer chooses between the direct and indirect presentation of operating cash flow:

Profit | P |

Depreciation | D |

Amortization | A |

Impairment expense | I |

Change in working capital | ΔWC |

Change in provisions | ΔP |

Interest Tax | (I) |

Tax | (T) |

Operating cash flow | OCF |

The items in the cash flow statements are not cash flows but “reasons why cash flow is different from profit.”

Depreciation expense reduces profit but does not impact cash flow. Hence, it is added back. Similarly, if the starting point profit is above interest and tax in the income statement, then interest and tax cash flows will need to be deducted if they are to be treated as operating cash flows.

There is no specific guidance on which the profit amount should be used in the reconciliation. Different companies use operating profit, profit before tax, profit after tax, or net income. Clearly, the exact starting point for the reconciliation will determine the exact adjustments made to get down to an operating cash flow number.

Cash Flow from Investing Activities includes the acquisition and disposal of non-current assets and other investments not included in cash equivalents. Investing cash flows typically include the cash flows associated with buying or selling property, plant, and equipment (PP&E), other non-current assets, and other financial assets.

Cash spent on purchasing PP&E is called capital expenditures (or CapEx for short).

Cash Flow from Financing Activities are activities that result in changes in the size and composition of the equity capital or borrowings of the entity. Financing cash flows typically include cash flows associated with borrowing and repaying bank loans, and issuing and buying back shares. The payment of a dividend is also treated as a financing cash flow. Learn how to analyze a statement of cash flow in CFI’s Financial Analysis Fundamentals Course.

Interest and Cash Flow

Under IFRS, there are two ways of presenting interest in the cash flow statement. Many companies present both the interest received and interest paid as operating cash flows. Others treat interest received as an investing cash flow and interest paid as a financing cash flow. The method used is the choice of the finance director.

Investment bankers and finance professionals use different cash flow measures for different purposes. Free cash flow is a common measure used typically for DCF valuation. However, free cash flow has no definitive definition and can be calculated and used in different ways.

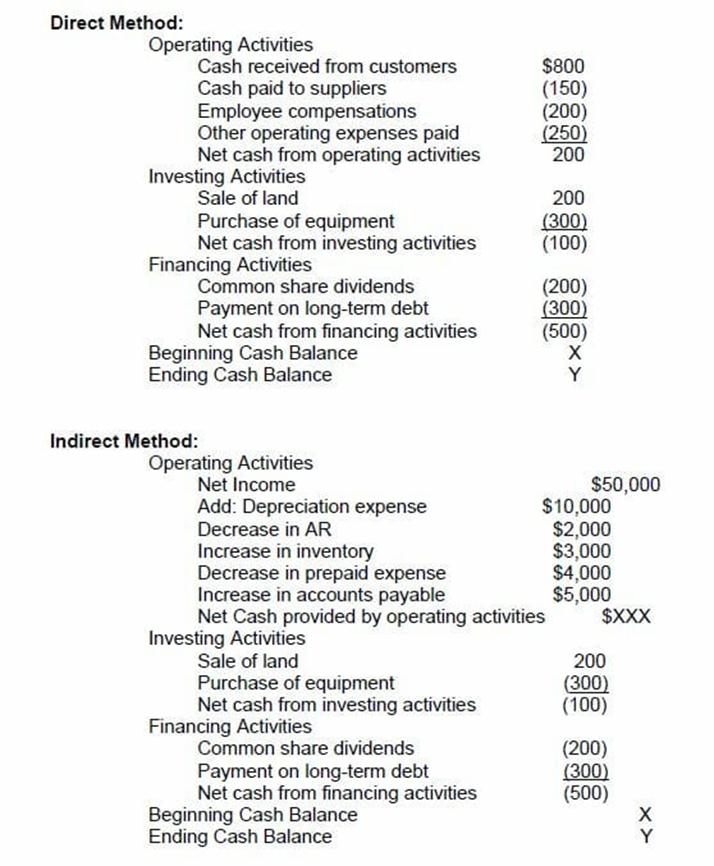

The operating section of the statement of cash flows can be shown through either the direct method or the indirect method. For either method, the investing and financing sections are identical; the only difference is in the operating section. The direct method is a method that shows the major classes of gross cash receipts and gross cash payments. The indirect method, on the other hand, starts with the net income and adjusts the profit/loss by the effects of the transactions. In the end, cash flows from the operating section will give the same result whether under the direct or indirect approach, however, the presentation will differ.

The International Accounting Standards Board (IASB) favors the direct method of reporting because it provides more useful information that the indirect method. However, it is believed that greater than 90% of companies use the indirect method.

There are two methods of producing a statement of cash flows, the direct method, and the indirect method.

In the direct method, all individual instances of cash that is received or paid out are tallied up and the total is the resulting cash flow.

In the indirect method, the accounting line items such as net income, depreciation, etc. are used to arrive at cash flow. In financial modeling, the cash flow statement is always produced via the indirect method.

Below is a comparison of the direct method vs the indirect method.

Perform an analysis of a cash flow statement in CFI’s Financial Analysis Fundamentals Course.