The Institute of Chartered Accountant of India as per Accounting Standard-2 (Revised) defines inventory as the assets held −

· For sale in the ordinary course of a business or

· In the process of production for such a sale or

· In the form of materials or supplies to be consumed in the production process or in rendering of the services.

Thus, the term inventory includes −

Proper valuation of inventory is important because of the following three reasons −

· Importance of sufficient Inventory − An inventory represents major current asset investment of any trading or manufacturing concern. Shortage of inventory may close down the business. Realization of profit from resale of an inventory makes valuation of inventory. Therefore, the point is that every business unit has to follow a proper method of inventory valuation.

· To Determine True Financial Position − Proper valuation of an inventory can only give true and fair view of the financial position of a business unit, as it constitutes a significant portion of the current assets.

· For Proper Determination of Income − Proper determination of income and profit depends on correct valuation of the inventories. Over valuation of closing inventory may overstate the profit figure and vice-versa. Therefore, proper valuation of an inventory is necessary to determine the true income and profit by the business concern.

Following are the two important methods of taking inventory −

Let’s discuss each of them separately −

This method of stock valuation is also known as physical stock taking method or annual stock taking method. Under this system of taking inventories, stock is determined by physical counting at the end of the accounting period i.e. the date of preparation of final accounts. This system is very simple and useful in small business organizations.

This system of inventory valuation records every movement of stock on the receipt and issue of material reflecting running balances of different kind of inventories through preparation of store ledgers for raw material, work-in- progress, and finished goods. To insure the accuracy of store records, a periodic reconciliation of records is done by taking physical inventories.

An inventory is valued at a cost or market price, whichever is lower to ensure that the anticipated profit should not be accounted for and full provision for anticipated losses should be done.

As per American Institute of Certified Public Accountants −

“A departure from the cost basis of pricing the inventory is required when the utility of the goods is no longer as great as its cost. Where there is evidence that the utility of goods, in their disposal in the ordinary course of business, will be less than cost, whether due to physical deterioration, obsolescence, changes in price levels, or other causes, the difference should be recognized as loss of the current period. This is generally accomplished by stating such goods at a lower level commonly designated as market.”

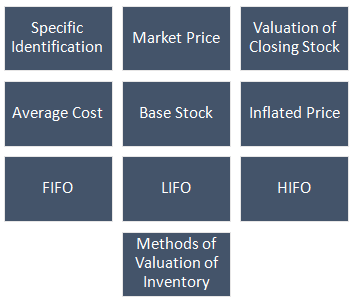

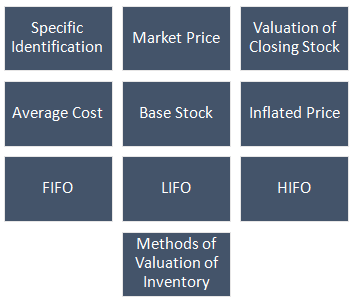

The following illustration shows the methods of Valuation of Inventory −

Let’s discuss each one of the methods in detail.

FIFO is the most popular method of an inventory valuation, which is based on assumption that the material first received or purchased are the first to be sold or issued. It means, closing stock is out of the last or latest received or manufactured goods.

It will clear with a small and simple example as given below −

Date | No. of Item | Rate | Value |

Opening stock | 100 | 10 | 1000 |

Purchased on 01-04-13 | 500 | 10 | 5000 |

Purchased on 01-07-13 | 500 | 12 | 6000 |

Purchased on 01-01-14 | 1000 | 15 | 15000 |

Total Purchases | 2100 |

| 27000 |

Item Sold | 1700 |

|

|

Closing stock | 400 | 15 | 6000 |

In above example, it is assumed that closing stock of 400 items was out 1000 items purchased on 01-01-2014.

As name suggests, closing stock is valued on the basis of oldest purchased or manufactured items. First time, this method was used by the U.S.A., at the time of Second World War to get the advantage of hike in prices. In the above example, closing stock will be valued at 400 items @ Rs. 10 each = Rs. 4000

Note − Here 100 items from opening stock and 300 items were out of purchases made on 01-04- 2013

Average cost method is used where identification of stock with rate or value of stock is not possible. It is of two types Viz…

Simple average price method may be explained as below −

Suppose, four types of items are in stock as follows −

500 units purchased @ Rs. 10 per unit | = Rs. 5000 |

750 units purchased @ Rs. 12 per unit | = Rs. 9000 |

600 units purchased @ Rs. 14 per unit | = Rs. 8400 |

Total Units 1850 for | = Rs. 22400 |

Simple average method ignored the inventory at cost, therefore the valuation of stock of 1850 units will be = 12 × 1850 = Rs. 22,200 whereas the actual cost is Rs. 22,400

So, if we want to choose average method then weighted price method should be followed under which valuation will be done as hereunder.

In the above example, Rs. 22,400 will be divided by 1850 units and the average price will be Rs. 12.1081.

This method is based on the assumption that the highest value of material always consumed first and closing stock will be valued at the lowest cost of purchased or manufactured material. This method is not a popular method of valuation of inventory and so, used only by the business units having monopoly products or who are dealing with the cost + contract.

Base stock means — minimum level of stock maintained by a business unit to run his business without any interruption or which is according to AS-2 issued by The Institute of Chartered Accountants of India as “the base stock formula proceeds on the assumption that a minimum quantity of inventory (base stock) must be held at all times in order to carry on business.”

Note − This method can be followed only when LIFO method is used.

This method of valuation covers normal losses, increasing price of purchases to calculate closing value of an inventory. For example, if 550 units purchased for Rs. 2000 and due to normal loss units, remain 500 then the cost per unit will be 2000/500 = Rs. 4 per unit, and while calculating closing stock value for 100 unit, cost will be Rs. 400 (100 × 4).

Under this method, where identification of items with price is possible, then closing stock will be valued accordingly.

Under this method of valuation, stock is valued at current market price. It is also called replacement price or realizable price method.

In case, where the value of closing stock is not given, we may calculate it as −

Opening stock | xx |

Add: Net Purchases | xx |

Less: Cost of Sales | xx |

Less: Gross Profit | xx |

Value of Closing stock | xx |

Putting value in above formula, we may also calculate the value of opening stock.