Following are the essentials of a bill of exchange −

· Bill of exchange should be in written.

· The seller who makes the bill is termed as “Drawer,” the purchaser upon whom the bill is drawn is known as “Drawee” and must be a person.

· Bill of exchange must be carrying certain amount and only in terms of money, and not in terms of goods or services.

· Order to pay the money, should be unconditional.

Apart from all these (given above), we also need to pay attention on the following points −

Following are the parties of ‘Bill of Exchange −”

· The Drawer − Seller of goods is termed as drawer of “bills of exchange.”

· The Drawee − Drawee or purchaser is a person who accepts the bill of a certain amount to be paid after a specific time.

· The Payee − Payee and drawer may be same person who gets the payment or may be a different person. In case of same parties, will be reduced to two instead of three.

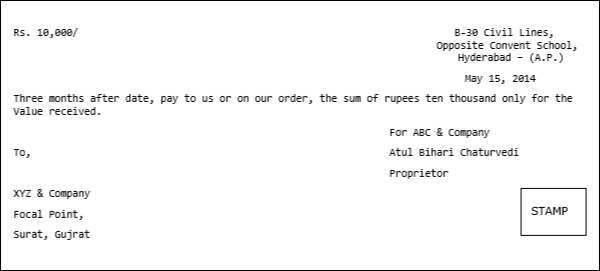

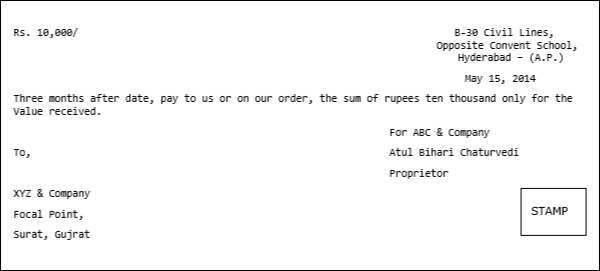

· Stamp − Amount in excess of certain limit should be paid and signed on affixed revenue stamp according to above specimen. In these days, threshold limit is INR 5,000/.

· Amount − Amount of bill must be written in figure as well as in words as shown in above specimen.

· Date − Date on bill will be written on face of it as above.

· Value and Terms − Both are essential part of it and must be written as shown above.

To make it a legal document, it must be signed by “Drawee.” Acceptance may be general acceptance i.e. Drawee agrees with the full content of the bill without any change and it may be conditional, which is called as qualified acceptance.

Bill of exchange may be classified as viz…

· Inland Bill − Bill, which is drawn in India, both the Drawer and the Drawee are from India and also payable in India called Inland Bill.

· Foreign Bill − Bill, which is drawn outside India, drawn on a person residing in India, payable in India or vice versa. Due date of foreign bill starts from the date on which Drawee sees it and accepts it.

As per Section 4 of the Indian Negotiable Instrument Act, 1881

“An instrument in writing (not being a Bank note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or the order of a certain person, or to the bearer of the instrument.”

Promissory Note | Bill of Exchange |

It is an unconditional promise to pay | Bill of Exchange is unconditional order to pay. |

Debtor make the promise to pay to the creditor | Bill of Exchange drawn by a seller of goods or services and he makes an order to debtor to make the payment. |

Foreign promissory note make in a set of one only | Foreign Bills of Exchange drawn in a set of three. |

Promissory note payable on demand, requires stamp duty | Bill of Exchange payable on demand does not require stamp duty. |

Promissory note has only two parties i.e. drawer and payee | Bill of exchange may have three parties, drawer, drawee and may be payee. |

Since debtor himself makes the promise to make the payment, hence no acceptance required in this case | To be a legal document, it must be accepted by Drawee. |

Followings are the important advantages of Bills of Exchange and Promissory Notes −

· Facilitation of the credit transactions is helpful in increasing the size of business.

· Both are the proof of purchase of goods or services in credit.

· Being a legal document, both can be produced in a court, in case of its dishonor.

· Since date of payment is fixed, it is helpful for both debtors and creditors; and, they may manage their payment schedule accordingly.

· In case of any urgency of payment, creditor can get the bill discounted from the bank.

· Being a negotiable instrument, promissory note is easily transferable from one person to another.

Bills of exchange and Promissory notes are treated as bills receivable and bills payable in regards to accounting treatment −

· Bills Receivable − If we have to receive the payment against bills of exchange or promissory note, it will be called as “Bills Receivable” and will be shown in the Asset side of Balance-sheet under Current Assets.

· Bills Payable − Bills payable is current liabilities in hand of Drawee.

· Accounting Entries − When the Bill received and retained in possession till due date.

Accounting entries to be done in the books of Drawer and Payee as −

Sr.No. | In the Books of Drawer | Entries in the Books of Acceptor |

1 | Customer A/cDr To Sales A/c (Being Goods sold on credit) | Goods Purchase A/cDr To Supplier A/c (Being Goods Purchased on credit) |

2 | Bills Receivable A/cDr To Customer A/c (Being Bill accepted by Customer) | Supplier A/cDr To Bills Payable A/c (Being Bill accepted drawn by supplier of goods) |

3 | Cash/Bank A/cDr To Bills Receivable A/c (Being Amount of bill received on due date) | Bills Payable A/cDr To Cash/Bank (Being Amount paid on due date and bills payable received back) |

· In the Book of Drawer − The drawer of a bill may get the bill discounted from his bank before due date of that bill. In this case, bank charges some interest on bill amount according to waiting time. For example, if bill is drawn on 1st January for 3 months and drawer may get bill discounted on 1st February, in this case, bank will charge interest for two months at applicable rate say 14% and drawer of bill may pass following entry.

Cash / Bank A/c Dr

Discount A/c Dr

To bills Receivable A/c

(Being bill discounted with bank @ 14% p.a.

discount charge debited by bank for 2 months)

· In the book of Drawee − Drawee has no need to pass entry on above, he just needs to pass the entry at the time of payment on maturity of bill as explained earlier.

If Drawer of the bill of exchange endorsed the bill to his creditor for his own liabilities and bill is met on maturity, following journal entries will be passed −

Creditors A/c Dr

To bills Receivable A/c

(Being bill receivable endorsed to creditor)

Note − Drawer has no need to pass any entry at the time of maturity of a Bill.

In the book of Drawee − Drawee has no need to pass any entry at the time of endorsement of Bill. Entries will remain same as explained earlier.

In case where the acceptor of a Bill of Exchange failed to pay the bill on due date of maturity or refused to pay, it is called as dishonor of a Bill of Exchange. As a proof of dishonor of a Bill, payee may get a certificate from a Notary Officer appointed by the Government for this purpose. Notary officer charges some fees in this regard called as “Noting Charges.”

Following entries will pass in the books of Drawer and Drawee −

Sr.No | In the Books of Drawer |

1 | If bill is kept by the Drawer with himself till the date of maturity − Customer/Acceptor A/c Dr (with total Bill amount + Noting Charges) To Bills Receivable A/c(with Bill Receivable amount) To Cash/Bank(Noting Charges paid) (Being Bills receivable dishonor and noting charges paid) |

2 | If bill is discounted with the bank − Customer/Acceptor A/c Dr (with total Bill amount + Noting Charges) To Bank A/c(with total Bill amount + Noting Charges) (Being discounted Bills receivable dishonor and noting charges paid) |

3 | If bill is endorsed by the Drawer in favor of a Creditor− Customer/Acceptor A/c Dr (with total Bill amount + Noting Charges) To Creditor A/c(with total Bill amount + Noting Charges) (Being endorsed Bills receivable dishonor and noting charges paid) |

Entries in the Books of Acceptor/Debtors |

In all above three case acceptor will pass only one journal entry − Bills payable A/cDr(with the bills payable amount) Noting Charges A/cDr(with Noting Charges ) To Drawer/Creditor A/c(with total Bill amount + Noting Charges) (Being Goods Purchase on credit) |

There may be a situation when the acceptor of bill may not be in position to pay the bill on due date and he may request drawer to cancel the old bill and draw a new bill on him (i.e. Renewal of Bill). Drawer of bill may charge some interest on mutually agreed terms and that amount of interest may be paid in cash or may be included in the bill amount.

Following accounting entries to be done in the books of Drawer and Drawee −

Sr.No. | In the Books of Drawer | Entries In the Books Acceptor |

1 | Cancellation of old bill − Customer/Acceptor A/cDr To Bill receivable A/c (Being old bill cancelled) | Cancellation of old bill − Bills Payable A/cDr To Creditor A/c (Being request for cancellation of old bill accepted by Creditor) |

2 | Interest received in cash− Cash A/cDr To Interest A/c (Being interest received on delayed payment) | Interest paid in cash − Interest A/cDr To Cash A/c (Being Interest paid on renewal of Bill) |

3 | In case interest not payable in cash − Customer/Acceptor A/cDr To Interest A/c (Being Interest due on renewal of bill) | In case interest not payable in cash − Interest A/cDr To Creditor A/c (Being Interest on renewal of bill due) |

4 | On renewal of bill − Bills Receivable A/cDr To Customer/Acceptor A/c (Being renewal of bill including amount of interest) | On renewal of bill − Supplier A/cDr To Bills Payable A/c (Being Bill accepted after cancellation of a new bill including interest) |

Sometimes, acceptor may approach to drawer of a bill to make early payment before due date of a bill, following journal entries will pass in this case −

Sr.No. | Entry In the Books of Drawer | Entries In the Books of Acceptor |

1 | Cash/Bank A/cDr Rebate A/cDr To Bills Receivable A/c (Being Amount of bill received before due date and rebate allowed to customer) | Payable A/cDr To Cash/Bank A/c To Rebate A/c (Being Amount paid before due date on rebate) |

To manage several numbers of bills receivable, drawer sent those bills to the bank for collection and bank gives credit to the customer whenever a bill is collected from a drawee. Following journal entries will be passed −

Sr.No. | Entry In the Books of Drawer |

1 | When a bill is sent to the bank for collection − Bills sent for Collection A/cDr To Bank A/c (Being bills receivable sent to the bank for collection) |

2 | On collection of payment by bank − Bank A/cDr To Bills sent for Collection A/c (Being Collection of bills receivable by bank) |

A bill of exchange may be accepted to oblige a friend or any known person at the time of his need or to provide him a loan or else to accommodate one or more parties is called as accommodation bill.”