Final Accounts are the accounts, which are prepared at the end of a fiscal year. It gives a precise idea of the financial position of the business/organization to the owners, management, or other interested parties. Financial statements are primarily recorded in a journal; then transferred to a ledger; and thereafter, the final account is prepared (as shown in the illustration).

Usually, a final account includes the following components −

Now, let us discuss each of them in detail −

Trading accounts represents the Gross Profit/Gross Loss of the concern out of sale and purchase for the particular accounting period.

· Opening Stock − Unsold closing stock of the last financial year is appeared in debit side of the Trading Account as “To Opening Stock“ of the current financial year.

· Purchases − Total purchases (net of purchase return) including cash purchase and credit purchase of traded goods during the current financial year appeared as “To Purchases” in the debit side of Trading Account.

· Direct Expenses − Expenses incurred to bring traded goods at business premises/warehouse called direct expenses. Freight charges, cartage or carriage charges, custom and import duty in case of import, gas, electricity fuel, water, packing material, wages, and any other expenses incurred in this regards comes under the debit side of Trading Account and appeared as “To Particular Name of the Expenses”.

· Sales Account − Total Sale of the traded goods including cash and credit sales will appear at outer column of the credit side of Trading Account as “By Sales.” Sales should be on net releasable value excluding Central Sales Tax, Vat, Custom, and Excise Duty.

· Closing Stock − Total Value of unsold stock of the current financial year is called as closing stock and will appear at the credit side of Trading Account.

closing Stock = Opening Stock + Net Purchases - Net Sale

· Gross Profit − Gross profit is the difference of revenue and the cost of providing services or making products. However, it is calculated before deducting payroll, taxation, overhead, and other interest payments. Gross Margin is used in the US English and carries same meaning as the Gross Profit.

Gross Profit = Sales - Cost of Goods Sold

· Operating Profit − Operating profit is the difference of revenue and the costs generated by ordinary operations. However, it is calculated before deducting taxes, interest payments, investment gains/losses, and many other non-recurring items.

Operating Profit = Gross Profit - Total Operating Expenses

· Net Profit − Net profit is the difference of total revenue and the total expenses of the company. It is also known as net income or net earnings.

Net Profit = Operating Profit - (Taxes + Interest)

Trading Account of M/s ABC Limited (For the period ending 31-03-2014) | |||

Particulars | Amount | Particulars | Amount |

To Opening Stock | XX | By Sales | XX |

To Purchases | XX | By Closing Stock | XX |

To Direct Expenses | XX | By Gross Loss c/d | XXX |

|

|

|

|

To Gross Profit c/d | XXX |

|

|

Total | XXXX | Total | XXXX |

Manufacturing account prepared in a case where goods are manufactured by the firm itself. Manufacturing accounts represent cost of production. Cost of production then transferred to Trading account where other traded goods also treated in a same manner as Trading account.

Apart from the points discussed under the section of Trading account, there are a few additional important points that need to be discuss here −

· Raw Material − Raw material is used to produce products and there may be opening stock, purchases, and closing stock of Raw material. Raw material is the main and basic material to produce items.

· Work-in-Progress − Work-in-progress means the products, which are still partially finished, but they are important parts of the opening and closing stock. To know the correct value of the cost of production, it is necessary to calculate the correct cost of it.

· Finished Product − Finished product is the final product, which is manufactured by the concerned business and transferred to trading account for sale.

· Raw Material Consumed (RMC) − It is calculated as.

RMC = Opening Stock of Raw Material + Purchases - Closing Stock

· Cost of Production − Cost of production is the balancing figure of Manufacturing account as per the format given below.

Manufacturing Account (For the year ending……….) | |||

Particulars | Amount | Particulars | Amount |

To Opening Stock of Work-in-Progress | XX | By Closing Stock of Work-in-Progress | XX |

To Raw Material Consumed | XX | By Scrap Sale | XX |

To Wages | XXX | By Cost of Production | XXX |

To Factory overheadxx |

| (Balancing figure) |

|

|

|

|

|

Power or fuelxx |

|

|

|

Dep. Of Plantxx |

|

|

|

Rent- Factoryxx |

|

|

|

Other Factory Exp.xx | xxx |

|

|

Total | XXXX | Total | XXXX |

Profit & Loss account represents the Gross profit as transferred from Trading Account on the credit side of it along with any other income received by the firm like interest, Commission, etc.

Debit side of profit and loss account is a summary of all the indirect expenses as incurred by the firm during that particular accounting year. For example, Administrative Expenses, Personal Expenses, Financial Expenses, Selling, and Distribution Expenses, Depreciation, Bad Debts, Interest, Discount, etc. Balancing figure of profit and loss accounts represents the true and net profit as earned at the end of the accounting period and transferred to the Balance Sheet.

Profit & Loss Account of M/s ……… (For the period ending ………..) | |||

Particulars | Amount | Particulars | Amount |

To Salaries | XX | By Gross Profit b/d | XX |

To Rent | XX |

|

|

To Office Expenses | XX | By Bank Interest received | XX |

To Bank charges | XX | By Discount | XX |

To Bank Interest | XX | By Commission Income | XX |

To Electricity Expenses | XX | By Net Loss transfer to Balance sheet | XX |

To Staff Welfare Expenses | XX |

|

|

To Audit Fees | XX |

|

|

To Repair & Renewal | XX |

|

|

To Commission | XX |

|

|

To Sundry Expenses | XX |

|

|

To Depreciation | XX |

|

|

To Net Profit transfer to Balance sheet | XX |

|

|

Total | XXXX | Total | XXXX |

A balance sheet reflects the financial position of a business for the specific period of time. The balance sheet is prepared by tabulating the assets (fixed assets + current assets) and the liabilities (long term liability + current liability) on a specific date.

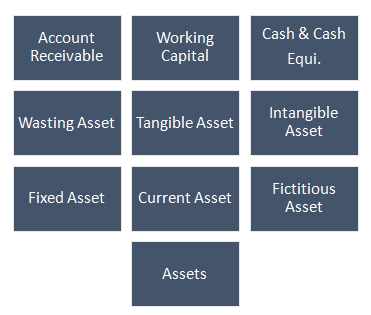

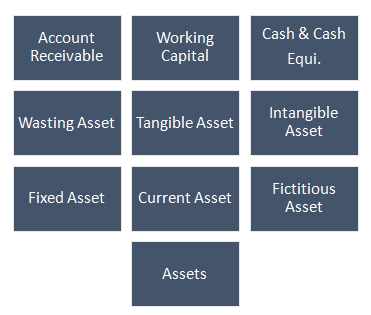

Assets are the economic resources for the businesses. It can be categorized as −

· Fixed Assets − Fixed assets are the purchased/constructed assets, used to earn profit not only in current year, but also in next coming years. However, it also depends upon the life and utility of the assets. Fixed assets may be tangible or intangible. Plant & machinery, land & building, furniture, and fixture are the examples of a few Fixed Assets.

· Current Assets − The assets, which are easily available to discharge current liabilities of the firm called as Current Assets. Cash at bank, stock, and sundry debtors are the examples of current assets.

· Fictitious Assets − Accumulated losses and expenses, which are not actually any virtual assets called as Fictitious Assets. Discount on issue of shares, Profit & Loss account, and capitalized expenditure for time being are the main examples of fictitious assets.

· Cash & Cash Equivalents − Cash balance, cash at bank, and securities which are redeemable in next three months are called as Cash & Cash equivalents.

· Wasting Assets − The assets, which are reduce or exhausted in value because of their use are called as Wasting Assets. For example, mines, queries, etc.

· Tangible Assets − The assets, which can be touched, seen, and have volume such as cash, stock, building, etc. are called as Tangible Assets.

· Intangible Assets − The assets, which are valuable in nature, but cannot be seen, touched, and not have any volume such as patents, goodwill, and trademarks are the important examples of intangible assets.

· Accounts Receivables − The bills receivables and sundry debtors come under the category of Accounts Receivables.

· Working Capital − Difference between the Current Assets and the Current Liabilities are called as Working Capital.

A liability is the obligation of a business/firm/company arises because of the past transactions/events. Its settlement/repayments is expected to result in an outflow from the resources of respective firm.

There are two major types of Liability −

· Current Liabilities − The liabilities which are expected to be liquidated by the end of current year are called as Current Liabilities. For example, taxes, accounts payable, wages, partial payments of long term loans, etc.

· Long-term Liabilities − The liabilities which are expected to be liquidated in more than a year are called as Long-term Liabilities. For example, mortgages, long-term loan, long-term bonds, pension obligations, etc.

There may be two types of Marshalling and grouping of the assets and liabilities −

· In order of Liquidity − In this case, assets and liabilities are arranged according to their liquidity.

· In order of Permanence − In this case, order of the arrangement of assets and liabilities are reversed as followed in order of liquidity.

In order to prepare a true and fair financial statement, there are some very important adjustments those have to be done before finalization of the accounts (as shown in the following illustration) −

Sr.No. | Adjustments | Accounting Treatments |

1 | Closing Stock Unsold stock at the end of Financial year called Closing stock and valued at “Cost or market value whichever is less” | First Treatment Where an opening and closing stock adjusted through a purchase account and the value of Closing Stock given in Trial Balance − Closing stock will be shown as adjusted purchase account on the debit side of Trading account and will appear in the Balance Sheet under current Assets. |

2 | Outstanding Expenses Expenses which are due or not paid called as outstanding expenses. | Accounting Treatment Outstanding expenses will be added in Trading or Profit & Loss account in particular expense account and will appear in liabilities side of the Balance Sheet under the current liabilities. |

3 | Prepaid Expenses Expenses which are paid in advance are called as Prepaid Expenses. | Accounting Treatment Prepaid Expenses will be deducted from the particular expenses as appear in Trading & Profit & Loss account and will be shown in the Balance Sheet under the current assets. |

4 | Accrued Income The income, which is earned during the year, but not yet received at the end of the Financial Year is called as Accrued Income. | Accounting Treatment Accrued income will be added to a particular income under the Profit & Loss account and will be shown in the Balance Sheet as current assets. |

5 | Income Received in Advance An income received in advance, but not earned like advance rent etc. | Accounting Treatment An income to be reduced by the amount of advance income in profit & loss account and will appear as current liabilities in the Balance Sheet. |

6 | Interest on Capital Where an interest paid on the capital introduced by the proprietor or partner of the firm. | Accounting Treatment · Debit Side of Profit & Loss account · Add to capital account (Credit side of Capital account). |

7 | Interest on Drawing Where an interest paid on the capital introduced by the proprietor or partner of the firm. | Accounting Treatment · Credit Side of Profit & Loss account · Reduced from capital account (Debit side of Drawing account). |

8 | Provision for Doubtful Debts If there is any doubt on the recovery from Sundry Debtors. | Accounting Treatment · Debit Side of Profit & Loss Account · In a Balance Sheet, provision for the Doubtful will be deducted from the Sundry Debtors’ Account. |

9 | Provision for Discount on Debtors If there is any offer of discount to pay the debtors within certain period. | Accounting Treatment · Debit Side of Profit & Loss Account · In a Balance Sheet, provision for the Discount on Debtors will be deducted from the Sundry Debtors Account. |

10 | Bad Debts Unrecovered debts or irrecoverable debts | Accounting Treatment · Debit Side of Profit & Loss Account · In a Balance Sheet, Sundry debtors will be shown after deducting the Bad Debts. |

11 | Reserve for Discount on Creditors If there is any chance to get discount on the payment of sundry creditors within certain period. | Accounting Treatment · Credit Side of Profit & Loss Account · In a Balance Sheet, Sundry Creditors will be shown after deducting the Reserve for Discount. |

12 | Loss of Stock by fire There may be three conditions in this case | Accounting Treatment 1. If Stock is fully insured · Credit Side of Trading Account · Assets side of Balance Sheet · (With full value of loss) 2. If Stock is partially insured · Credit side of Trading Account (With Total value of Loss) · Debit side of Profit & Loss a/c (With value of loss unrecoverable) · Asset Side of Balance Sheet ( With value recoverable) 3. If Stock is not insured · Credit Side of Trading Account · Debit side of Profit & Loss Account |

13 | Reserve Fund | Accounting Treatment · Debit side of Profit & Loss Account · Liabilities side of Balance Sheet |

14 | Free Sample to Customers | Accounting Treatment · Credit side of Trading Account · Debit Side of Profit & Loss Account |

15 | Managerial Commission | Accounting Treatment · Debit side of Profit & Loss Account · Liabilities side of Balance Sheet as commission payable |

16 | Goods on Sale or Approval Basis If there is any un-approved stock lying with the customers at the end of financial year. | Accounting Treatment · Sales AccountDr To Debtors A/c (With Sale Price) · Stock AccountDr To Trading Account (with cost price) |