Government accounting is a scientific procedure of collecting, classifying, recording, summarizing, and interpreting all the financial transactions including revenues and expenditures of all the government offices. It keeps the record of public funds.

Followings are the main objectives of the Government Accounting −

· Information about Revenues − One of the most important functions of the Government accounting is to maintain the transactions of generation and collection of revenues during the financial year (and maintain all the past years’ financial data). Under the ‘Right to Information Act,’ if someone asks to have the information regarding the financial transactions of a government office, it is oblige to provide that.

· Information about Expenditures − One of the most important objectives of the Government accounting is to provide information about the expenditures incurred on various heads. It is checked by the Parliament in case of Central Government and state legislature in case of the State Government.

· Information about Deposits and Loans − Government has to provide information about the loan granted by the Government to others and repayment of the deposits.

· Information about Availability of Cash − It has to provide information about the present and the future cash availability.

There are following notable differences between the Government accounting and the commercial accounting −

Headings | Govt. Accounting | Comm. Accounting |

Objective | Administration and management of all the financial activities of the government. | Maintain the records of trading and manufacturing of goods or to provide services to calculate profits. |

Date Entry System | It has single entry system — Govt. does not work to earn profit; so, it does not need cross-check the accounting records. | Normally, it has double entry system — need to prepare Trading & Profit & Loss account and Balance Sheet at the end of the accounting period. |

Basis of Accounting statements | Accounting statements are also prepared on the basis of single entry system. Most of the statements are merely statements of collections of revenue and expenditures done, except where the Government acts like a banker or lender or borrower. | Accounting statements are prepared on the basis of double entry system. |

Following are the important terms and expressions used in Government accounting −

· Demand for Grant − Without sanction from the Parliament, no expenditure can be incurred by any Government Authority. Public Authority can request for the grant of expenditure to the Government, this request is called “Demand for Grant”.

· Supplementary Grant − Sometimes, grants are sanctioned before the end of the financial year, in case where annual budget might be inadequate. Supplementary demand can be made, if need arises to meet the expenditure. For example, amount granted for the Natural Disaster Relief fund, may be found inadequate due to extraordinary disaster by the flood; in such a condition, an additional grant may be asked by the concerned state or ministry.

· Treasuries − Treasuries are the units of fiscal system in India. Every Indian States and Union Territory is divided into different districts’ headquarters and every district headquarters has one or more than one treasury. Treasuries are conducted by the State Bank of India as an agent of the Reserve Bank of India. Central Government and State Government keep their separate accounts and differences of Central and State Govt. are adjusted by the Reserve Bank of India.

· Votable and Non-votable Items − To incur some expenditures, Parliamentary approval is not required; so, these expenditures may be charged from the Consolidated fund or the Public account, these items are known as Non-votable items. Some items of expenditure require sanction of the Parliament and cannot be incurred without its grant. Thus, demand for grant for that expenditure may be placed to the government, such items are called as Votable Items.

· Appropriation Act − After the approval of the budget proposal in the Parliament or Legislature, an Appropriation Bill has to be introduced, when this Bill is passed, it becomes Appropriation Act. Now, money can be withdrawn from the Consolidated Fund of India or the concerned State to meet the grants.

· Vote on Account − In certain condition, when government has no time to place full budget in the Parliament, then it uses the special provision of ‘Vote on Account.’ Under this provision, government obtains the vote of the Parliament for the amount required to incur the expenditure of the items in demand. After sanction obtained in the Parliament, government obtains money from the Consolidated Fund of India.

· Public Accounts Committee (PAC) − Public Account Committee is formed by the Parliament and each Legislature to scrutinize the Appropriation account and Audit the report thereon. All the reports on financial statements those are to be submitted to the President of Indian and in the Parliament are examined by the Public Accounts Committee (PAC). Examination by the PAC is similar to post-mortem of the reports. Members of the PAC are appointed from the Opposition Parties of the Parliament. Member of the ruling party cannot be part of this committee, as this committee is working as a watchdog to look after the affairs of ruling party.

· Local Government Accounting − Accounting of the Local government is based on the concept of “fund accounting” and on the budget. Urban local government entities and rural local government entities are two types of local government entities. Accounting of the Local Government in India comprises budget, Receipt, and payment accounts.

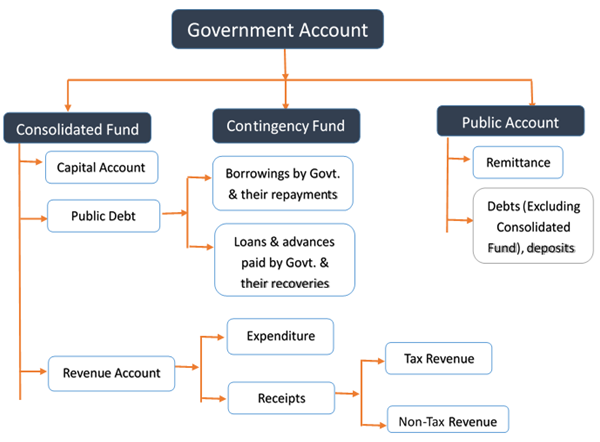

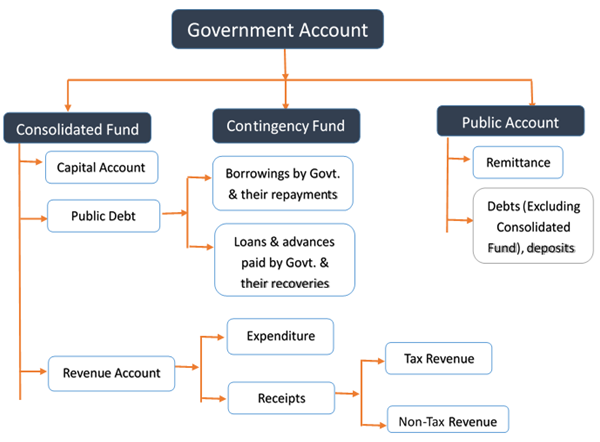

Government of India has following three types of Funds for marinating the records of all sorts of financial transactions −

Let’s discuss each of them succinctly −

As per the Clause 1 of the Article 266 of the Indian Constitution −

“All revenues received by the Government by way of taxes like Income Tax, Central Excise, Customs and other receipts flowing to the Government in connection with the conduct of Government business i.e. Non-Tax Revenues are credited into the Consolidated Fund constituted. Similarly, all loans raised by the Government by issue of Public notifications, treasury bills (internal debt) and loans obtained from foreign governments and international institutions (external debt) are credited into this fund. All expenditure of the government is incurred from this fund and no amount can be withdrawn from the Fund without authorization from the Parliament.”

As per the Article 267 of the Indian Constitution −

“The Contingency Fund of India records the transactions connected with Contingency Fund set by the Government of India. The corpus of this fund is Rs. 50 crores. Advances from the fund are made for the purposes of meeting unforeseen expenditure which are resumed to the Fund to the full extent as soon as Parliament authorizes additional expenditure. Thus, this fund acts more or less like an imprest account of Government of India and is held on behalf of President by the Secretary to the Government of India, Ministry of Finance, and Department of Economic Affairs.”

The Public Account is constituted under Clause 2 of Article 267 of the Indian Constitution, which says −

“The transactions relate to debt other than those included in the Consolidated Fund of India. The transactions under Debt, Deposits and Advances in this part are those in respect of which Government incurs a liability to repay the money received or has a claim to recover the amounts paid. The transactions relating to ‘Remittance’ and `Suspense’ shall embrace all adjusting heads. The initial debits or credits to these heads will be cleared eventually by corresponding receipts or payments. The receipts under Public Account do not constitute normal receipts of Government. Parliamentary authorization for payments from the Public Account is therefore not required.”

Similarly, all 29 states of India has the same structure as described above.

The general structure of the government accounts is illustrated below −

Treasury and other government departments, initially compile their receipt and payment accounts on monthly basis for central government and state government separately and then send to respective Accountant General of India.

Collection of revenue and disbursement are directly made by Railway, Defense, Post & Telegraphs, Forest, and public departments and lump sum payments are made by treasury through the departmental officers. Detail of accounts on monthly basis is maintained by the departmental Accounts officers.

Monthly accounts submitted by the treasury and account officer are compiled by the Accountant General, for the central government as a whole and for each state separately. The compiled report shows progressive figure of each month from 1st April to 31st March of every year. Complied accounts along with appropriation accounts are submitted by Comptroller and Auditor General of India to the President of India, to the Governor of each state, or to the Administrator of the Union Territory accordingly.

· Charges or expenditure on a new project like constructions, new equipment, plant & machinery installation, maintenance, improvement, and service should be allocated to the capital account as per the rule made by competent authority.

· Working charges of the project should be allocated to the revenue account.

· In case of renewal and replacement and cost of the genuine replacement should be charged to capital account.

· In case of damage due to extraordinary calamities, charged should be debited from the capital account or revenue account or from both. However, it will be determined by the government according to the case and circumstances.

· Capital receipts during the new project should be credited to the capital account to reduce the capital expenditure of the project.

Comptroller and Audit General (CAG) is an independent Constitutional body. Special status has been given to safeguard his independence and enable him to discharge his duty without fear or favor.

As per the Article 148 of the Constitution of India, the comptroller and Auditor-General will be appointed by the President of India. The provision of removal of CAG is the same as of the judges of the Supreme Court. He can be removed only on the basis of proven misbehavior or incapacity.

As per the Article 150 of the Constitution of India — the accounts of the Union and of the States shall be kept in such form as the President may prescribed, on the advice of the Comptroller & Auditor General.

Article 151 of the Constitution provides that the audit reports of the Comptroller & Auditor General relating to the accounts of the Union shall be submitted to the President, who shall cause them to be laid before each House of Parliament.