Stock exchange is an organized market where sale and purchase of listed securities of all description i.e. shares, stocks, debentures, government securities, etc. are done. It is a government approved market place where buyer and seller of securities of all kind find each other to buy and sell securities on the market price.

“ An association, organization or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities.”

- The Securities Contracts (Regulation) Act, 1956

A stock exchange is a common and authorized point of exchange, which offers the services for stock brokers and traders to buy or sell stocks, bonds, and other securities of such kind. Further, it also provides facilities for issue and redemption of securities, other financial instruments, and capital events. For example, payment of income and dividends.

Following are the main features and characteristics of a stock exchange −

· Stock exchange is the market place where trading of listedsecurities can be done.

· Trading of un-listed securities is not allowed.

· There are certain rules and regulations that need to be followed while trading.

· Stock exchange is an association of persons, whether incorporated or not.

· Anyone can buy or sell securities whether he is investor or speculator.

· For doing business transaction i.e. sale & purchase of securities, membership is compulsory. Non-members are not allowed to do business transactions. Membership can be applied only when there is a vacancy in any stock exchange and after paying the prescribed fees of respective stock exchange, membership can be acquired. Members of stock exchange are called as brokers and commission charged by them for the transaction done is called as brokerage.

· Only a broker (member) can buy or sell securities, therefore, investors or speculators can do transaction through members only.

Followings functions are performed by Stock Exchange −

· Anyone can sell and buy any industrial, financial, and Government securities. Stock Exchange is an organized ready market to do all this.

· Liquidity is provided by the stock exchange. Investors and speculators can buy and sell their securities at any time.

· Stock exchange provides collateral value to the securities that is helpful in borrowing from the bank on easy terms.

· Capital for the industrial growth is provided by the stock exchange that is helpful for the investor to participate in the industrial development.

· Price list and reports are prepared and published in the newspapers and broadcasted through the TV channels by stock exchange. It is helpful in knowing the true value of the investments. With the help of this, an investor or speculator can get to know the fair market value of his securities as per the latest market trend.

· Listing of securities is encouraged by the stock exchange. Listing of securities means — “a permission to trade” that is given by the stock exchange only after fulfillment of the prescribed standards.

· Listed companies have to provide the financial statements, reports, and other statements time to time to stock exchange — necessary for the maintaining the record and deciding the value of securities.

Thus, stock exchange works as the center of providing business information at one platform.

Following procedures are normally followed for dealing at stock exchange −

· No one can directly deal in stock exchange, therefore, any person who wants to sell or buy securities, requires a broker through whom selling or buying of securities can be done.

· After finalization of a member or a broker, intending buyer or seller of the securities, places an order according to his choice, mentioning tentative quantity, and price. Thereupon, broker opens a new account for each client and start trading in the best possible way.

· After getting an order, broker tries to finalize the deal between seller and buyer. After finalization of deal, seller and buyer of securities send a selling and buying note respectively mentioning the detail of traded securities.

· Finally, settlement of account may be done in the following three manners −

o When the settlement of account is done as per the fixed and agreed date, it is called as “liquidation in full.”

o When only difference of agreed price and ruling price is settled on the fixed date, it is called as “liquidation by payment of difference.”

o When a settlement is carried forward to the next settlement period, it is known as “carried over to next settlement period”.

In case, when purchase is delayed and charge debited by the broker to purchaser is known as “contango” (Contango charge is also known as “Badla” Charge) and in case, where sale is delayed by the seller and charge debited by the broker is known as “backwardation.”

The following figure shows the three operators at the Stock Exchange −

As studied earlier, no one can deal directly in stock exchange and every intended seller or buyer, who wants to sell or buy securities has to deal through members known as brokers. Broker is duly certified by SEBI (Stock and Exchange Board of India) under its 1992 rule. Membership of the stock exchange is restricted to prescribed numbers of members, to financially sound persons who have sufficient experience in dealing in securities.

A broker cannot buy or sell securities on his personal capacity. He charges commission from the parties, sellers, and buyers and deals on the behalf of his non-member clients.

Sub-brokers are non-members of the stock exchange and deal only on behalf of the members or registered brokers. Commission is received by sub-brokers on the business procured by them out of total commission received by the brokers. Sub brokers are known as “half commission men” and “remisiers” too.

Jobbers are the independent dealers, who deal in securities at their own. A jobber cannot sell or buy securities on the behalf of others, but he deals in securities for his own profit through fluctuation of the prices. Difference between sale price and purchase price of securities is the profit of a jobber.

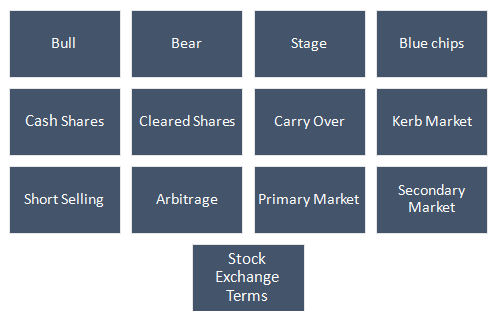

Following are the significant terms more commonly used in stock exchange −

· Bull − Bulls are those brokers who strongly expect price hike of securities and with this hope, they buy shares to sell them at later stage (when price gets increased). Thus bull market means when buying of the securities are on much higher side instead of selling of the securities. Bulls first buy securities and sell when the price of securities is high.

· Bear − Bear is pessimist, who expect fall in the price of certain securities. A Bear first sells his securities and purchases at later stage when the price of securities are low and the difference of both is his profit.

· Stag − A cautious investor or speculator is known as a stag. Stag doesn’t sell or buy shares in his hand, but he tries to buy shares of new company with a hope that price of those shares will increase in the future.

· Blue Chips − Shares of well-recognized, well-renowned, financially strong, and well-established companies.

· Cash Shares − Settlement of some of the transactions are completed in cash are known as cash shares. These transactions are done by real and genuine investors who want to buy or sell shares for the actual investment purpose.

· Cleared Shares − Speculators are normally deals in such type of shares. In these types of shares, settlement of the payments are done by the differential amounts only; however, actual delivery of the securities may not be done.

· Carry Over or Badla System − Speculator earns money by foreseeing the future. If their expectations come true, they earn profit and if not, they lose money. Speculator mostly does transactions on forward basis, when any speculator forwards his transactions from one settlement date to another, he has to pay charges called “Badla charge.” Transaction of these natures is called as Badla System.

· Kerb Market − Transactions that done before and after the official hours are known as kerb market.

· Short Selling − Short selling means where the large volumes of securities are sold by the bear speculator without actually possessing.

· Arbitrage − Securities are traded at the different stock exchanges and there is normally a little difference in prices (among different stock exchanges). Therefore, arbitrage is practiced to take advantage of different rates.

· Primary Market − Primary market is the market where new securities are issued for the capital formation in the form of a new issue or in the form of a right issue to the existing shareholders.

· Secondary Market − Secondary market is the market where subsequent trading (sale and purchase) of securities are done called as secondary market and the transactions are known as secondary transactions.

· Group A Shares − Actively traded shares of the reputed companies are called a Group A shares.

· Group B Shares − Not actively traded shares or the shares of different stock exchanges are called as Group B shares.

The Securities and Exchange Board of India (SEBI) is the regulatory board. It regulates affairs of stock exchange in India, similar to Securities Exchange Commission of the United States. To protect the rights of investors and to enforce an orderly growth of securities market, SEBI came into existence by an Act of Parliament known as “Securities and Exchange Board of India Act, 1992”.

The Over the Counter Exchange of India (OTCEI) was established in India in 1990. It is the latest concept and a new way to do securities business in India similar to Electronic Exchange in the United States. Brokers located at the different regions, communicate through latest means of technologies such as Telephones, Faxes, Mobile phones, and Computers.

Selectors are allowed to select the prices as shown on the computer screen among the competitive markets, without the floor meeting of brokers. It is the most efficient, economic, and courageous way of the trading of securities. The latest market prices of the securities are displayed on the computer screens. Since, listing of the securities is not required on OTCEI, hence it is the most suitable way for the small and medium size companies.

Brokers require and maintain following books of accounts as per the SEBI rules, 1992 −

· Cash Book

· Bank Book (Pass Book)

· General Ledger

· Client Ledger

· Register of Transaction

· Journal

· Document Register (Showing Particulars of the Securities received and delivered)

· Members Contract Book

· Duplicates of Contract Notes issued to clients

· Written consent of clients

· Margin Deposit Books

· Register of accounts of Sub Brokers

· An agreement with a Sub-Broker.