Personal Property

Personal property can be divided into three main types:

1. Chattels or goods – tangible, moveable things such as cars and furniture.

2. Choses in action – intangible things (chose is the French word for thing) such as cheques, shares, and promissory notes.

3. Intellectual property – results of the creative process and the protection attached to those ideas through patents, copyrights, etc.

This section focuses on the first two types. Intellectual property is discussed in the next section.

Acquiring Personal Property Rights

Because chattels are moveable, they can easily change hands from one person to another. Therefore, an important question is who has the right to the goods. “Personal property rights are usually acquired through the intention of one or more people,”203 as is the case, for instance, when someone purchases the item or receives it as a gift. However, sometimes personal property is simply found; in that case, the finder may have a better claim to it than anyone else except the rightful owner who lost it. The order of priority of claims to found property is summarized below in Figure . At all times, the finder or the employer, depending on who has a second claim to the property as set out above, has the obligation to make reasonable efforts to locate the rightful owner of the property.

Figure: Finder’s Rights to Personal Property

Bailment

Many things can be done with personal property. For instance, goods can be sold, cheques can be negotiated, and contractual rights can be assigned. Goods can also be turned over to someone else temporarily. Bailment occurs when an owner of personal property temporarily gives up possession of property with the expectation of getting it back. Leasing is a form of bailment, where the owner of a chattel permits another person to have temporary possession of it in return for payment of rent.

Duty of Bailee

Generally, the bailee’s primary obligation is to return the property, in good condition, to the bailor at the end of the arrangement. If the bailor proves that the goods were lost or damaged during a bailment, then the burden of proof shifts to the bailee to prove that he or she was not to blame. Despite the shift of the burden of proof, the bailee is not generally required to guarantee the safety of the bailor’s property. Liability arises from failure to take reasonable care. What constitutes reasonable care depends on the factors set out in Figure .

Figure : Bailor's Duty of Care

Other factors that affect the duty of care include standard business practices and customs, the nature and value of the property, how easily it can be damaged or stolen, and the bailee’s expertise. In addition to the duty of care imposed under tort law, responsibilities may be imposed pursuant to a contract.

There are also special types of bailment where reasonable care is dictated by statute. These are discussed below.

Specific Liabilities for Various Types of Bailees

Bailees for Storage and Safekeeping

There is a duty to take reasonable care of goods stored with them (e.g., warehouse storage, car parking lot where operator takes car keys). Unless the goods are fungible (replaceable with identical goods also in storage, such as grain), the bailee must return the exact goods stored. The contract may contain an express or implied authority to subcontract for storage of the goods with another warehouse, with the nature of the goods being a determining factor. The terms of a contract may reduce liability.

Repairers

Repairers are bailees for value with a standard of care similar to that of a warehousing company and an obligation to do the repairs in a workmanlike manner and in the time promised.

Carriers

A common carrier (a business that specializes in transportation of goods) is really an insurer of the goods since it will be held liable regardless of fault unless it can prove that damage or loss occurred through an act of God, an inherent vice (latent defect or dangerous condition) in the goods, or default by the shipper (improper labelling or packing). A carrier may limit its liability by inserting an exemption clause in a bailment contract that limits liability to a set amount.

A private carrier (carries on some other business but occasionally transports goods) owes only the normal standard of care.

Hotelkeepers

A hotel or inn (a place of lodging that cannot choose its customers) has a duty to take reasonable care and, in some instances, acts as an insurer against theft or loss of its guests' goods. Provincial legislation enables a hotel to limit liability for loss or theft of goods except if the loss of theft occurs through a wilful act of an employee or through the hotel's refusal to accept a guest's goods for safekeeping.

Remedies of the Bailee

If the bailment is contractual, the bailee has the usual contractual remedies. For complete performance, the bailee is entitled to the contract price. Where performance is partially complete, the bailee can make a quantum meruit claim (a reasonable price for services) and may also be able to make a claim for lost profits.

If the bailee has performed its services and payment is due by the owner, common law and various statutes give some bailees (warehouses, repairers, common carriers, hotels, and boarding houses) a right of lien: the right to keep the goods until the owner is paid. If the owner doesn't pay, the bailee may eventually sell the goods after following certain provisions but must give any surplus monies to the bailor.

Insurance

Personal property rights are often fragile. Because personal property is moveable, it is often difficult to locate goods that have gone missing. As well, personal property is subject to damage either innocently or in a way that does not make it worthwhile to take action against the offending party under either tort or contract law. Therefore, property owners are wise to purchase property insurance, whereby, in exchange for a premium, an insurance company promises to pay money if property is lost, stolen, damaged, or destroyed.

A person cannot buy property insurance unless he or she has an insurable interest, that is, “if a person benefits from the existence of the property and would be worse off if it were damaged”.204 Property insurance should, of course, be purchased for real property (i.e., buildings) as well as personal property housed in those buildings and used elsewhere in the business.

All provinces have passed legislation to require certain mandatory terms in an insurance policy as well as to suggest terms that may be included at the option of the parties. Although insurance policies are based on the ordinary law of contracts, they have certain unique features:

1. An offer is made by the proposed insured in his application. Acceptance is made by the insurer upon issuing the policy, unless interim arrangements are agreed upon between the parties to effect their earlier coverage.

2. A policy of insurance ends upon the expiry of its term unless renewed specifically or in accordance with the intentions and past dealings of the parties. Thus, a mere renewal notice does not extend insurance contracts.

3. For reasons of public policy, claims arising out of criminal or tortious acts (except claims arising under negligence insurance) will generally not be enforced.

4. Ambiguous standard form provisions will be interpreted strictly against an insurer because it is the insurer who drafted the clauses in question.

5. An insured owes a duty of utmost good faith to provide full, true, and complete disclosure of all material facts affecting the risk, failing which the insurance contract is voidable by the insurer. Virtually all insurance policies contain strict notice provisions by which the insured must immediately notify the insurer in the event of a loss.

6. Where an insured is reimbursed for a claim by the insurance company, the insurer steps into the shoes of the insured (subrogation) and has the right to sue any third party.

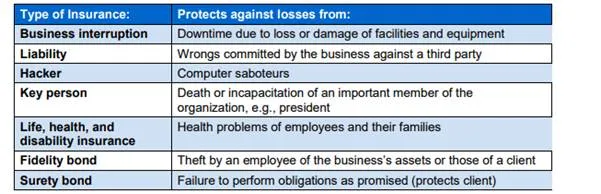

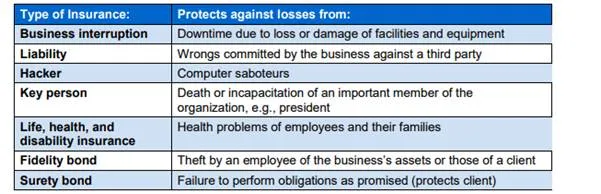

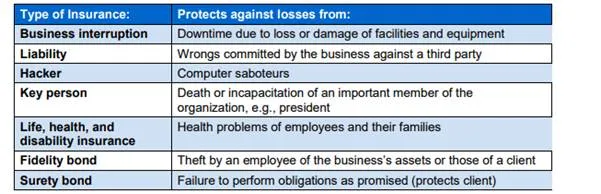

In addition to insuring against the risk of property loss or damage, businesses usually insure against a variety of other business risks, as shown in Figure.

Figure 6-63: Other Types of Insurance for Businesses

Property insurance is an example of first-party coverage since it does not involve an outsider—if the insured suffers a loss that falls within the scope of the policy, she receives payment. In contrast, liability insurance is an example of third-party coverage, whereby the insurance company renders payment to a third party.