Property Rights

In law, the term property actually refers to a person’s rights in relation to something other than the thing itself.199 The acquisition and use of real property (immoveable property like land and buildings) and personal property (tangible moveable property and intangible things like copyrights) is a key part of business decisions and operations.

The last part of these notes will begin by discussing real property, including mortgages and leases. It will then cover personal property, including contracts of bailment (where possession of property is temporarily given to another party) and insurance against loss of or damage to property. The final topic is an important sub-category of personal property: intellectual property.

Real Property

Estates in Land

Real property includes land and anything attached to land, such as fences and buildings. The most significant interests in land are called estates. An estate is an exclusive right to possess a property for a period of time. The extent of your bundle of rights with respect to real property is dependent on the type of estate or interest you hold. The most extensive rights are acquired under fee simple, as shown in Figure.

Figure: Fee Simple Estate

Under a life estate, the holder is entitled to exclusive possession of a property for her lifetime. However, a life tenant cannot commit acts of waste (change the property in a way that significantly reduces its value). On the death of the life tenant, the property reverts back to the person who holds the fee simple unless the latter person has transferred the reversionary interest to a third party (called a remainder). As well, the life tenant cannot bequeath the property since on her death, the property reverts to the person who bestowed the life estate. Life estates are often used in family situations but are rare in business situations.

The holder of a leasehold estate has exclusive rights to a property for a specified period of time.

Shared Ownership

Title can be held by more than one person as either joint tenants or tenants in common. The differences are explained below.

1. Joint tenancy or joint ownership – Two or more people have an equal undivided interest in the property with the right of survivorship. This means that a joint tenant has no ability to bequeath his ownership interest at death as the surviving joint tenant automatically becomes the sole owner. Most married couples hold title as joint tenants. A joint tenant can avoid the right of survivorship by severing the joint tenancy by acting in a way inconsistent with joint ownership, i.e., selling his interest to a third party without notice to the other joint tenant or by partition, where there is a division of either the property or its sale proceeds. The joint tenancy is also severed if one of the parties becomes bankrupt or murders the other.

2. Tenancy in common or co-ownership – Two or more people have undivided interests equally or as specified by percentages on the deed. When one owner dies, her interests pass to her estate and are bequeathed in accordance with the terms of her Will or, if there is no Will, in accordance with the provisions of the Succession Law Reform Act.

Condominiums

A condominium owner has both individual ownership and shared ownership. The owner obtains title to a specific apartment or unit (more specifically a slice of air space above the real property). He or she becomes a tenant in common of all common areas such as hallways, walkways, and recreational areas. The condominium owner also obtains a third set of rights, the right to vote on matters concerning the condominium corporation, such as the creation of bylaws and the election of directors. A monthly fee is also paid to the condominium corporation for maintenance of common elements.

Cooperatives

In a cooperative, the entire building is owned by a group or corporation. An individual buys shares in the corporation, and takes an apartment or unit under a long-term lease.

Interests Less than Estates

None of these interests gives the right of exclusive possession as do the freehold and leasehold estates discussed in the previous section.

Easements

An easement is the right to enter land owned by another for a special purpose, e.g., a right of way to pass back and forth over the land of another to get to and from your own land. An easement can be created by:

1. Express agreement

2. Implied grant – There is a right of necessity implied if the front half is severed, and no provision is made to reserve a right-away to get to the road at the front; there is an implied right of mutual support for owners of semi-detached homes.

3. Prescription – An adjoining landowner continuously exercises a right for 20 years without interruption or consent; the user must prove the owner knew he was using it, had the right and power to stop him, and refrained from doing so.

4. Statute – Although not strictly an easement, since the party benefiting from the easement does not own property, statutes give utility companies the right to run wires and cables either underground or overhead on poles.

Restrictive Covenants

A restrictive covenant is a promise to refrain from certain conduct on, or use of, land. It runs with the land, i.e., it passes to the next owner. It is commonly used in new developments to put restrictions on the type of homes to be built, use of siding/brick, paving of driveways, minimum square footage, size of satellite dishes, etc.

Mineral Leases and Profit à Prendre

A mineral lease permits a person to extract and retain something of value (e.g., gold or oil) from another’s property. Since the 1880s, the government has reserved mineral rights when making grants of land. Therefore, most mineral leases are made by the government, even though someone owns the fee simple to the property. Profit à prendre is similar but gives the right to take something of value from a piece of land, such as timber or berries.

Leases

A lease, or tenancy, is a contract for the transfer of use and possession of land from the landlord to the tenant. The two key characteristics of a lease are that the interest in land is for a definite period of time and the tenant is entitled to exclusive possession. In other words, the tenant controls the land and has the right to exclude all others, including the owner (subject to the right to inspect with notice as set out in legislation and/or the contract), for a fixed period.

Figure describes four types of tenancies. It is sometimes said that the third and fourth types are not really leases because there is no set term (in the first case) or there is no longer any lease at all (in the second case).

Figure: Types of Tenancies

A lease of three years or longer duration must be in writing to be enforceable, by virtue of the Statute of Frauds.

Covenants and their Breach

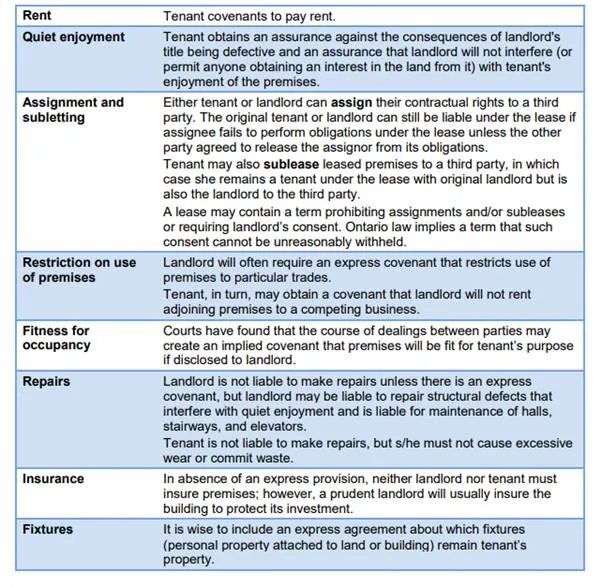

A commercial lease normally provides certain covenants or promises, as set out in Figure .

The landlord has access to five remedies for breach of a lease contract:

1. Damages (for any breach of covenant other than payment of rent)

2. Recovery of rent

3. Eviction

4. Distress (right to seize assets of the tenant found on the premises and sell them for arrears of rent)

5. Injunction (right to order the tenant to stop a prohibited use.

The tenant has three remedies: damages, injunction, and termination of the lease.

Figure: Standard Covenants in Commercial Leases

Termination of a Lease

A lease may be terminated by one of the following:

1. Surrender – The tenant vacates the premises at the expiration of the lease (or during the lease, by agreement with the landlord).

2. Forfeiture – The landlord evicts the tenant.

3. Notice to quit – A periodic tenancy is ended by either the landlord or the tenant serving a notice to quit upon the other party. The length of notice required is normally set by provincial legislation, although the parties may alter the period by an express term in the lease.

4. Renewal – A lease for a term certain often provides for a renewal at the option of the tenant.

Transfer of Interests in Land

A person may dispose of interests in land during his or her lifetime by transferring them to another in a deed of conveyance (deed). On the death of a person, land will pass either under the Will or according to the statutory rules of inheritance. There could also be a compulsory transfer of land (expropriation) to the government for public purpose, for which the government must pay appropriate compensation.

A person may acquire title to land by adverse possession. To do so, he must stay in exclusive possession of the land, using it as an owner and ignoring the claims of other persons including the true owner. Possession must be open, notorious, and continuous. An example of adverse possession would be if a neighbour built a fence on your property or had a portion of his garage on your property. Adverse possession is based on a wider principle, the law of limitations, whereby a person who has a right of action against another will lose that right if it is not pursued within a specified period of time. To prevent acquisitions by adverse possession, a property owner must interrupt the other's possession before the limitation period (10 years in Ontario, 20 years in other jurisdictions) elapses by ejecting the possessor, demanding and receiving rent, or receiving a signed acknowledgment that he is using the property with permission. Adverse possession is not possible in most land titles systems (see below).

Mortgages

The purchase of real property often requires financing. A mortgage is an interest in land that provides security for the repayment of that debt.

At common law, a mortgage is, in fact, a conveyance of an interest in land as security for a debt. If the debt is repaid as promised, the conveyance becomes void, and the interest in land reverts to the mortgagor (borrower). If the debt is not repaid, the land becomes the property of the mortgagee (bank), subject to the right of the mortgagor to redeem (the grace period the courts allow a defaulting mortgagor is known as the equity of redemption). Under the land titles system, mortgages (called charges) are not conveyances of the legal title but are liens upon the land. If the debt is not repaid, the mortgagee must start foreclosure proceedings to gain title to the land.

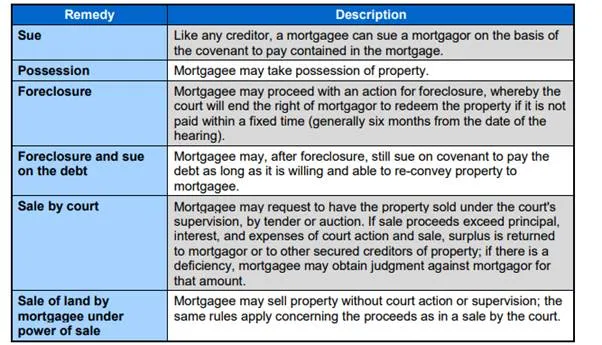

Normally, a mortgagor promises to repay the amount borrowed plus interest at specified times, to maintain adequate insurance on the land and buildings, to pay the taxes, and to keep the buildings in a proper state of repair. In turn, the mortgagee promises to discharge the mortgage upon payment in full and to allow the mortgagor quiet enjoyment of the land as long as it is in good standing. The mortgagee’s remedies upon default are shown in Figure.

Figure : Remedies of Mortgagee

A second mortgagee has rights (and remedies) similar to the first mortgagee, except that its interest is in the equity of redemption, not the legal title, and it ranks behind the first mortgagee in priority of payment

Recording of Interests in Land

Under the registry system, you must register a copy of a document creating an interest in land (or your interest will not be protected). A prospective purchaser will have his or her lawyer search title to the land in the registry office; based on that search, the lawyer will "certify title." Under the land titles system, (which covers parts of Ontario), the land titles office provides a document showing the state of the title and the purchaser is entitled to rely on that document.