International Business Law

The laws that impact a Canadian business that engages in the export and import of goods fall roughly into two categories: 1) laws that control or facilitate trade and 2) laws that govern international contracts of sale. Of course, a Canadian business that has operations in foreign countries is also required to follow the laws of those countries.

Laws to Control or Facilitate Trade

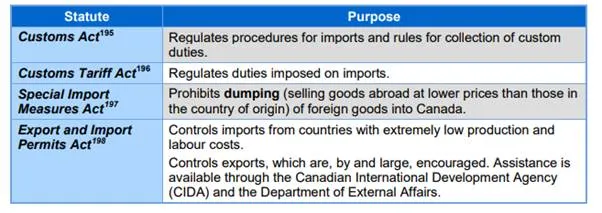

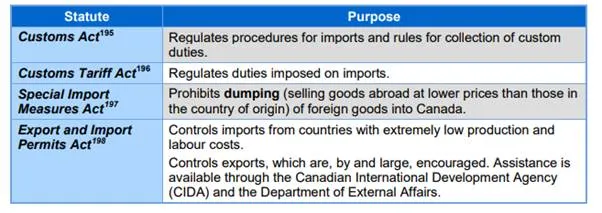

A sampling of Canada’s federal statutes that regulate imports and exports is found in Figure .

Figure : Exports and Imports

International trade is also regulated by international agreements, where signing nations agree to limit their controls and duties on goods. For Canada, these include the World Trade Organization (WTO), which provides a forum for negotiating trade rules and a mechanism for resolving disputes, and the North American Free Trade Agreement (NAFTA), which includes a phased-in reduction and elimination of tariffs among Canada, the United States, and Mexico.

International Contracts of Sale

An export sale requires four documents, each of which plays a distinct role in the sale transaction:

1. Contract of Sale

a. Trade terms and terminology must have the same meaning to both parties, so reference is often made to published interpretations of international trade terms.

b. There should be a reference to the governing law.

c. The contract is very detailed as to quantity, quality, price, shipping, etc.

d. There is usually an arbitration clause to resolve disputes.

2. Bill of Lading – This is a contract between the seller and the carrier of goods.

3. Insurance – This is required to protect against the hazards associated with shipment of goods.

4. Commercial Invoice – This is usually required by the buyer’s customs office.

Study Questions For Business Relationships

1. Which of these would not be covered under the Sale of Goods Act?

a. Sale of car paid for by credit card.

b. Sale of crops paid for by cheque.

c. Sale of services paid for by cash.

d. All of the above are covered.

2. In general, under the Sale of Goods Act, a purchaser becomes responsible for risk of loss or damage to goods he has purchased when:

a. The purchaser makes the contract with the vendor, even if the vendor still has something to do to put the goods into a deliverable state.

b. The purchaser notifies the vendor he is ready to receive delivery.

c. The purchaser receives delivery.

d. Passing of property has occurred.

3. This specific remedy under the Sale of Goods Act allows a seller to receive full payment if a buyer refuses to take delivery, even though title has passed:

a. Liquidated damages

b. Specific performance

c. Action for the price

d. Lien

4. Misleading advertising and other representations of sellers are:

a. Prohibited by the federal Competition Act.

b. Prohibited by Ontario’s Consumer Protection Act.

c. Prohibited by the federal Competition Act and Ontario’s Consumer Protection Act.

d. Not prohibited—it is a case of caveat emptor (buyer beware).

5. This Act provides general rules related to identifying products, stating the quantity, and using standardized sizes:

a. Consumer Packaging and Labelling Act

b. Textile Labelling Act

c. Hazardous Products Act

d. Food and Drugs Act

6. When the bank provides services like financial advice to your business, it is required to:

a. Provide account information and maintain secrecy of your affairs.

b. Maintain secrecy of your affairs and provide safeguards for electronic communications.

c. Provide a duty of care and skill and disclose potential conflicts of interest.

d. All of the above.

7. Which of these is a distinguishing feature of a negotiable instrument?

a. Notice of any assignment has to be given to the original promisor.

b. An innocent party who acquires possession of a negotiable instrument has the right to collect on it, even when original contractual obligations have not been met.

c. A holder may sue only if all remaining parties join in the suit.

d. None of the above.

8. This type of security interest gives a creditor the right to sell all of the debtor’s assets:

a. Chattel mortgage

b. Conditional sale

c. General security agreement

d. All of the above

9. Which of these persons is bankrupt?

a. Owes more than $1,000 and cannot meet obligations as they become due.

b. Owes more than $1,000 and has debts which exceed the realizable value of his or her assets.

c. Owes more than $1,000 and has performed any of ten specific acts within the preceding six months.

d. Owes more than $1,000, has performed any of ten specific acts, and has had a petition filed with the courts against him or her by creditors.

10. When bankruptcy occurs, which of these has first priority?

a. Secured creditors

b. Preferred creditors

c. General unsecured creditors

d. Employees owed wages