Competition

Governments intervene in the marketplace to ensure an efficient market economy that is characterized by free competition. In particular, the Competition Act180 deals with the following anti-competitive practices: conspiracies, monopolizing, and mergers.

Conspiracies

The Act prohibits cartels (called trusts in the U.S., hence the expression “anti-trust law”) and any conspiracy by two more persons to unduly lessen competition. To determine whether an agreement has seriously reduced competition, the courts must first determine the relevant market in terms of product and geographic area and then decide whether the accused parties had a large enough market share to injure the competition.

Because it is difficult to prove that there was an agreement to lessen competition, the existence of such an agreement is often inferred from tactics used. Methods of reducing or eliminating competition include parallel pricing (adopting similar pricing strategies), setting quotas (limiting production), market sharing (agreeing to divide up the market by territory), and product specialization (agreeing to each make/sell different products).

Another specific prohibited offence is bid rigging, where an agreement is made not to submit a bid, or an agreement is made in advance regarding what bids will be submitted in response to a call for bids or tenders.

Monopolizing

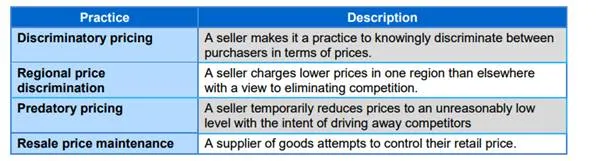

The Act also prohibits certain types of conduct by a monopoly or very powerful, dominant firm that are contrary to the public interest. In particular, it bans four types of pricing practices, as set out in Figure.

Figure 5-52: Illegal Pricing Practices

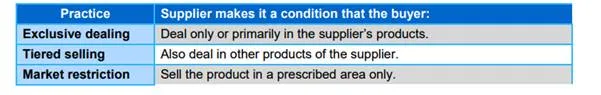

Other practices related to distribution identified in Figure are not illegal but are subject to review. The tribunal may order the practice to be stopped or modified.

Figure : Reviewable Distribution Practices

Abuses of dominant position are also reviewable; these include buying up products to prevent price drops, pre-emption of scarce facilities or resources, and requiring a supplier to either refrain from selling to a competitor or to sell only to certain customers.

Mergers

The tribunal can prevent a merger that it concludes will likely prevent or significantly lessen competition in Canada. There are also pre-notification requirements for proposed mergers of firms whose combined revenues exceed $400 million per year or whose combined assets exceed $35 million.