Banking

“Banks have become financial marketplaces, offering services in cash management, investment advice and brokerage, and business financing.”161 As a result, the relationship between businesses and banks is a complex one. These notes will highlight some of the key legal requirements related to the banking agreement, negotiable instruments, and electronic banking.

Banking Agreement

The banking agreement sets out the rights and obligations of a bank and the customer. Its purpose is to specify who has authority to issue instructions to the bank on behalf of the customer and to allocate the risk of loss associated from difficulties with verifying the customer’s authority and carrying out the customer’s instructions.

An operation of account agreement sets out service charges, chequing arrangements, and release of information. Common law imposes additional duties on both parties to a banking contract. These are set out in Figure.

Figure : Implied Duties of Bank and Customer

Standard banking documents are designed to protect the bank, not the customer. However, in instances where the bank provides services like financial advice, a fiduciary relationship exists that imposes a duty of care and skill, as well as the requirements to disclose actual and potential conflicts of interest and to consider the consumer’s interests ahead of the bank’s.

Negotiable Instruments

A negotiable instrument is “a written contract containing an unconditional promise or order to pay a specific sum on demand or on a specified date to a specific person or bearer.” The federal Bills of Exchange Act governs the law relating to negotiable instruments. Cheques, bills of exchange (a written order to a person to pay a specified amount to another person), and promissory notes are all included under the act as negotiable instruments.

Negotiable instruments are negotiated by endorsement and delivery, although an instrument that is payable to the holder or "to bearer" need only be delivered to complete negotiation.

There are three distinguishable features of a negotiable instrument that are not common to the ordinary assignment of contractual rights, as discussed below. These are designed to facilitate the free transfer of negotiable instruments from party to party. Even if an instrument is not negotiable, in that it fails to meet one or more of the criteria, it still may be assignable as a contractual right as discussed under contract law.

1. Notice of the assignment need not be given to the original promisor.

This makes a negotiable instrument enforceable at face value and allows the holder to collect on the instrument even if the original debtor has not been notified of transfer(s) that have taken place.

2. The assignee may sometimes acquire a better right to sue on the instrument than its predecessor (assignor) had.

This gives an innocent party who acquires possession of a negotiable instrument the right to collect on it whether the original contractual obligations have been met or not, unless there has been fraud or forgery with respect to the instrument. In commercial transactions, banks and other institutions are willing to discount drafts or cash cheques drawn on other banks or institutions because the law provides them the protection of holders in due course and allows them to enforce payment despite defects of title such as a forged signature, incapacity to contract as a result of drunkenness or insanity, or discharge of the instrument by payment. For example, where a purchaser pays for goods with a cheque and the goods turn out to be defective, the purchaser can stop payment on the cheque as long as it is in the hands of the person/business to whom it is made out. If the cheque has been transferred to an innocent third party (even the payee’s bank), the purchaser will have to pay and seek recourse through contractual law against the vendor of the goods.

3. A holder may sue in its own name any other party liable on the instrument without joining any of the remaining parties.

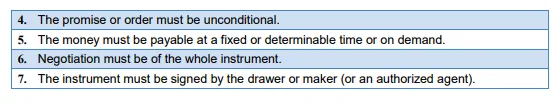

There are seven essential criteria for negotiable instruments to acquire the desirable features set out above. These are shown in Figure .

Figure: Criteria for Negotiable Instruments

Electronic Banking

Although electronic banking is cheap and efficient, the absence of paper can make it challenging to safeguard the authority for such transactions. Problems may also occasionally be caused by transmission failures or system crashes. Consequently, banking contracts now include provisions for the risks of electronic transactions, including the customer’s duties to report problems, to select personal identification numbers (PINs) that are not obvious, and to safeguard those numbers, and the bank’s responsibility for electronic failures. Banks also impose daily and weekly limits on transactions to control losses due to fraud. Finally, there is greater reliance on international rules, such as the UNCITRAL Model Law for International Credit Transfers.