Consumer Protection

Consumers are “individuals who purchase goods and services from a business for their personal use and enjoyment.”

Modern developments that have led to the advent of consumer protection legislation include:

1. Large enterprises that have considerably more power than buyers;

2. Complexity of manufactured goods so that retailers cannot detect or remedy defects;

3. Bulk shipping in sealed packages so that neither the retailer nor the shopper can examine products until they are purchased;

4. High profile advertising through mass media that often plays a bigger role in inducing consumers to buy than the retailer plays;

5. Extensive use of credit to purchase expensive goods with borrowing terms that are often difficult to understand; and

6. Expanded use of Internet contracts with detailed terms that consumers may be unaware of and/or that may be one-sided.

Principal Areas of Consumer Protection Legislation

This section reviews the basic requirements imposed by the five main areas of consumer protection laws: advertising, quality, business conduct, disclosure of cost of credit, and dealing with the public.

Misleading Advertising and Other Representations of Sellers

The federal Competition Act prohibits misleading representations about the qualities of a product, its "regular" selling price, and warranties. The Act also makes certain selling practices offences, such as publishing test results or user testimonials that cannot be corroborated and have been used without permission of the testing agency or user, double ticketing, bait-and switch advertising, pyramid selling and referral selling, and advertising an article or service at a lower price than that asked of the customer.

Ontario's Consumer Protection Act, 2002, makes it an unfair practice to make "a false, misleading, or deceptive consumer representation," and provides a long list of examples, including failure to reveal a material fact and making unconscionable representations. A consumer who is subjected to an unfair practice can terminate the contract and, where rescission is not possible, may recover any amount in excess of the fair value of goods or services received. The court may also award exemplary or punitive damages.

Regulation of Labelling, Product Safety, and Performance Standards

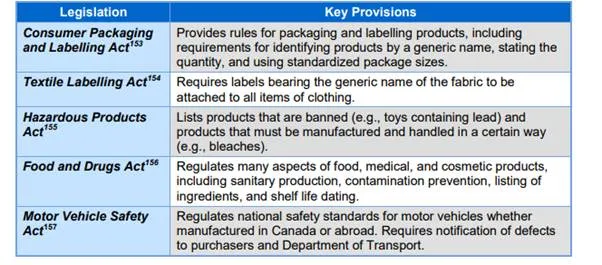

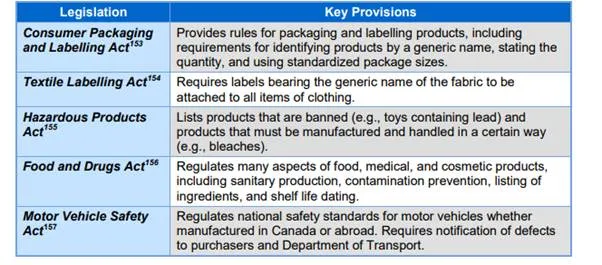

Since the statutes are numerous, Figure identifies only some of the more important ones and their key provisions.

Figure: Key Regulations for Labelling, Product Safety, and Performance Standards

Regulation of Business Conduct Towards Consumers

To reduce pressure selling, statutes provide a cooling-off period after door-to-door sales.158 To discourage businesses from sending unsolicited goods to consumers, the recipient of such goods may use them without becoming liable for their price.

To discourage sellers from creating standard-form contracts that provide self-help remedies in the event of consumer default, statutes impose two constraints. First, once a buyer has paid a specified portion of the purchase price, a seller loses the remedy of repossession. Second, there are limits on the circumstances in which a seller or creditor can enforce an acceleration clause (whereby the unpaid balance of the price becomes payable as soon as the buyer defaults).

As a result of concerns about fraudulent telemarking (use of telephone communications to promote a product or business interest), the federal Competition Act made deceptive telemarketing a criminal offence. The rules require agents to disclose the company’s name, purpose of the call, product and service being promoted, terms and restrictions pertaining to product delivery, and other information. The Telecommunications Act was amended in 2008 to establish a National Do Not Call List, which prevents telephone solicitations to registrants except for charities, political parties, or businesses that have an existing relationship with the registrant.

Businesses often assign consumer credit contracts to finance companies. Consequently, most consumer protection acts state that the assignee of a consumer credit contract has no greater rights than the assignor and is subject to the same obligations. This ensures that consumers do not end up owing money to a finance company (who would otherwise be a holder in due course) with no opportunity to refuse to pay for defective goods or being forced to waive their rights against an assignee in a cut-out clause.