Corporate Law

“The corporation is the most common form of business organization. It is used for all types and sizes of businesses, from one-person operations to large multinationals.” 128 This section will deal with the basic characteristics of a corporation, the process of incorporation, and the legal rules for corporate governance.

Nature of a Corporation

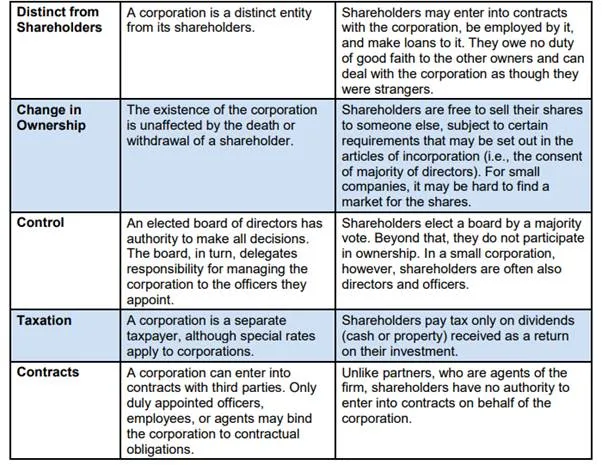

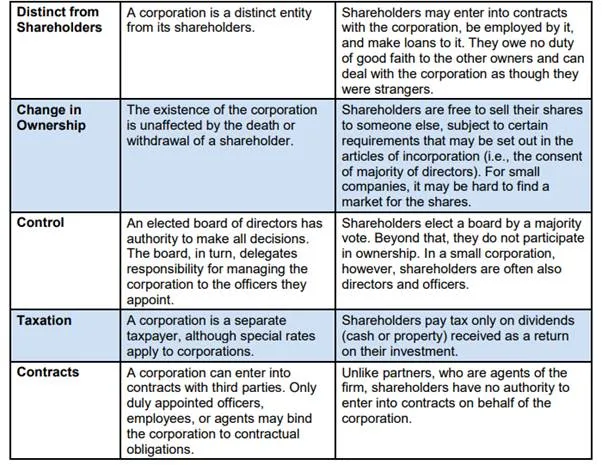

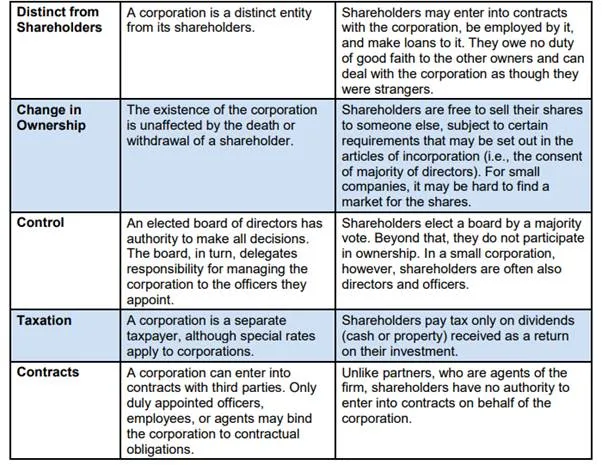

As noted above, a corporation is a person in the eyes of the law. Figure highlights the distinct characteristics of the corporate form of ownership, along with the implications for the corporation and its owners (shareholders). It also draws attention to the special impact on shareholders of small private companies.

Figure : Distinct Characteristics of a Corporation

Methods of Incorporation

Ontario, British Columbia, Alberta, Saskatchewan, Manitoba, New Brunswick, and Newfoundland and Labrador, and the federal Parliament all permit incorporation by articles of incorporation. Quebec and P.E.I. still use the older system of letters patent, while Nova Scotia uses a memorandum system, in which corporations file a memorandum and are issued a certificate of incorporation.

The choice of jurisdiction dictates the filing and registration requirements (e.g., name selections and use, fees, proportion of directors that must be Canadian residents, annual filings). However, a business incorporated in one province or under the federal jurisdiction is free to carry on business throughout Canada and abroad. Certain types of businesses, such as banks, are required to incorporate federally. Once incorporated, a company is bound by the laws of the jurisdiction where incorporation occurred.

Under the Business Corporations Act, incorporation in Ontario is accomplished by filing signed articles of incorporation, a name search report on the proposed name of the corporation, and the requisite fee. The government office, in turn, issues a certificate of incorporation. Articles of incorporation set out information that is central to the corporation, such as name, registered office, number of directors, restrictions on business, classes of shares and the rights and restrictions of each class, and any restrictions on the transfer of shares.

Once the company has been incorporated, by-laws are adopted.129 General by-laws provide the basic operating rules of the company, such as number and terms of directors, quorums necessary for meetings, the categories and duties of executive officers, and voting rules. Other by-laws give directors or officers authority from the shareholders to carry out specific transactions that require approval under terms of the statute or charter.

Types of Corporations

Although the terms public corporation and private corporation are often used, only two jurisdictions in Canada (Nova Scotia and P.E.I.) permit the formation of private companies, where the right to transfer shares is restricted, the number of shareholders is limited, and no invitation can be made to the public. Therefore, a better distinction is between corporations that issue shares to the general public and those that do not.

The two types of corporations are also distinguished by the terms widely held and closely held. Widely held corporations issue shares to the general public and usually list their shares on a stock exchange. Closely held corporations restrict the transfer of their shares and do not issue shares to the general public; thus, they have a small number of shareholders. Over 90% of corporations in Canada are closely held, and most of these are small- and medium-sized businesses.

Incorporation statutes apply to both widely and closely held corporations, but they impose additional obligations on the former. For example, the Canada Business Corporations Act refers to widely held corporations as distributing corporations and imposes requirements related to proxy solicitation, number of directors, and the need for an audit committee. These companies are also subject to regulation under the relevant provincial securities acts for the provinces where shares are issued or traded.

Corporate Financing

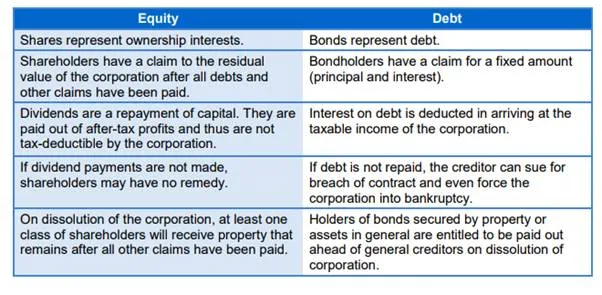

Corporations are financed in one of two ways: equity or debt. Equity financing refers to “what shareholders have invested in the corporation in return for shares,” while debt financing “consists of loans that have been made to the corporation.”132 The distinction between a share and a bond (or debenture) can become blurred as more features are attached to corporate securities. However, Figure sets out some of the basic differences between equity and debt financing. Determining the ideal proportion of debt-to-equity financing is a complex decision that is beyond the scope of this document.

Figure: Equity vs. Debt Financing

Share Capital

Most corporations have one class of shares called common shares, whose holders have the three rights referred to above: “rights to vote, to receive dividends, and to receive the remaining property of the corporation upon dissolution”.133 In contrast, holders of preferred shares are entitled to receive specified dividends, to be paid in priority over common dividends, and to receive a return of the amount invested before any payments are made to common shareholders. They may or may not have the right to vote. Large multinational corporations often have many classes of shares, and the distinction between common and preferred shares can also begin to blur as the bundle of rights given to each class to attract investors becomes more complex.

Authorized capital is the maximum number (or value) of shares a corporation can issue according to its charter. Only letters patent or memorandum jurisdictions impose such an upper limit. Issued capital refers to shares that have been issued by a corporation; since shares must now be fully paid for when issued, it equals paid-up capital (shares issued and fully paid for). Stated capital equals the amount received for the issue of shares. Par value is a nominal value attached to a share at time of issue; most jurisdictions (those using articles of incorporation) no longer have par value shares.

Corporate Governance

Corporate governance refers to “the rules governing the organization and management of the business and affairs of a corporation in order to meet its internal objectives and external responsibilities.” This definition refers to the two distinct types of corporate activities delineated in the Canada Business Corporations Act (and the corresponding provincial statutes, including the Business Corporations Act):

a) “The affairs: the internal arrangements among those responsible for running a corporation”: directors, officers, and shareholders.

b) “The business: the external relations between a corporation and those who deal with it as a business enterprise—its customers, suppliers, and employees—as well as relations with government regulators and society as a whole.”