Legal Requirements

As is the case with sole proprietorships, partnerships also require an HST number and business name registration. In addition, as with sole proprietorships, depending on the type of activity being carried out by the partnership, a business licence may be needed

Termination of Partnership

A good partnership agreement will make express provision for what is to happen on the retirement or death of a partner, including what will justify termination, how much notice a partner must give when leaving the partnership, whether the partnership will continue with the remaining members, how the retiring partner's share is to be valued, and how continuing partners will buy out the share of a deceased or retired partner. In the absence of express agreement, the Partnerships Act specifies rules governing termination.

In particular, the Act allows for termination in a number of ways:

1. Expiration of a fixed term, if there was one;

2. Notice by a partner to the others;

3. Death, bankruptcy, or insolvency of any partner;

4. Charge or assignment of a partner's interest;

5. Application to the court by one or more partners under certain circumstances (e.g., partner becomes incompetent or incapable, acts prejudicial to the business, or breaches the partnership agreement); or

6. Agreement of the partners.

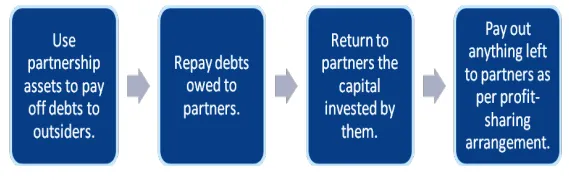

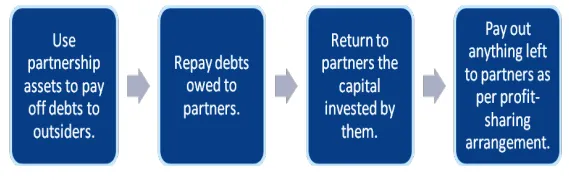

On dissolution of a partnership, section 44 of the Partnerships Act126 provides a framework for dealing with claims against the partnership, as shown in Figure.

Figure : Dissolution of Partnership

Limited Partnerships

In a limited partnership, one or more of the partners limits their liability to the amount of their capital contributions. There must be at least one or more general partners whose liability is unlimited. A limited partner may not take an active part in the management of the partnership, but she is permitted to be an employee of the limited partnership and may provide management advice. It can be a difficult balancing act—if the limited partner chooses to exercise some control, she will incur unlimited liability; but if she does not, there may be instances where the business is at risk to fail.

While a general partnership exists as soon as the partners start carrying on business together, a limited partnership does not exist until a declaration has been filed with the appropriate government authority. Limited partnerships are not often used, except for tax-planning purposes. Incorporation is a more effective way to obtain limited liability.

Limited Liability Partnerships

A limited liability partnership (LLP) is a special form of partnership for certain professions, such as lawyers and accountants.

Individual partners are not personally liable for the professional negligence of their partners or for certain other obligations provided certain requirements are met. A partner remains liable for his own negligence and for that of people under the partner’s direct supervision or control. The firm itself also remains liable. Therefore, a non-negligent partner may still lose the entire value of his partnership share but will not lose personal assets.

In Ontario, the protection of non-negligent partners from personal liability extends only to negligence; it does not apply to other torts, breaches of trust, or contractual obligations. By contrast, legislation in other provinces provides broader protection. For example, in Alberta, a member of an LLP is not liable for the “negligence, wrongful acts or omissions, malpractice, or misconduct” of a partner, or of an employee or agent of the firm, unless that partner knew of the act and did not take reasonable steps to prevent it or unless the act was committed by a direct report over whom he failed to provide adequate supervision. Saskatchewan holds only partners in an LLP personally liable for obligations that a director would have. New Brunswick and Nova Scotia adopt both approaches.

All provinces require a written agreement that designates the partnership as an LLP. An LLP must register its firm name, and the name must contain “limited liability partnership,” LLP, or L.L.P. An LLP is the same as a general partnership in all other respects.

Corporation

A corporation is a separate legal entity created for carrying on business. As an artificial person, a corporation has a continuous existence independent of the existence of its owners, and it has powers and liabilities distinct from its owners. As such, it is responsible for its own debts. It may enter into contracts, sue, and be sued. It can commit torts, such as negligence, or crimes. The corporate form of ownership is covered extensively in the next section.