Legal Forms Of Business

In Canada, there are three basic ways to carry on business: sole proprietorship, partnership (general, limited, and limited liability), and corporation. Each of these is examined below.

Sole Proprietorships

A sole proprietorship is one individual carrying on business on his or her own (under his or her own name or a business name) without adopting any other form of business organization such as incorporation.

Because the business and the person are one and the same, the sole proprietorship brings with it three key implications, as set out in Figure.

Figure : Implications of Sole Proprietorship

Thus, the main disadvantage of the sole proprietorship is unlimited personal liability, which means that third parties are entitled to take the sole proprietor’s personal assets, as well as the assets of the business, to satisfy the business’s obligations.

On the other hand, a sole proprietorship is easy to form and has few legal requirements. An HST number may be required depending on the type of business and if the supply of HST taxable goods/services exceeds $30,000. As well, the Business Names Act requires the proprietor to register the business name if he is carrying on business using a name other than his legal name, e.g., Perfect Hair Styles. Registration would have to be done in every province/territory in which the business operates. Finally, depending on the type of activity being carried out by the business, a business licence may be needed. For example, a municipal licence is required by taxi drivers, electricians, and restaurant operators. A provincial licence is needed by real estate agents, car dealers, insurance brokers, and securities brokers.

General Partnerships

While there is no distinct body of law relating to sole proprietorships, there is a well-developed body of law—initially common law and now codified by statute—governing the affairs of a partnership.

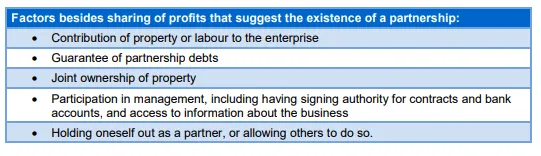

The Partnership Act, passed by the British Parliament in 1890, defined partnership as “the relation which subsists between persons carrying on a business in common with a view of profit.” Thus, a partnership is a joint business enterprise carried on for profit. In determining whether or not a relationship constitutes a partnership, the courts look at the substance rather than the form. The sharing of profits is an essential element of a partnership, as evidenced by the phrase with a view of profit. However, merely sharing profits does not by itself prove that a partnership exists but would be used in connection with other factors such as those outlined in Figure to assess whether a partnership exists.

Figure: Is the Relationship a Partnership?

The Legal Relationship Between Partners

Partners have both obligations and rights pursuant to either statutes and/or a partnership agreement.

Partnership Liability

A partner is personally liable for:

1. Debts and obligations of the partnership incurred while he or she is a partner;

2. Negligence and other torts perpetrated by any of the partners acting in the ordinary course of the partnership business; and

3. Misapplication of trust funds placed in the care of the partnership.

Each partner becomes the agent of the other partners. Therefore, actions taken by one partner bind all of the partners. Although partners may wish to restrict authority by an internal agreement, such restrictions are only binding on third parties who have actual notice of the restrictions. As well, each partner owes a fiduciary duty to the other partners, i.e., a duty to act honestly and in good faith with a view to the best interests of the partnership.

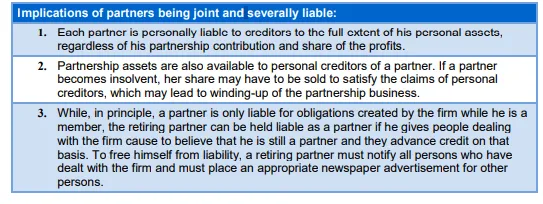

Another key feature of a partnership is joint and several liability, which means that each partner is individually as well as collectively responsible for the entire debt. The implications of this are discussed in Figure .

Figure : Partnership Liability

Partnership Agreement

The relations of partners are essentially governed by the terms of the partnership agreement. A partnership agreement does not have to be in writing to be legally enforceable unless it extends beyond one year, and performance has not yet begun. A partnership agreement can be created orally or it can be implied from the conduct of the partners.

A good partnership agreement will clearly set out the business objectives, partners' responsibilities, capital contribution, sharing of profit and losses, procedures for settling disputes (usually by arbitration), and provisions for an efficient and peaceful dissolution. Generally speaking, partners may agree to whatever terms they wish, provided the terms are not illegal and do not offend public policy. However, Ontario’s Partnerships Act sets out certain terms that will be implied if those matters are not expressly covered in the agreement. These are described in Figure .

Figure : Implied Statutory Partnership Rules

Because a partnership is not a separate legal entity, each partner’s share of profits is the personal responsibility of that partner for income tax purposes.