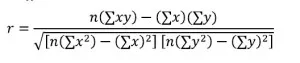

The Pearson Product-Moment Correlation equation.

In signal processing, cross correlation is where you take two signals and produce a third signal. The method, which is basically a generalized form of “regular” linear correlation, is a way to objectively compare different time series and allows you to see how two signals match and where the best match occurs. It can be used to create plots that may reveal hidden sequences.

The basic process involves:

1. Calculate a correlation coefficient. The coefficient is a measure of how well one series predicts the other.

2. Shift the series, creating a lag. Repeat the calculations for the correlation coefficient.

3. Repeat steps 1 and 2. How many times you repeat the process will depend on your data, but as the lag increases the potential matches will decrease.

4. Identify the lag with the highest correlation coefficient. The lag with the highest correlation coefficient is where the two series match the best.

Cross correlation and autocorrelation are very similar, but they involve different types of correlation:

· Cross correlation happens when two different sequences are correlated.

· Autocorrelation is the correlation between two of the same sequences. In other words, you correlate a signal with itself.