Significance of Audit Risk

Low audit risk is significant as auditors can’t verify every transaction.

The auditors generally focus on main risk areas, for example, understated costs or overstated revenues, where errors may lead to material misstatements on the financial statements.

Moreover, auditing standards necessitate the auditors to plan and perform audits with professional skepticism as there is always a possibility for the financial statements being materially misstatement.

Audit Risk at the Financial Statement and Account Balance Levels

The auditor specifies an overall audit risk level to be achieved for the financial statements taken as a whole.

Generally, that same level applies to each account balance and all related assertions.

Currently, if an auditor were to use different audit risk levels for different accounts and assertions, there would be no generally accepted way of combining the results to determine the achieved overall audit risk level for the financial statements as a whole.

In contrast, the assessed levels of inherent and control risk, and the acceptable level of detection risk can vary for each account and assertion.

The auditor does not control the levels of inherent and control risk and intentionally varies the acceptable level of detection risk inversely with the assessed levels of the other risk components to hold audit risk constant.

Thus, expressions of the levels inherent, control, and detection risk pertain to individual assertions at the accounts balance level, not to the financial statements taken as a whole.

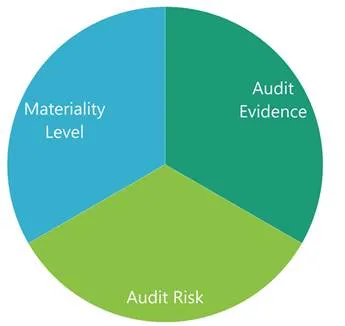

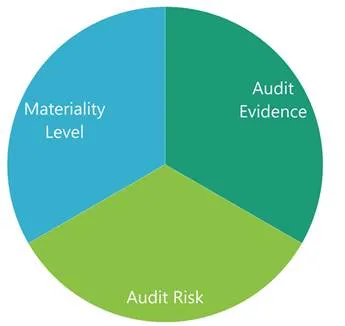

Interrelationships among Materiality, Audit Risk and Audit Evidence

There is an inverse relationship between materiality and audit evidence and an inverse relationship between audit risk and audit evidence.

The above figure illustrates these relationships as well as the interrelationships among all three concepts.

For example, if in the figure, we hold audit risk constant and reduce the materiality level, audit evidence must increase to complete the circle.

Similarly, if we hold the materiality level constant and reduce audit evidence, the audit risk must increase to complete the circle.

Or, if we wish to reduce audit risk, we can do any of the following;

1. increase the materiality level while holding audit evidence constant,

2. increase audit evidence while holding the materiality level constant, or

3. make a smaller increase in both the amount of audit evidence and the materiality level.