Testing Insurance Domain Applications with Sample Testcases

Insurance Companies rely heavily on Software to run their business. Software Systems helps them to deal with various insurance activities like developing standard policy forms, handling billing process, managing customer's data, rendering quality services to the customer, coordinating between branches and so on.

Though this software is designed to meet the customer's expectations, its durability and consistency needs to be tested before its actual deployment. Software testing assures the quality of the insurance software by identifying bugs before go-live.

In this tutorial, we will learn,

● What is Domain in Testing?

● Why Insurance Domain Knowledge Matters?

● What is Insurance? Type of Insurance

● What is Premium? How is Premium calculated?

● Testing required in different process area of Insurance

● What to Test in Insurance?

● Sample Test Case for Insurance Application Testing

What is Domain in Testing?

Domain is nothing but the industry for which the software testing project is created. When we talk about software project or development, this term is often referred. For example, Insurance domain, Banking domain, Retail Domain, Health Care Domain, etc.

Usually, while developing any specific domain project, domain expert help is sought out. Domain expert are master of the subject, and he may know the inside-out of the product or application.

Why Insurance Domain Knowledge Matters?

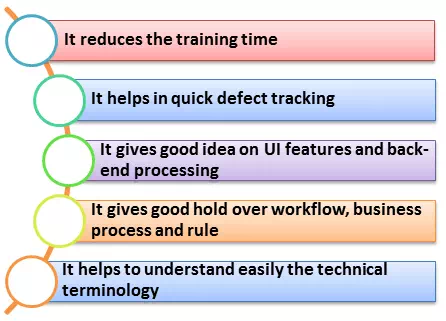

Domain knowledge is quintessential for testing any software product, and it has its own benefits like

What is Insurance? Type of Insurance

Insurance is defined as the equitable transfer of the risk of a loss from one entity to another in exchange for payment. Insurance Company, which sells the policy is referred as INSURER while the person or company who avails the policy is called the INSURED.

Insurance policies are usually classified into two categories, and insurer buy these policies as per their requirement and budget.

However, there are other types of insurance that falls under these categories

● Unemployment insurance

● Social Security

● Workers Compensation

What is Premium? How is Premium calculated?

Premium is defined as the amount to be charged for a certain amount of insurance coverage or policy the insured has bought.

Premium for the insurance is determined by on the basis of two factors

● The frequency of claims

● The Severity of claims (Cost of each claim)

For example, we will see how insurance system works,

Suppose an insurance company provides insurance to all houses in a village

|

Home Insurance |

Amount |

|

Total number of house in village |

= 1000 |

|

Value of each house |

= $ 800 |

|

Contribution of each house owner as premium |

= $ 8 |

|

Total Premium Collected |

= $8000 |

Statistically, it has calculated that in case of fire a maximum of 10 houses are burnt which it need to compensate.

So incase, of fire, it will have to pay 10 house $800 which comes $8000 equal to the premium it collected.

The risk of 10 house owners is spread over 1000 house owner in the village hence reducing the burden on any one of the owner.

In case of no fire in a particular year, the entire sum goes to its profit while if more than 10 houses burn the insurer will incur a loss.

Testing required in different process area of Insurance

Testing can mitigate the risk of business disruption during and after deployment of software. There are many branches of an insurance company that requires testing.

● Policy Administration Systems

● Claim Management Systems

● Distribution Management Systems

● Investment Management Systems

● Third party Administration Systems

● Risk Management Solutions

● Regulatory and Compliance

● Actuarial Systems (Valuation & Pricing)

What to Test in Insurance?

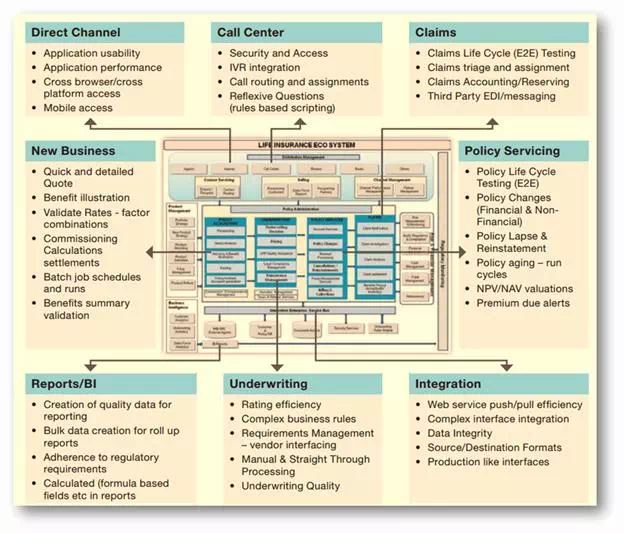

The insurance sector is a network of small units that deals directly or indirectly with processing claims. For smooth functioning of an insurance company, it is necessary that each of this unit is tested rigorously before it is sync together to deliver the desired outcome. The testing includes

|

● Call Center |

● IVR Integration Testing ● Call routing and assignment ● Security and access ● Reflexive Questions |

|

● Policy Serving |

● Policy life cycle testing ● Financial and Non-financial policy changes ● Policy lapse and Re-instatement ● Policy aging-run cycles ● Premium due alerts ● Valuation of NPV/NAV |

|

● Claims |

● Claims triage and assignment ● Testing claims life cycle ● Claims accounting/reserving ● Third party EDI/messaging |

|

● Direct channel |

● Mobile access ● Cross browser/cross platform accessibility ● Application performance ● Usability of application |

|

● Reports/BI |

● Behaving to regulatory requirements ● Generate quality data for reporting ● Create bulk data for roll-up reports ● Testing formula based fields in reports |

|

● Underwriting |

● Underwriting quality ● Manual and Straight through processing ● Complex business rules ● Rating efficiency ● Requirements Management (Vendor Interfacing) |

|

● Integration |

● Data integration ● Complex interface integration ● Source/Destination formats ● Production like interface ● Web service pull/push efficiency |

|

● New Business |

● Validate rates-factor combinations ● Batch job schedules and runs ● Commissioning calculations settlements ● Quick and detailed quote ● Benefit illustration ● Benefit summary validation ● Quick and detailed quote |

Sample Test Case for Insurance Application Testing

|

Sr# |

Test Cases for Insurance Application |

|

1 |

Validate claims rule |

|

2 |

Ensure that claim can occur to the maximum and minimum payment |

|

3 |

Verify data is transferred accurately to all sub-systems including accounts and reporting. |

|

4 |

Check that the claims can be processed via all channels example web, mobile, calls, etc |

|

5 |

Test for 100% coverage and accuracy in calculations determining premium rates |

|

6 |

Make sure formula for calculating dividend and paid up values gives correct value |

|

7 |

Verify surrender values are calculated as per the policy requirement |

|

8 |

Verify fiduciary details and bookkeeping requirements |

|

9 |

Test complex scenarios for policy lapse and revivals |

|

10 |

Test various conditions for non-forfeiture value |

|

11 |

Test scenarios for policy termination |

|

12 |

Verify general ledger account behave same as to reconcile with subsidiary ledger |

|

13 |

Test calculation of net liability for valuation |

|

14 |

Test conditions for extended term insurance |

|

15 |

Verify policy for a non-forfeiture option |

|

16 |

Check different insurance product term behaves as expected |

|

17 |

Verify premium value as per product plan |

|

18 |

Test automatic messaging system to inform customer about new products |

|

19 |

Validate all the data entered by users as it progresses through the workflow to trigger warnings, compliance, notification and other workflow events |

|

20 |

Verify insurance document template supports the document format like MS-Word |

|

21 |

Test system for generating invoice automatically and send it to customer through e-mail |