Managing and Recording Cash Receipts in Your Small Business

If youíre a small business owner, you likely receive cash payments from your customers. And if you receive cash payments, you need to know about recording cash receipts in your books. So, how do you do that?

To ensure your books are accurate, you need to understand cash receipts accounting. Read on to get the inside scoop about managing and recording cash receipts in your small business.

What are cash receipts?

You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet.

When recording cash receipts, increase, or debit, your cash balance. Recording cash receipts offsets the accounts receivable balance from the sale.

If you have a cash sale, you are responsible for recording a cash receipt. The following payment methods are considered cash sales:

∑ Cash

∑ Check

∑ Purchases on store credit

Record all cash payments in your cash receipts journal. And, enter the cash transaction in your sales journal or accounts receivable ledger.

Cash receipts journal

Your cash receipts journal manages all cash inflows for your business. Record all of your incoming cash in your journal.

Your cash receipts journal typically includes cash sales and credit categories. In your journal, you will want to record:

∑ The transaction date

∑ Notes about the transaction

∑ Check number (if applicable)

∑ Amount

∑ Cash receipt account types (e.g., accounts receivable)

∑ Any sales discounts

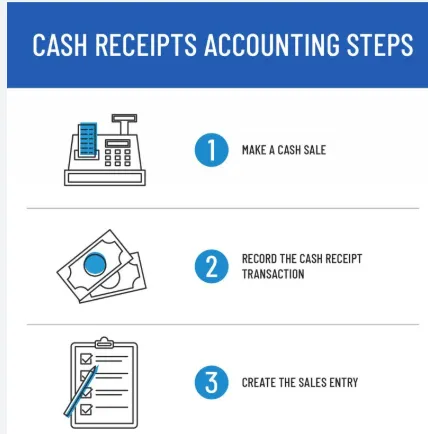

Cash receipts accounting steps

Now that you know a little more about them, itís time to learn accounting for cash receipts.

Use the steps below to properly account for cash receipts in your small business books:

1. Make a cash sale

2. Record the cash receipt transaction

3. Create the sales entry

1. Make a cash sale

Before you can record cash receipts, you need to make a cash sale. When making a cash sale, be sure to keep all receipts. The sales receipts provide proof that the sale took place.

Sales receipts typically include things like the customerís name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable).

If you accept checks, be sure to also include the check number with the sales receipt. To make sure your books are as accurate as possible, make sure you organize business receipts using a storage system (e.g., filing cabinets or computer).

2. Record the cash receipt transaction

Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash receipts journal.

Do not record the sales tax you collected in the cash receipts journal. You must record this in the sales journal instead.

3. Create the sales entry

Record your cash sales in your sales journal as a credit and in your cash receipts journal as a debit. Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit).

Cash receipt journal entry examples

Letís take a look at a couple of examples of cash receipts. To make sure you have cash receipt accounting down pat, check out the examples below.

Cash sale

Say you make a cash sale of $250 at your small business. Because you have already received the cash at the point of sale, you can record it in your books. Again, you must record a debit in your cash receipts journal and a credit in your sales journal.

Cash Receipts Journal

|

Date |

Account |

Debit |

Credit |

|

8/10/19 |

Cash Sales |

$250 |

Sales Journal

|

Date |

Account |

Debit |

Credit |

|

8/10/19 |

Cash Sales |

$250 |

Record a $250 debit in your cash receipts journal and a $250 credit in your sales journal.

Combination of cash and credit

When customers pay with a mixture of payment methods, you need to account for it. When this occurs, you must debit and credit various accounts.

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customerís accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

Say a customer buys $1,000 worth of merchandise from your business. They pay $100 in cash and use store credit for the remaining $900. Your journal entry would look like this:

|

Date |

Account |

Debit |

Credit |

|

8/10/19 |

Cash Receipts |

$100 |

|

|

Accounts Receivable |

$900 |

||

|

Sales |

$1,000 |

Cash receipts procedure

To keep your books accurate, you need to have a cash receipts procedure in place. Your cash receipts process will help you organize your total cash receipts, avoid accounting errors, and ensure you record transactions correctly.

Your cash receipts procedure should look something like this:

1. Organize and sort business receipts

2. Record cash and check information

3. Record other incoming cash (if applicable)

4. Make cash deposits

In some cases, you might receive a check or cash payment from a customer later on. In these cases, you will need to make a separate journal entry to record this information. You must also track how these payments impact customer invoices and store credit.

If you plan on depositing cash payments, make sure your deposit slip amount matches your cash receipts journal. Store deposit receipts along with your other business receipts in case of any discrepancies.

Keep in mind, the cash receipt process varies from business to business. You can tweak the above steps to better fit the workflow of your company.