Does Your Business Qualify for a 20% Pass-through Deduction?

As a business owner, you might be eligible for various types of deductions. If you own a small business or are self-employed, one deduction you might qualify for is the pass-through deduction.

Read on to learn all about the pass-through deduction, including whether or not you’re eligible for it and how to claim it.

What is a pass-through deduction?

In 2017, the Tax Cuts and Jobs Act established a new pass-through deduction for owners of pass-through businesses. The deduction is also called the 199A, pass-through, or qualified business income deduction.

Pass-through businesses use a structure that helps reduce the effects of double taxation. A pass-through entity doesn’t pay income taxes on the corporate level. Instead, taxes “pass through” onto the individuals or owners on a personal level. With a pass-through tax, income is only taxed once.

Pass-through businesses include:

· Sole proprietorships

· Partnerships

· S corporations

· Limited liability companies (LLCs)

Corporations, or C corps, do not qualify for this deduction. However, they do qualify for a low 21% corporate tax rate on their business income. Before the Tax Cuts and Jobs Act of 2017, the corporate tax rate was 35%.

The pass-through deduction allows qualified business owners deduct up to 20% of their net business income from their income taxes. This allows business owners to reduce their income tax liability up to 20%.

The deduction is scheduled to last through 2025. Business owners can take advantage of the pass-through deduction until January 1, 2026, unless Congress extends it.

Does your business qualify for the pass-through deduction?

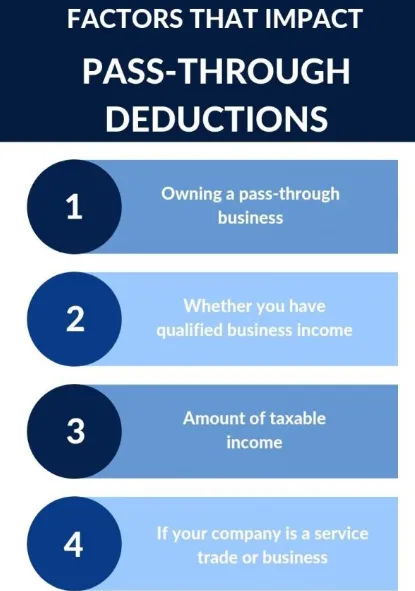

To find out if your business qualifies for the pass-through tax deduction, you need to ask yourself a few questions, such as:

· Do I own a pass-through business?

· Do I have qualified business income?

· How much is my taxable income?

· Am I a specified service trade or business?

Not sure whether to answer yes or no to the above questions? Let’s break them all down.

Owning a pass-through business

Again, if your business is a sole proprietorship, partnership, LLC, or S Corp, you have a pass-through business. C Corps do not count as a pass-through corporation because they are double taxed.

Qualified business income

To qualify for the deduction, you must have qualified business income. Qualified business income (QBI) is the sum of income and gains minus deductions and losses from running a qualified trade or business.

QBI excludes:

· Capital gains or losses

· Dividends

· Interest income

· Income earned outside the U.S.

· Some wage or guaranteed payments made to partners and shareholders

Taxable income

To qualify for the deduction, your taxable income cannot exceed a threshold. Your business can qualify for the 20% pass-through deduction if you:

· Make less than $157,500 (Single, Married Filing Separately, Head of Household)

· Make less than $315,000 (Married filing jointly)

If you earn above the threshold, you need to find out if your business is considered a “service trade or business.” Some businesses that earn above the threshold may be qualified for the entire 20% deduction or a portion of it.

Service trade or business

If your business is specified as a service trade or business, then you might not qualify for the pass-through tax deduction.

In most cases, more non-service businesses qualify for the deduction. Here is a list of some industries that are typically disqualified from the deduction:

· Consulting

· Financial services

· Health

· Law

· Brokerage services

Many businesses that offer services do not qualify for the deduction because of their type of business or industry. Be sure to check whether or not your business qualifies, especially if you offer a type of service.