Business Tax Credit vs. Tax Deduction: The Distinction That Makes a Difference

Reducing your tax liability can be a huge relief to your small business. Individual taxpayers and business owners alike have the option to lower their tax bill through business tax deductions and credits. What’s the difference between business tax credit vs. tax deduction?

Business tax credit vs. tax deduction

Business tax credits and deductions can reduce what you owe on your small business tax return. You can claim a tax credit or deduction (or both) to offset the cost of qualifying business expenses.

If you don’t know the difference between a tax credit versus tax deduction, you may have trouble maximizing your tax savings.

So, what is the tax credit vs. deduction difference?

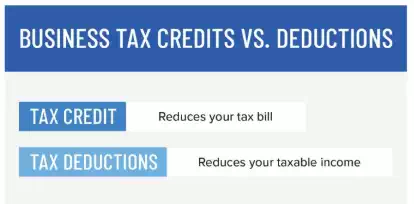

A business tax credit is a dollar-for-dollar tax liability reduction. Tax credits directly lower your tax bill by the amount of the credit. So if you have a tax bill of $20,000, a $1,000 tax credit would lower your bill to $19,000.

On the other hand, a business tax deduction reduces your total taxable income. Let’s say your total taxable income is $90,000. A small business tax deduction of $1,000 would drop your taxable income to $89,000. The $1,000 business tax deduction would not lower your tax bill by $1,000.

Basically, a tax deduction lowers what your tax liability is based on, not the tax bill itself. A tax credit applies at the end and lowers your tax bill directly.

Think of tax deductions as being indirect tax reductions and tax credits being direct deductions.

Business tax credit versus deduction: Which is better?

So, should you take a tax credit or deduction? The answer depends.

Reducing your tax liability is not always an either-or decision. You can claim both tax deductions and credits.

But, you cannot claim both a tax credit and tax deduction for the same expenses. For example, taxpayers must choose between claiming an education credit and the tuition and fees deduction.

Tax credits generally provide a larger tax reduction than tax deductions. However, many tax credits are nonrefundable, meaning the credit’s benefit ends when your tax bill reaches $0.

If you must choose between a tax credit or deduction, first calculate which would give you the greater tax savings.

Types of tax deductions and credits

There are a number of tax credits and deductions you might be able to claim. Check out three common business tax deductions and credits below.

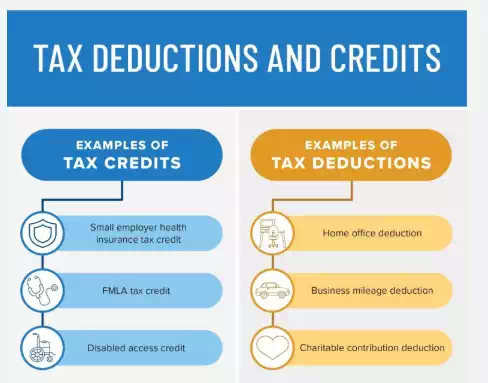

Examples of tax credits

Some tax credits for small business include the small employer health insurance, FMLA, and disabled access credits.

Small employer health insurance tax credit

The small employer health insurance tax credit applies to qualifying businesses that enroll in the Small Business Health Options Program (SHOP).

To qualify, you must have fewer than 25 full-time equivalent employees and pay employees an average annual salary of $50,000 or less. Also, you need to provide at least 50% of your full-time employees’ premium costs and offer coverage to all full-time employees.

How much is the Small Business Health Care Tax Credit? This refundable credit is worth up to 50% of your premium costs.

FMLA tax credit

If you voluntarily provide paid family and medical leave to qualifying employees, you may be eligible for the nonrefundable FMLA tax credit.

Employers who pay at least 50% of their employee’s wages, provide at least two weeks of paid FMLA to full-time employees, and have a written policy qualify.

You can claim a minimum FMLA tax credit of 12.5% if you pay 50% of your employees’ wages. If you pay 100% of your employees’ wages, you can claim a maximum credit of 25%.

Disabled access credit

Have you incurred expenses making your business more accessible and accommodating to individuals with disabilities? If so, you may be eligible for the disabled access credit.

You can claim the disabled access credit if you meet the IRS’s definition of small business. And, you must have qualifying expenses, like removing barriers that prevent accessibility.

The maximum tax credit small business owners can claim is $5,000. The disabled access credit is worth 50% of your eligible access expenses (after incurring $250 in expenses), up to a maximum of $10,250.

Examples of tax deductions

A few types of small business tax deductions include the home office, business mileage, and charitable contribution deductions.

Home office deduction

You may be eligible to claim the home office tax deduction if you use part of your owned or rented home for business. Small business owners can deduct expenses related to the part of their homes used for business.

To qualify for the home office tax deduction, you must regularly and exclusively use part of your house for business. And, your home must be your principal place of business.

You can either use the simplified or regular method to claim the home office tax deduction. If you use the IRS’s simplified method, you can claim a maximum deduction of $1,500.

Business mileage deduction

Do you drive for your business? If so, you may be able to take the business mileage deduction for business miles driven.

You can claim the business use of car deduction for business-related errands like miles spent driving to meet customers or to the bank for a business transaction.

To claim the business mileage deduction, you can either use the standard mileage rate or actual expense method. The standard mileage rate for 2019 is 58 cents per business mile driven.