Understanding an Employee Stock Ownership Plan, And How It Can Benefit Your Business

As a business owner, you might offer a variety of benefits to your employees, including health insurance and retirement plans. One option you can offer employees is an employee stock ownership plan (ESOP).

Along with other benefits, ESOPs are growing in popularity for small businesses. According to the National Center for Employee Ownership (NCEO), as of 2018, there are approximately 6,500 plans covering 14 million participants.

So, what is ESOP?

What is an employee stock ownership plan?

An employee stock ownership plan is a type of retirement and benefit plan that gives employees ownership interest in your business

Now, stick with me here. Employee ownership plans can get a little confusing. In an ESOP, companies provide employees with stock ownership. You allocate shares to your employees, which vest over time. And, business owners typically hold shares in an ESOP trust until the employee leaves the company or retires.

If an employee is terminated, retires, or becomes disabled, the plan distributes the shares of ESOP stock in the employeeís account.

If you terminate an employee with a plan, they usually only qualify for the amount they vested in the program.

You can also purchase vested shares from retiring or resigning employees. Depending on the plan, employees typically receive money from the purchase in a lump sum or regular payments. Then, you can redistribute or void the stock.

Purpose of an ESOP

Business owners typically implement ESOPs to allow employees to purchase stock in the company.

Companies can also use an ESOP to help keep participants focused on the businessís performance. ESOPs encourage workers to do whatís best for shareholders since the employees themselves are shareholders.

ESOP benefits

Both employees and employers can reap the benefits of an ESOP program. Compare the different benefits for both you and your employees below.

Employee advantages

ESOP benefits for employees vary depending on the business and program.

Employees can enjoy many benefits by participating in their businessís ESOP, such as:

∑ Getting a stake in the companyís success

∑ Receiving an additional source of income

∑ Getting an ESOP employer match

∑ Being able to combine ESOP with other retirement plans

∑ Receiving better job stability

Employer advantages

Of course, along with employees, employers also benefit from an ESOP.

Some ESOP advantages for employers include the following:

∑ Tax benefits

∑ Small business tax deductions

∑ More likely to withstand economic hardships

∑ Help improve business cash flow

∑ Business continuity

∑ Improve employee retention

To learn more about employee and employer benefits, visit the ESOP Associationís website.

Starting an ESOP

ESOPs can be a huge expense for a small business. The NCEO website states ESOPs can cost around $20,000 to $30,000 annually for smaller businesses. And, businesses that have certain business structures, like partnerships, might not be able to set up ESOPs.

When deciding whether or not to implement an ESOP, look at the financial status of your business. That way, you can determine a feasible plan for your business.

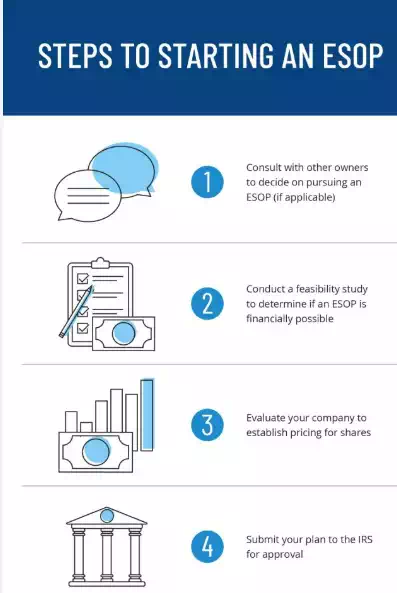

Follow these steps before starting an ESOP:

1. Consult with other owners to decide on pursuing an ESOP (if applicable)

2. Conduct a feasibility study to determine if an ESOP is financially possible

3. Evaluate your company to establish pricing for shares

4. Submit your plan to the IRS for approval

Before starting an ESOP, consider consulting with advisors, such as a small business lawyer or CPA, to verify whether an ESOP will be beneficial to your business.

Funding an ESOP

After you decide to start an ESOP, your business must establish a trust fund for employees.

You can put your own stock (existing or new shares) into the fund. And, you can choose to use your own funds or put up a loan through the ESOP to purchase stocks. If you opt to take out a loan, you can make tax-deductible contributions to the plan to pay off the loan.

In addition to starting a trust fund, you must also appoint a trustee. Your trustee oversees the plan and should communicate the ESOP option to your employees. Consider also forming an ESOP committee to help promote the plan and encourage employees to participate.

If you decide an ESOP is not for you, some alternatives include other employee stock options and profit sharing.

With some stock options, some businesses give employees the opportunity to purchase company stock at a discount price once the employee meets certain criteria, such as working for the business for three years.

Profit sharing is a plan that gives employees a share in the businessís profits. Typically, employees receive a percentage of the companyís profits based on its quarterly or annual earnings.