Offer in Compromise: Possible Solution for Business Owners Drowning in Tax Debt

Not being able to pay your debts can be scary. And when your creditor is the IRS, you might be especially nervous about making ends meet. To alleviate some of your tax debt burden, consider applying for an offer in compromise.

You must apply for an offer in compromise through the IRS. But before applying, weigh your options—the IRS does not accept all applications. In fact, the IRS rejects approximately 60% of offers in compromise applicants.

Familiarize yourself with the IRS offer in compromise process and qualifications to improve your chances of acceptance.

What is an offer in compromise?

Offers in compromise (OIC) allow taxpayers to settle their tax debt with the IRS at a lower price than what they owe.

An offer in compromise is typically a last-ditch effort for taxpayers who have already explored other payment options, like an installment agreement. Installment agreements let you make monthly tax payments, but you are still liable for your full tax debt.

To settle with the IRS, you need to submit an official application. In your application, provide personal and financial information and make an offer amount.

Businesses and individuals who want to apply for an offer in compromise must meet IRS eligibility requirements.

Do you meet the IRS eligibility requirements?

Before applying, verify that you are eligible. The IRS requires that you:

· Have filed all required tax returns

· Are not in an open bankruptcy proceeding

You might be able to use the IRS offer in compromise pre-qualifier tool to determine eligibility and calculate your preliminary offer.

The pre-qualifier tool is a guide, not an offer in compromise application. To get started, you must answer some questions and input personal and financial information.

You cannot use the IRS offer in compromise pre-qualifier tool if your business is structured as a partnership or corporation.

When does the IRS accept a business offer in compromise?

Even if you meet the eligibility requirements, the IRS can decline your offer in compromise.

When reviewing an offer in compromise, the IRS looks at your ability to pay, income, expenses, and asset equity.

The IRS typically declines offers if the taxpayer can afford to pay what they owe.

Here are some reasons that the IRS may accept your offer in compromise:

1. Doubt as to liability: Do you think your tax debt is genuinely incorrect? If you think you should owe nothing or less than what the IRS says, the IRS may accept an offer of compromise.

2. Doubt as to collectibility: Do you earn and have less than what you owe? The IRS may accept a compromise if your assets and income are less than your tax liability.

3. Effective tax administration: Would paying your tax debt in full create an economic hardship? You might receive an accepted offer if paying your liability is unfair due to exceptional circumstances.

Offer in compromise guidelines

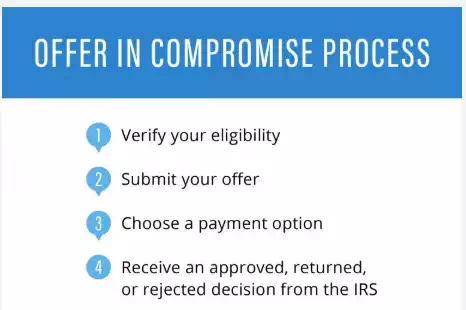

Ready to learn about the OIC tax settlement program? After verifying that you are eligible, you can begin the application process.

Keep in mind that after submitting your offer, the IRS can take up to two years to make a determination.

While you wait for a determination, the IRS suspends collection activities. And, you do not need to make payments on an existing installment agreement.

If the IRS accepts your OIC, they will keep tax refunds for tax periods that extend through the calendar year. For example, if the IRS accepts your OIC in 2019, you cannot receive a refund on your 2019 tax return. The refund does not go toward your tax debt.

To submit your offer in compromise, you must file the appropriate forms and choose a payment option. After filing, you will receive your IRS determination.

Filing the offer in compromise form

The forms you must file depend on two things:

1. Why you are submitting your OIC

2. Whether you are filing as an individual, business, or both

If you are submitting an OIC based on doubt as to collectibility or effective tax administration, you must file Form 656, Offer in Compromise.

You must also file Form 433-A (OIC), Collection Information Statement for Wage Earners and Self-Employed Individuals, Form 433-B (OIC), Collection Information Statement for Business, or both.

File Form 433-A (OIC) if you are:

· A sole proprietor

· A single-member LLC taxed as a sole proprietor

· An individual wage earner

· Someone submitting an offer on behalf of a deceased individual’s estate

File Form 433-B (OIC) if you are a:

· Corporation

· Partnership

· Single or multi-member LLC taxed as a corporation

· Multi-member LLC classified as a partnership

The IRS’s Form 656 Booklet contains Forms 656, 433-A (OIC), and 433-B (OIC).

If you are submitting an OIC based on doubt as to liability, only file Form 656-L, Offer in Compromise (Doubt as to Liability).

All taxpayers submitting an OIC should also include copies of supporting documents to back up their claims.