Cash-only Businesses: Are They Worth It, How to Run, and More

What are cash-only businesses?

A cash-only business operates on cash transactions. Cash-only businesses only accept cash from customers. An all-cash business generally does not accept checks, debit or credit cards, money orders, credit, or mobile wallets. And, a cash-only business might primarily use cash to pay vendors.

But, can a business only accept cash? Yes, running a cash-only business is a viable option for entrepreneurs. There are no federal laws saying you must accept other payment methods from customers.

Limiting customer payments to cash is common in some industries. Examples of cash-only businesses include:

∑ Restaurants

∑ Coffee shops

∑ Street vendors

∑ Lawn services

∑ Babysitters

∑ Vending machines

∑ Laundromats

Some types of businesses, like the ones above, rarely accept credit cards. This means customers wonít be blindsided by having to pay cash.

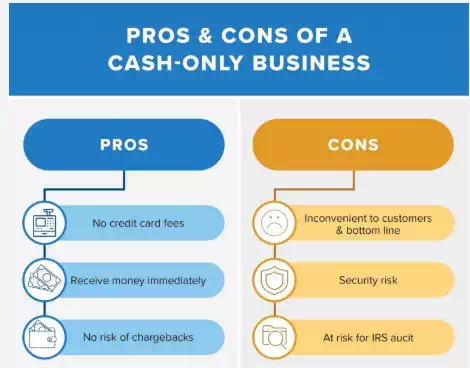

Pros and cons of a cash-only business

Keep in mind that there are benefits and downsides to limiting transactions to cash. Before deciding to operate an all-cash company, weigh these pros and cons.

Pros

Accepting credit card payments for small business can be overwhelming. And for some small companies, accepting multiple payment options isnít a priority. You might choose to only accept cash because of factors like the price of your products, number of employees, and credit card fees.

Here are some benefits to running a cash-only business.

1. You donít have credit card fees

For small businesses with low-priced products, credit card fees can be crippling. You may not want to pass credit card fees onto customers or foot the bill yourself.

If you accept credit cards, you need to set up a merchant account, buy or rent processing equipment, and pay credit card fees each time a customer makes a purchase.

You donít pay extra fees when customers give you cash.

Accepting only cash payments simplifies your responsibilities when it comes to setup. However, you must record cash transactions in your accounting books.

2. You receive money immediately

Choosing to accept only cash puts money in your register immediately. You donít need to worry about when or if customers will pay you.

Businesses that extend credit to customers generally donít receive payments until weeks after the time of purchase. And, chasing down customers who wonít pay can be frustrating and fruitless.

3. There is no risk of chargebacks

When you only accept cash, you donít need to worry about credit card fraud. Credit card fraud is always a concern for businesses that accept credit card payments.

Credit card fraud costs you time and money because it can lead to chargebacks. Chargebacks are when a bank or credit card provider demands that a merchant refund money to a credit card holder.

Chargebacks can either be legitimate or fraudulent. By limiting your payment options to cash, you donít need to worry about chargeback fraud.

Cons

Despite some benefits of cash-only businesses, limiting forms of payment to cash can hurt your company.

The majority of consumers (77%) prefer using debit and credit cards. That number continues to grow. Running a cash-only business might alienate a large percentage of consumers from buying from you.

Here are some disadvantages of accepting only cash payments.

1. It can be inconvenient to customers and your bottom line

Maybe youíve eaten dinner at a mom and pop restaurant. When you went to pay, the cashier told you they donít take cards. You ran across the street to an ATM only to receive an unexpected withdrawal fee.

Inconvenient, right?

Accepting only cash can be just as inconvenient for your customers and prevent you from making a sale. And if a customer doesnít have cash on hand, they might not want to come back to your business.

Rather than encouraging large purchases, running a cash-only business can end up discouraging them. And we all know that discouraging sales directly results in slow cash flow.

2. Accepting only cash can be a security risk

Another downside of accepting only cash is the added security risk. Keeping large amounts of cash in your business can open you up to theft.

When you accept only cash, you end up with large amounts of cash in the register at the end of the day. Your property might become a target to thieves, especially if you promote the fact that you are a cash-only business on your storefront.

Accepting only cash can also expose you to employee theft. Unlike with credit and debit cards, employees can pocket cash from the register.

In addition to theft, you run the risk of accepting counterfeit money when you run a cash-only business.

3. You are more at risk for an IRS audit

Running a cash-only business means you have to count all the cash by hand. That makes it harder to stay organized.

Cash-only business tax evasion is easier because there isnít an audit trail for your records.

Barbara Weltman, guest blogger for the Small Business Administration (SBA), says: ďCash businesses are suspected of omitting income because they can; there is little or no paper trail.Ē

Accepting only cash can be an IRS audit red flag indicating that you might not be paying taxes on your income.

How to run a cash-only business

Running a cash-only business means you need to take extra precautions.

Your customers should know right away that you only accept cash, and your employees should handle cash with care. Also, you must keep your accounting books in tip-top shape. And, you need to file the appropriate forms with the IRS.

If you decide to run an all-cash business, take a closer look at the following tips.

1. Notify your customers

Hang signs around your business that let customers know you do not accept debit or credit cards. Customers could become irritated if they spend an hour in your shop, go to pay with a credit card, and learn that they need cash.

And, include a disclaimer on your companyís website or social media accounts that you only accept cash. That way, consumers know that they need to withdraw cash before going to your business.

2. Train your employees

Do your employees know how to properly handle cash? Are your employees honest and dependable?

Require employees to go through training before they start working. Teach employees how to tell if money is fake.

Take extra care when hiring new workers. Regardless of if you run an all-cash business or not, you must conduct background checks on candidates. Go over security features on bills, like the Federal Reserve seal, raised printing, and microprinting. And, you might consider investing in supplies to help employees spot counterfeit bills, like counterfeit detection pens.

Make sure employees do not get distracted when receiving a cash payment. Otherwise, they could give a customer back the wrong amount of change.

You hope that your employees are morally sound, but things happen. Check to make sure your employees are not taking any cash from the register. You can do this by personally balancing the cash against the register tape each day.

3. Keep thorough records

Accepting only cash can lead to a lack of records. You donít have signed receipts or electronic statements that come from swiping credit cards. Instead, you need to record the:

∑ Date

∑ Amount

∑ Item or service sold

Make sure to keep a copy of each customerís receipt for your records.

Maintaining clear records makes things easier when calculating your gross income. And, thorough records can help protect you in case of an audit.

The IRS is on high alert when businesses operate as cash only. If the IRS audits you as a cash-only business, donít panic. The IRS offers an Audit Techniques Guide (ATG) for cash-only businesses.