9 Business Formulas Math Haters Canít Ignore

9 Business formulas you need to know

You may not be an accountant, but you should know how to analyze your businessís financial health. So whip out those calculators or pens and paper and read on.

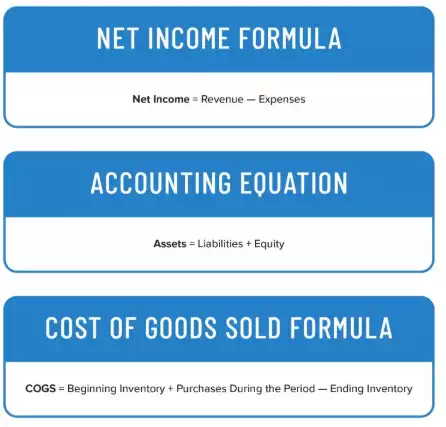

1. Net income formula

Financial accounting formulas, like net income, are essential for determining how your business is doing.

Net income shows you the difference between your income and expenses. Net income is also called net profit, net earnings, or your business bottom line. If your net income is negative, it is known as a net loss.

Obviously, nobody wants a negative net income. Negative net income means your business has more expenses than revenue. But when youíre starting a business, negative net income is common until you get to your break-even point (which is another fun accounting formula weíll tackle later).

To find your net income, you need to know your total business revenue and expenses (including cost of goods sold) during a period. Add up your companyís expenses, like operating expenses, payroll costs, and business loan payments. Then, use this formula:

Net Income = Revenue Ė Expenses

Why does net income matter? First, you need to know whether your business is gaining or losing money. You can use that information to cut expenses or drive up marketing efforts. Secondly, you need to report your net income on your businessís income statement.

Net income example

During a period, you earn $25,000 in revenue. You have expenses of $30,000.

Net Income = $25,000 Ė $30,000

Net Income= -$5,000

You have a net loss of $5,000.

2. Accounting equation

Is your business balance sheet Ö balanced? Use the accounting equation to find out.

The accounting equation shows you how much of your assets you financed through debt vs. equity. You need to know your businessís assets, liabilities, and equity to get started.

Business assets are items of value your business owns. Liabilities are debts you owe. And, business equity is how much ownership you have in your business.

The accounting equation is:

Assets = Liabilities + Equity

If your assets donít equal the sum of your liabilities and equity, somethingís wrong. You may not have recorded a transaction. Look over your accounting books to find out why your accounting equation is unbalanced.

You can also use the accounting equation to determine how much your business would have remaining if you used your assets to pay off your liabilities. To do this, manipulate the equation to find the difference between your assets and liabilities:

Equity = Assets Ė Liabilities

Accounting equation example

Letís say you have liabilities totaling $12,000. Your equity is $20,000.

Assets = $12,000 + $20,000

Assets = $32,000

Your assets must be worth $32,000.

3. Cost of goods sold formula

How much is your small business spending to produce your products or services? If youíre spending too much, your profit margin will be low.

Use the cost of goods sold (COGS) formula to determine how much it costs you to develop products or services during a period.

COGS = Beginning Inventory + Purchases During the Period Ė Ending Inventory

You need to know your COGS to set prices, calculate net income, and more.

COGS example

Letís say you have a beginning inventory worth $2,000. You spent $3,000 during the period. Your ending inventory is $1,000.

COGS = $2,000 + $3,000 Ė $1,000

COGS = $4,000

Your cost of goods sold is $4,000.

4. Break-even point formula

A businessís break-even point is when its total sales equal its total expenses. When you hit your break-even point, you donít generate a profit or a loss.

Do you know how many products you need to sell or services you must perform to hit your businessís break-even point? Why not find out?

Use the break-even point formula to determine how many products you need to sell during a period to break even. You need to know your businessís fixed and variable costs. And, record your sales price per unit.

Break-even Point = Fixed Costs / (Sales Price Per Unit Ė Variable Costs Per Unit)

Break-even point example

Letís say you want to determine how many coffees you need to sell per month to break even. You sell coffee for $2.95. You have monthly fixed costs of $2,500. Your variable costs per unit are $1.40.

Break-even Point = $2,500 / ($2.95 Ė $1.40)

Break-even Point = 1,612.90

You need to sell approximately 1,613 cups of coffee each month to break even.

5. Return on investment

Do you make wise investments? How can you tell?

You make wise investments when you gain more than what you paid. To find out how well you are investing your businessís money, find your return on investment (ROI) percentage.

Use this formula to find ROI:

ROI = [(Investment Gain Ė Cost of Investment) / Cost of Investment] X 100

ROI example

You invest $5,000 into your marketing strategy. Your strategy leads to an investment gain of $8,000. You know you made a smart move, but how smart?

ROI = [($8,000 Ė $5,000) / $5,000] X 100

ROI= 60

Your return on investment is 60%ónot too shabby.

6. Profit margin

Does your business earn a profit? How does that profit compare to your revenue? Find your businessís profit margin to determine the percentage of revenue you keep after taking care of expenses.

Here is the profit margin formula:

Profit Margin = (Net Income / Revenue) X 100

Shoot for high profit margins. The higher your margin, the greater your businessís earnings.

Profit margin example

During a month, you have a net income of $2,000. Your revenue is $8,000.

Profit Margin = ($2,000 / $8,000) X 100

Profit Margin = 25%

Your profit margin is 25%. This means you get to keep 25% of your businessís revenue.

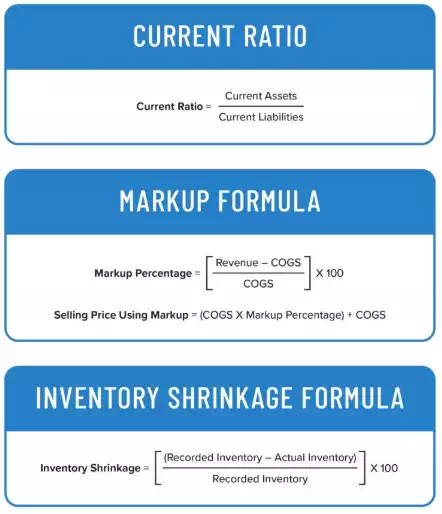

7. Current ratio

Do you have more assets or liabilities? Letís find out! Use the current ratio to compare your current assets to current liabilities.

Current assets are the items of value your business owns that can convert to cash within one year. Likewise, current liabilities are your debts that are due within one year.

To find your current ratio, divide your current assets by your current liabilities:

Current Ratio = Current Assets / Current Liabilities

The result shows you how much more you have in assets than liabilities. Your current ratio should be greater than one. Having a current ratio of less than one means you have more current liabilities than assets.

Current ratio example

After totaling up your assets, you find that you have $10,000 in current assets. And, the sum of your liabilities is $10,000.

Current Ratio = $10,000 / $10,000

Current Ratio = 1

Your current ratio of 1 means you have enough in assets to cover your current liabilities.

8. Markup formula

If you need help setting your productsí prices, you can try using the markup formula. The markup percentage shows you how much more you sell offerings for than what they cost.

A higher markup can lead to a greater profit margin. But remember, markup vs. margin are different.

To find your markup percentage, use this formula:

Markup Percentage = [(Revenue Ė COGS) / COGS] X 100

You can also choose a markup percentage and multiply it by the cost of your product or service to set your selling price. To use markup to find your selling price, use the following formula:

Selling Price Using Markup = (COGS X Markup Percentage) + COGS

Markup example

Letís say you sell desks for $700. The cost to build the desks is $300 each. Whatís your markup percentage?

Markup Percentage = [$700 Ė $300) / $300] X 100

Markup Percentage = 133.33%

You mark up your desks by 133.33%.

Now, letís find out what your selling price would be if you wanted to mark up your desks by 70%.

Selling Price Using Markup = ($300 X 0.70) + $300

Selling Price Using Markup = $510

You would need to sell your desks at $510 if you wanted to use a markup percentage of 70%.

9. Inventory shrinkage formula

Does your business have less inventory than what you started with? If so, youíre experiencing inventory shrinkage, or loss. Some shrinkage is normal, but too much can be a bad sign.

If you want to figure out the percentage of inventory your business is losing, use the inventory shrinkage formula.

You need to know how much inventory you should have. And, you must know how much inventory you have after losing some to things like damage and theft.

First, determine how much inventory you should have. This is the amount of inventory recorded in your books. Subtract cost of goods sold from inventory to find your recorded inventory.

The inventory shrinkage formula is:

Inventory Shrinkage = [(Recorded Inventory Ė Actual Inventory) / Recorded Inventory] X 100

The lower your inventory shrinkage percent, the better.

Inventory shrinkage example

You have recorded inventory of 500 lightbulbs. After an unfortunate mishap, you shattered quite a few, leaving you with 375 lightbulbs. What is your inventory shrinkage percentage?

Inventory Shrinkage = [(500 Ė 375) / 500] X 100

Inventory Shrinkage = 25%

You lost 25% of your inventory to shrinkage.