Financial Accounting | Basic Concepts and Principles

Definition and introduction

Profit, it has been said often, is the sole objective of business. Therefore, for those running a business, information about the financial performance of the enterprise is a most important requirement.

This information is not available easily and can be obtained only by systematically recording, classifying, and summarising all the business transactions. The branch of accounting that accomplishes these tasks under internationally standardised procedures is called financial accounting.

However, financial accounting is not limited to recording, classifying, and summarizing information about business transactions. It also deals with reporting this information to stakeholders outside the organisation, such as investors and creditors, who are the important, primary recipients of the information.

There may be secondary recipients, too, such as competitors, customers, employees, and stock-market analysts, but the information generated by financial accounting is mainly aimed at external stakeholders who are not part of the business organisation per se.

Therefore, to put together a formal definition of financial accounting, it is a specialized branch of accounting that records and reports information about the financial position and performance of a company, mainly for use by the business entity’s external stakeholders.

How does financial accounting achieve its tasks? Financial accounting mainly generates three financial statements to provide the information required—the balance sheet, income statement, and cash flow statement.

These documents provide the stakeholders a clear idea about the performance of the business during a particular period and its financial position at a specific time. The objective of the financial accountants is not to estimate the value of a company but to facilitate this valuation by others.

According to the

International Financial Reporting Standards, financial accounting provides

information about a business organisation that is useful to existing and

potential investors, lenders, and other creditors in making decisions about

providing resources to the organisation.

Objectives

The objectives of financial accounting can be put in four categories, as follows:

· Record financial transactions as and when they occur (bookkeeping), so that the data can be analysed for preparing financial statements

· Calculate profit or loss, to enable management to take course-correction strategies if required

· Ascertain the financial strength of the company by determining its assets and liabilities

· Communicate the information to stakeholders through statements and reports, so that these stakeholders can take appropriate decisions on their investments in the business

Financial statements

For meeting these objectives, financial accountants mainly prepare three types of documents, as briefly mentioned in the introduction above—the balance sheet, which reflects the assets and liabilities; income statement, which shows the profit and loss; and, cash flow statement, which charts the cash inflow and outflow.

The external users of financial statements look at the balance sheet to find out how strong the business is, financially (assets vs. liabilities), and at the income statement to find out how well the business is doing (profit vs. loss).

Creditors and other lenders would be happy to see a positive balance sheet so that they know their investments are safe, and investors would like to see an income sheet with profit so that they know some money would be coming to them from the company in the form of dividend or interest.

Almost all stakeholders want to see the cash flow statement to know the cash availability with the company and whether it will be able to clear its liabilities.

Among the internal users of financial statements are managers, who can take decisions on the basis of the financial statements, and among the external users are government authorities, who can initiate tax measures.

Here are some additional notes on the three financial statements mentioned above.

· Balance sheet: The balance sheet of a company shows its assets, liabilities, and stockholders’ equity as on the last day of the accounts-reporting period. Assets include cash, stocks, buildings, and machinery, while liabilities include loans, interest, and wages. Stockholders’ equity is the difference between the assets and the liabilities. Read more about balance sheets.

· Income statement: The income statement (issued quarterly or annually) reports the company’s profitability in a given period. It presents the revenues (sales and service revenues), expenses (operating expenses, such as wages and rent, and non-operating expenses, such as loan interest), gains, and losses. Read more on Profilt and Loss.

·

Cash flow statement: The cash statement shows the

inflow and outflow of cash and its use for operating, financing, and investing

activities. Here are some details on the cash flow statement.

Concepts of Financial Accounting

At the core of financial accounting is the double-entry accounting method, by which each financial transaction is entered in at least two accounts (assets, liabilities, and expenses are examples of accounts)—as a debit in one account and as a credit in another account.

“Debit” simply means to enter a transaction on the left side of an account, and credit means to enter a transaction on the right side. A debit increases some accounts and decreases some others. Similarly, a credit increases some accounts and decreases some others.

Imagine that a company takes a bank loan. Under the double-entry system, this transaction has to be entered as a credit in one account and as a debit in another account. Bolstered by the loan, the company’s cash/assets increase, and this transaction, where the assets have increased, is a debit transaction. Therefore, it is entered as a debit transaction under the assets account.

However, with the loan, the company’s liabilities also increase, and this transaction, where the liabilities have increased, is a credit transaction. So, it is entered as a credit transaction under the liabilities account. This procedure is followed under the double-entry system of accounting.

Information about which accounts to credit or debit for each transaction is available from online resources on accounting. For example, an increase in expense and a decrease in income are always debit entries, and a decrease in assets and an increase in liabilities are always credit entries.

An important aspect to remember is that debiting an account does not always mean decreasing it, nor does crediting an account always mean increasing it.

Each credit should be balanced by a debit, and vice versa (it is not a question of balancing each increase in an account with a decrease in another account).

The advantage of double-entry accounting is that it helps keep the accounting equation (assets = liabilities + stockholders’ equity) always balanced. If a company records its accounts accurately, the left side of the equation will match the right side.

Another cornerstone of financial accounting is the accrual accounting system, by which revenues and expenses are recorded in the financial statements when they are earned or incurred, not when the cash comes in or goes out, as is done under the cash accounting system.

The accrual system

ensures that the statements reflect the financial position of the company

accurately, and that there is no overestimation of revenue or profits.

Principles of Financial Accounting

As discussed in the post “Accounting basics,” the rules of accounting, including financial accounting, have been standardised to achieve the following goals:

· Objectivity: Financial statements should be free from bias, and financial accountants should scrupulously follow the principle of objectivity.

· Usability: Users of financial documents should be able to depend on them—the documents should facilitate decision-making.

· Materiality: Omission of data from financial statements will mislead financial decision-makers; therefore, all important data should be recorded and misstatement of facts avoided.

· Comparability: Financial statements should enable users to compare the performances of companies, and the documents should follow the standards set internationally.

Financial Accounting Standards

Most or all of the general principles of accounting apply to financial accounting, too. These principles are kept in mind in the preparation of financial statements under the “Generally Accepted Accounting Principles,” or GAAP, followed internationally.

In India, financial accounting standards are notified by the Ministry of Corporate Affairs in tune with the guidelines of the International Financial Reporting Standards.

A new set of

standards known as “Indian Accounting Standards,” or “Ind AS,” is about to be

implemented in the country.

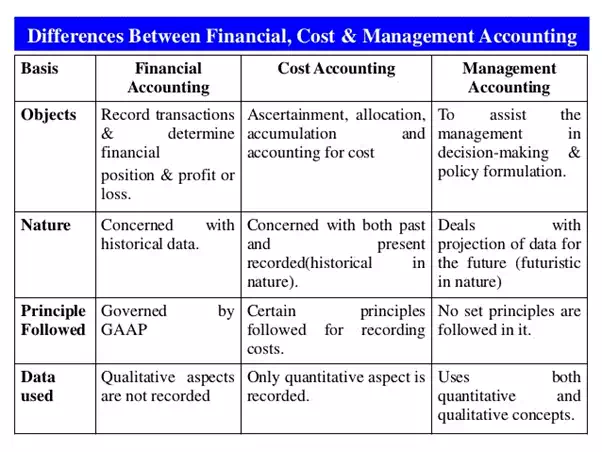

Comparison: Financial vs Management vs Cost Accounting

A final word on financial accounting: it differs from management accounting and cost accounting in that it mainly caters to external stakeholders, such as investors.

Management accounting, however, is intended for a company’s internal use and provides managers with the information necessary for taking steps to improve the performance of their company.

The objective of cost accounting, which is also an internal tool, is to calculate the cost of production and help managers come up with cost-reduction ideas.